Name

三均线系统Exodus

Author

Exodus[策略代写]

Strategy Description

本系统是双向合约策略,在满足条件是做多或做空,下单量为合约的数量,使用币安时下单量为几个btc,使用火币时下单量单位为张 【7-31更新】 本策略的参数适合在1小时级别运行,但小时级别开单次数过少,因此更新分钟级别。但是分钟级别需要手动修改参数。

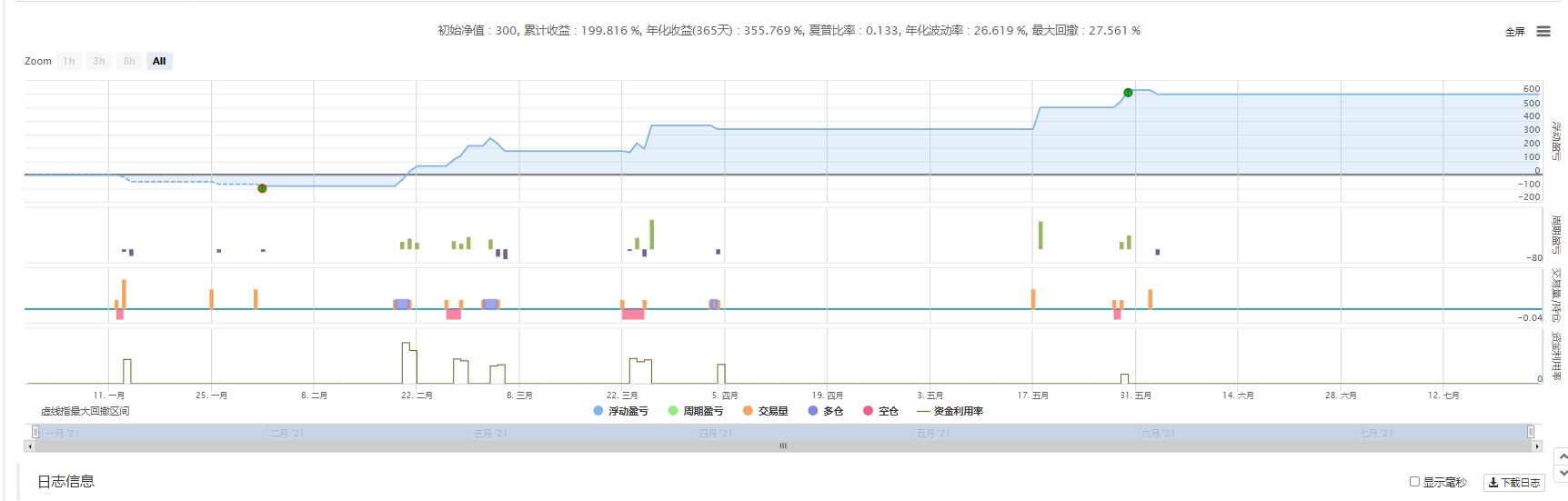

以下回测结果为小时周期

**** 4-27至7-25****

本金300,下单量0.04btc

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| afterEmaCrossTime | 4 | 在k线金叉或死叉后几根k线内macd满足条件才允许操作 |

| buyVolume | 0.016 | 交易数量(0.016BTC) |

| stopLossRate | true | 止损率(未计算杠杆) |

| winLossRate | 5 | 盈亏比 |

| period | 60 | 周期(分) |

| EMA1 | 8 | 最快均线周期 |

| EMA2 | 34 | 中等速度均线周期 |

| EMA3 | 89 | 最慢均线周期 |

| MACD1 | 16 | MACD参数1 |

| MACD2 | 26 | MACD参数2 |

| MACD3 | 9 | MACD参数3 |

Source (javascript)

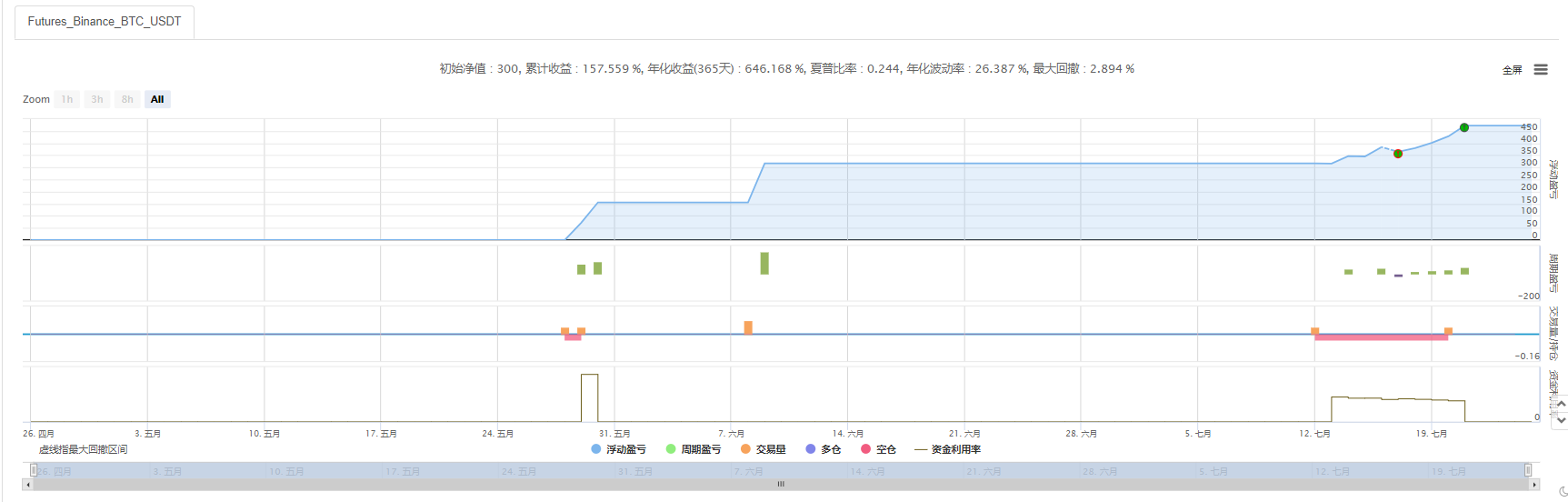

/*backtest

start: 2021-04-27 00:00:00

end: 2021-07-25 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","balance":300}]

args: [["afterEmaCrossTime",4],["buyVolume",0.04],["winLossRate",5]]

*/

function GetCrossStatus(a, lastA, b, lastB) {

let lastStatus = lastA < lastB;

let curStatus = a < b;

let crosssStaus = 0; //0表示没有交叉,1表示金叉,2表示死叉

//判断金叉还是死叉,同时判断此刻大于0轴或者小于0轴,因为在此系统中要求金叉时macd>0才有意义,死叉时macd<0才有意义

if (curStatus != lastStatus) //状态不同时表示金叉或者死叉了

{

if (a > b) {

crosssStaus = 1; //金叉

}

if (a < b)

crosssStaus = 2; //死叉

}

return crosssStaus;

}

var lastOpenTime;

function GetCurRecord(records) {

return records[records.length - 1];

}

function GetCurTime(records) {

return GetCurRecord(records).Time;

}

function GetCurPrice(records) {

return GetCurRecord(records).Close;

}

function Open(direction) {

let pos = exchange.GetPosition()[0];

if (pos != null) {

return;

}

let amount = buyVolume;

if (direction == 1) { //做多

Log("做多", amount);

exchange.SetDirection("buy");

exchange.Buy(-1, amount);

}

if (direction == 2) { //做空

Log("做空", amount);

exchange.SetDirection("sell");

exchange.Sell(-1, amount);

}

}

function Close(ticker,fastLine,midLine) {

let pos = exchange.GetPosition()[0];

if (pos == null) {

return;

}

if (pos.Type == PD_LONG) {

if (ticker.Last < pos.Price*(1- stopLossRate/100) || ticker.Last > pos.Price*(1+(stopLossRate*winLossRate)/100)) {

Log("平多,开仓价为:",pos.Price,"本次盈利:",pos.Profit);

exchange.SetDirection("closebuy");

exchange.Sell(-1, pos.Amount);

}

}

if (pos.Type == PD_SHORT) {

if (ticker.Last > pos.Price*(1+ stopLossRate/100) || ticker.Last < pos.Price*(1-(stopLossRate*winLossRate)/100) ) {

Log("平空,开仓价为:",pos.Price,"本次盈利:",pos.Profit);

exchange.SetDirection("closesell");

exchange.Buy(-1, pos.Amount);

}

}

}

var lastEmaCrossTime = 0;

var lastMacdCrossTime = 0;

function NearMacdCross(time) {

//Log("MACD",time,lastMacdCrossTime,time - lastMacdCrossTime);

return time - lastMacdCrossTime <= afterEmaCrossTime * 1000 * 3600;

}

function NearEmaCross(time) {

//Log("EMA",time,lastMacdCrossTime,time - lastMacdCrossTime);

return time - lastEmaCrossTime <= afterEmaCrossTime * 1000 * 3600;

}

var emaMeet = 0; //0表示不满足,1满足做多条件,2满足做空条件

var macdMeet = 0; //判断macd是否满足条件,0表示不满足,1表示做多条件满足,2表示做空条件满足

function main() {

exchange.SetContractType("swap");

while (1) {

let r = exchange.GetRecords(PERIOD_M1*period);

//************均线EMA****************

let emaChart8 = TA.EMA(r, EMA1);

let emaChart34 = TA.EMA(r, EMA2);

let emaChart89 = TA.EMA(r, EMA3);

let ema8 = emaChart8;

let curEma8 = ema8[emaChart8.length - 1];

let lastEma8 = ema8[emaChart8.length - 2];

let ema34 = emaChart34;

let curEma34 = ema34[emaChart34.length - 1];

let lastEma34 = ema34[emaChart34.length - 2];

let ema89 = emaChart89;

let curEma89 = ema89[emaChart89.length - 1];

let lastEma89 = ema89[emaChart89.length - 2];

//判断8均线和34均线的死叉和金叉,当金叉时如果当前实体在ema89均线以上做多,当死叉时如果实体在ema89以下时做空

let ticker = exchange.GetTicker();

let low = ticker.Low;

let high = ticker.High;

let close = ticker.Close;

Close(ticker,curEma8,curEma34);

let crossStatus1 = GetCrossStatus(curEma8, lastEma8, curEma34, lastEma34);

if (crossStatus1 != emaMeet) { //状态变化时更新状态

if (crossStatus1 == 1) {

emaMeet = 1;

Log("ema金叉,时间:", GetCurTime(r),talib.LINEARREG_SLOPE(ema8));

lastEmaCrossTime = r[r.length - 1].Time;

}

if (crossStatus1 == 2) {

emaMeet = 2;

//Log("ema死叉,时间:", GetCurTime(r));

lastEmaCrossTime = r[r.length - 1].Time;

//Log("Ema 2");

}

}

//***************Macd*************

let macdChart = TA.MACD(r, MACD1, MACD2, MACD3);

let macd = macdChart[2]; //动能柱

let curMacd = macd[r.length - 1]; //当前动能柱

let lastMacd = macd[r.length - 2]; //上一根动能柱,直接根据动能柱的正反来判断macd的金叉和死叉

//auto lastMacd = macd[r.size() - 2]; //上一根动能柱

//判断金叉还是死叉

let dif = macdChart[0];

let curDif = dif[r.length - 1];

let lastDif = dif[r.length - 2];

//判断金叉还是死叉,同时判断此刻大于0轴或者小于0轴,因为在此系统中要求金叉时macd>0才有意义,死叉时macd<0才有意义

//Macd形成金叉或者死叉的瞬间

if (curMacd < 0 != lastMacd < 0) {

if (curMacd > 0) {

macdMeet = 1;

//Log("macd金叉", lastMacd, curMacd);

lastMacdCrossTime = GetCurTime(r);

}

if (curMacd < 0) {

macdMeet = 2;

//Log("macd死叉", lastMacd, curMacd);

lastMacdCrossTime = GetCurTime(r);

}

}

let Account = exchange.GetAccount();

let curBalance = exchange.GetAccount().Balance; //余额

let curStock = exchange.GetAccount().Stocks; //币量

//均线系统

var curTime = GetCurTime(r);

if (NearEmaCross(curTime) && NearMacdCross(curTime)) {

if (emaMeet == 1 && macdMeet == 1 && curDif >= 0) {

Open(1);

}

if (emaMeet == 2 && macdMeet == 2 && curDif < 0) {

Open(2);

}

}

var myDate = new Date();

var myDataM = myDate.getMinutes();

var myDateS = myDate.getSeconds() * 1000;

var myDateMs = myDate.getMilliseconds(); //获取到毫秒以减少误差

Sleep(Math.abs(period - myDataM % period) * 60000 - myDateS - myDateMs);

}

}Detail

https://www.fmz.com/strategy/301620

Last Modified

2021-11-28 07:20:15