Name

动态均线交叉趋势策略Dynamic-SMA-Cross-Trend-Strategy

Author

ChaoZhang

Strategy Description

该策略是一种适用于加密货币市场的简单移动平均线(SMA)交叉策略。它利用快速、中速和慢速三组SMA来识别潜在的入市和出场信号。当快速SMA上穿中速SMA时,产生买入信号;当快速SMA下穿中速SMA时,产生卖出信号。

策略允许交易者设置以下关键参数:

- 价格数据源:收盘价或其他价格

- 是否考虑不完整K线

- SMA预测方法:平移预测或线性回归预测

- 快速SMA长度:默认7

- 中速SMA长度:默认30

- 慢速SMA长度:默认50

- 账户资金

- 每笔交易风险比例

根据用户设置的SMA长度,分别计算出快速SMA、中速SMA和慢速SMA。

当快速SMA上穿中速SMA时,产生买入信号;当快速SMA下穿中速SMA时,产生卖出信号。

策略结合账户资金和每笔交易承受的风险比例,计算出每笔交易的名义本金。再结合ATR来计算止损幅度,最终确定每笔交易的具体仓位。

- 使用多组SMA识别趋势,判断力更强

- SMA预测方法可选,适应性更强

- 交易信号简单清晰,容易实施

- 整合风险和仓位管理,更科学

- SMA本身滞后性会错过价格反转点

- 仅考虑技术指标,没有结合基本面

- 未考虑突发事件的影响

可以通过适当缩短SMA周期、辅助其他指标等方式来优化。

- 结合其他指标过滤误信号

- 加入基本面判断

- 优化SMA周期参数

- 优化风险和仓位计算参数

本策略整合了SMA交叉判断、风险管理和仓位优化多项功能,是一种适合加密市场的趋势跟踪策略。交易者可以根据自己的交易风格、市场环境等因素调整参数,实施优化。

||

This strategy is a simple moving average (SMA) crossover strategy suitable for cryptocurrency markets. It uses fast, medium and slow SMAs to identify potential entry and exit signals. When the fast SMA crosses over the medium SMA, a buy signal is generated. When the fast SMA crosses under the medium SMA, a sell signal is generated.

The strategy allows traders to set the following key parameters:

- Price source: close price or other prices

- Consider incomplete bars or not

- SMA forecast method: shift prediction or linear regression prediction

- Fast SMA length: default 7

- Medium SMA length: default 30

- Slow SMA length: default 50

- Account funds

- Risk percentage per trade

Fast SMA, medium SMA and slow SMA are calculated based on the SMA lengths set by the user.

When the fast SMA crosses over the medium SMA, a buy signal is generated. When the fast SMA crosses under the medium SMA, a sell signal is generated.

The strategy calculates the nominal principal per trade based on account funds and acceptable risk percentage per trade. It then uses ATR to calculate the stop loss range and eventually determines the position sizing for each trade.

- Uses multiple SMAs to identify trends with greater conviction

- Optional SMA forecast methods for stronger adaptability

- Simple and clear trading signals easy to implement

- Incorporates scientific risk and position management

- Lagging nature of SMAs may miss price reversal points

- Only considers technical indicators without combining fundamentals

- Does not consider impact of sudden events

Can optimize by shortening SMA periods, adding other indicators etc.

- Add other indicators to filter false signals

- Incorporate fundamental analysis

- Optimize SMA period parameters

- Optimize risk and position sizing parameters

This strategy integrates SMA crossover rules, risk management and position sizing for a robust trend following system suitable for crypto markets. Traders can tweak parameters like trading style, market conditions etc. to customize and optimize.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1_close | 0 | Price Source: close |

| v_input_2 | true | Consider Incomplete Bars |

| v_input_3 | 0 | Moving Average Prediction Method: flat |

| v_input_4 | 3 | Linear Regression Length |

| v_input_5 | 7 | Fast Moving Average Length |

| v_input_6 | 30 | Medium Moving Average Length |

| v_input_7 | 50 | Slow Moving Average Length |

| v_input_8 | 100000 | Trading Capital |

| v_input_9 | true | Trade Risk (%) |

Source (PineScript)

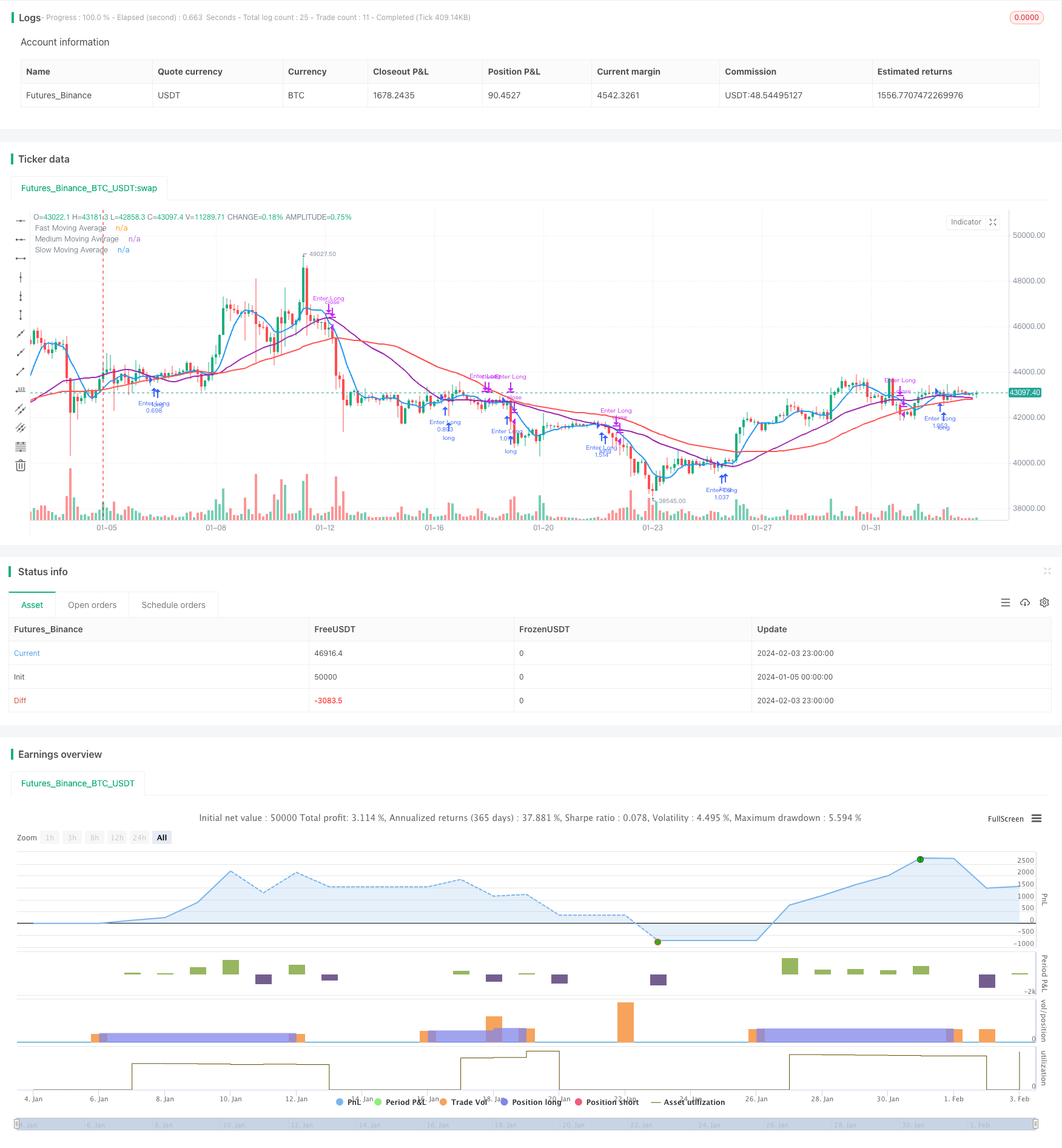

/*backtest

start: 2024-01-05 00:00:00

end: 2024-02-04 00:00:00

period: 3h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Onchain Edge Trend SMA Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// Configuration Parameters

priceSource = input(close, title="Price Source")

includeIncompleteBars = input(true, title="Consider Incomplete Bars")

maForecastMethod = input(defval="flat", options=["flat", "linreg"], title="Moving Average Prediction Method")

linearRegressionLength = input(3, title="Linear Regression Length")

fastMALength = input(7, title="Fast Moving Average Length")

mediumMALength = input(30, title="Medium Moving Average Length")

slowMALength = input(50, title="Slow Moving Average Length")

tradingCapital = input(100000, title="Trading Capital")

tradeRisk = input(1, title="Trade Risk (%)")

// Calculation of Moving Averages

calculateMA(source, period) => sma(source, period)

predictMA(source, forecastLength, regressionLength) =>

maForecastMethod == "flat" ? source : linreg(source, regressionLength, forecastLength)

offset = includeIncompleteBars ? 0 : 1

actualSource = priceSource[offset]

fastMA = calculateMA(actualSource, fastMALength)

mediumMA = calculateMA(actualSource, mediumMALength)

slowMA = calculateMA(actualSource, slowMALength)

// Trading Logic

enterLong = crossover(fastMA, mediumMA)

exitLong = crossunder(fastMA, mediumMA)

// Risk and Position Sizing

riskCapital = tradingCapital * tradeRisk / 100

lossThreshold = atr(14) * 2

tradeSize = riskCapital / lossThreshold

if (enterLong)

strategy.entry("Enter Long", strategy.long, qty=tradeSize)

if (exitLong)

strategy.close("Enter Long")

// Display Moving Averages

plot(fastMA, color=color.blue, linewidth=2, title="Fast Moving Average")

plot(mediumMA, color=color.purple, linewidth=2, title="Medium Moving Average")

plot(slowMA, color=color.red, linewidth=2, title="Slow Moving Average")

Detail

https://www.fmz.com/strategy/441067

Last Modified

2024-02-05 12:14:12