Name

动量策略的双底突破模型Momentum-Strategy-Based-on-Double-Bottom-Breakout-Model

Author

ChaoZhang

Strategy Description

该策略是基于技术指标的双底模型,当市场处于超卖状态时寻找底部区域形成的双底形态突破信号进行买入操作。策略同时结合多种指标判断市场的超卖与超买状态,在双底形成时发出买入信号。该策略主要适用于中短线交易。

该策略主要判断价格是否在关键支撑位附近形成双底,以及市场是否处于超卖状态。具体来说,策略采用以下指标进行判断:

-

RSI指标:当RSI指标显示市场处于超卖状态时,视为买入信号。

-

RVI指标:当RVI指标显示市场处于超卖状态时,视为买入信号。

-

MFI指标:当MFI指标显示市场处于超卖状态时,视为买入信号。

-

SAR指标:当价格上扬突破SAR指标时,视为买入信号。

-

SMA500指标:当价格上扬突破SMA500指标时,视为买入信号。

该策略综合考虑上述多个指标的判断结果,在关键支撑位附近形成双底形态时发出买入信号。

该策略具有以下优势:

-

结合多种指标判断市场状态,信号更加可靠。

-

在双底形成时发出买入信号,具有较高的获利概率。

-

采用指标组合判断超卖超买状态,避免错失买入时机。

-

融合双底突破模型与指标策略,兼具趋势跟踪与反转交易的优点。

-

策略参数优化空间大,可根据不同市场调整参数。

该策略也存在以下风险:

-

指标发出假信号的概率,导致买入亏损的风险。可以通过参数优化减少假信号。

-

双底没有成功突破的风险。可以设置止损点,降低单笔亏损。

-

高维度参数优化难度大,需要大量历史数据支持。可以采用步进算法逐步优化。

-

依赖历史数据测试效果,实盘效果会有差异。需要在不同市场验证。

该策略的主要优化方向包括:

-

对买入指标的权重进行优化,确定最优权重组合。

-

优化指标参数,确定最佳参数组合。

-

添加止损策略,降低单笔亏损。

-

增加仓位管理模块,让盈利更加平稳。

-

结合机器学习算法,建立自适应参数优化机制。

该策略整合双底突破模型与超卖指标判断,在关键支撑位附近形成双底时发出买入信号。优化空间较大,可调整权重、参数、止损、仓位等使策略更加稳定可靠。具备较高的实战价值。

||

This strategy is based on the double bottom model using technical indicators. It looks for breakthrough signals when the market is in an oversold state and a double bottom pattern is formed near the bottom area. The strategy combines multiple indicators to judge the overbought and oversold state of the market and generates buy signals when a double bottom forms. This strategy is mainly suitable for medium- and short-term trading.

This strategy mainly judges whether prices are forming a double bottom around key support levels and whether the market is in an oversold state. Specifically, the strategy uses the following indicators for judgment:

-

RSI Indicator: When the RSI indicator shows the market is oversold, it is considered a buy signal.

-

RVI Indicator: When the RVI indicator shows the market is oversold, it is considered a buy signal.

-

MFI Indicator: When the MFI indicator shows the market is oversold, it is considered a buy signal.

-

SAR Indicator: When prices break above the SAR indicator, it is considered a buy signal.

-

SMA500 Indicator: When prices break above the SMA500 indicator, it is considered a buy signal.

This strategy takes into account the judgments of the multiple indicators above and generates buy signals when a double bottom pattern forms around key support levels.

This strategy has the following advantages:

-

Combining multiple indicators to judge market status makes signals more reliable.

-

Generating buy signals when double bottoms form has a relatively high probability of profit.

-

Using indicator combinations to judge oversold and overbought states avoids missing buy opportunities.

-

Integrating the double bottom breakout model with indicator strategies combines the advantages of trend following and mean reversion trading.

-

The strategy has large parameter optimization space and parameters can be adjusted for different markets.

The strategy also has the following risks:

-

The risk of false signals from indicators, resulting in losses from buying. This can be reduced through parameter optimization.

-

The risk that double bottoms fail to break through. Stop losses can be set to reduce per trade loss.

-

The difficulty of high-dimensional parameter optimization is large and requires massive historical data support. Stepwise algorithms can be adopted for gradual optimization.

-

Reliance on historical data for testing results, actual performance will differ. Validation is needed across different markets.

The main optimization directions for this strategy include:

-

Optimizing the weights of buy indicators to determine the optimal weight combination.

-

Optimizing indicator parameters to determine the best parameter combination.

-

Adding stop loss strategies to reduce per trade loss.

-

Increasing position management modules for more steady profits.

-

Incorporating machine learning algorithms to build adaptive parameter optimization mechanisms.

This strategy integrates the double bottom breakout model and oversold indicator judgments, generating buy signals when double bottoms form around key support levels. It has large optimization space to adjust weights, parameters, stop losses, positions etc. for more stable and reliable strategies. It has high practical value.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_string_1 | 0 | Trade in: Uptrend and down trend |

| v_input_float_1 | 3.7 | Expected profit % |

| v_input_int_1 | 10 | (?Time Period Values)From Month |

| v_input_int_2 | true | From Day |

| v_input_int_3 | 2021 | From Year |

| v_input_int_4 | true | Thru Month |

| v_input_int_5 | true | Thru Day |

| v_input_int_6 | 2112 | Thru Year |

| v_input_float_2 | 0.0002 | (?SAR Values)SAR value 1 |

| v_input_float_3 | 0.0004 | SAR value 2 |

| v_input_float_4 | 0.1 | SAR value 3 |

| v_input_1_close | 0 | SAR Source - close: close |

| v_input_2_open | 0 | SAR Source - open: open |

| v_input_3 | false | Show SAR |

| v_input_int_7 | 16 | (?Super Trend)Supertrend - Trend |

| v_input_int_8 | 7 | Supertrend - Direction |

| v_input_int_9 | true | Supertrend - SMA |

| v_input_4 | false | Show Super Trend |

| v_input_5_high | 0 | (?SMA500)SMA500 - Source: high |

| v_input_int_10 | 143 | SMA500 - Look back period |

| v_input_6 | false | Show SMA500 |

| v_input_int_11 | 10 | (?RSI Indicator - 10)Length |

| v_input_7_ohlc4 | 0 | Source: ohlc4 |

| v_input_int_12 | 50 | (?RSI Indicator - 50)Length |

| v_input_8_high | 0 | Source: high |

| v_input_int_13 | 100 | (?RSI Indicator - 100)Length |

| v_input_9_ohlc4 | 0 | Source: ohlc4 |

| v_input_int_14 | 10 | (?RVI Indicator - 10)Length - RVI |

| v_input_int_15 | 10 | Length - EMA |

| v_input_10_high | 0 | Source: high |

| v_input_int_16 | 50 | (?RVI Indicator - 50)Length - RVI |

| v_input_int_17 | 50 | Length - EMA |

| v_input_11_close | 0 | source: close |

| v_input_int_18 | 100 | (?RVI Indicator - 100)Length - RVI |

| v_input_int_19 | 100 | Length - EMA |

| v_input_12_close | 0 | Source: close |

| v_input_int_20 | 10 | (?MFI Indicator - 10)Length - MFI |

| v_input_13_high | 0 | source: high |

| v_input_int_21 | 50 | (?MFI Indicator - 50)Length - MFI |

| v_input_14_high | 0 | source: high |

| v_input_int_22 | 100 | (?MFI Indicator - 100)Length - MFI |

| v_input_15_high | 0 | source: high |

| v_input_int_23 | 40 | (?Indicator Values)Lower value of RSI |

| v_input_int_24 | 40 | Lower value of RVI |

| v_input_int_25 | 40 | Lower value of MFI |

| v_input_16 | false | (?Safty Margins)Show Profit marjin and average price |

| v_input_17 | false | Show Safty Grids |

Source (PineScript)

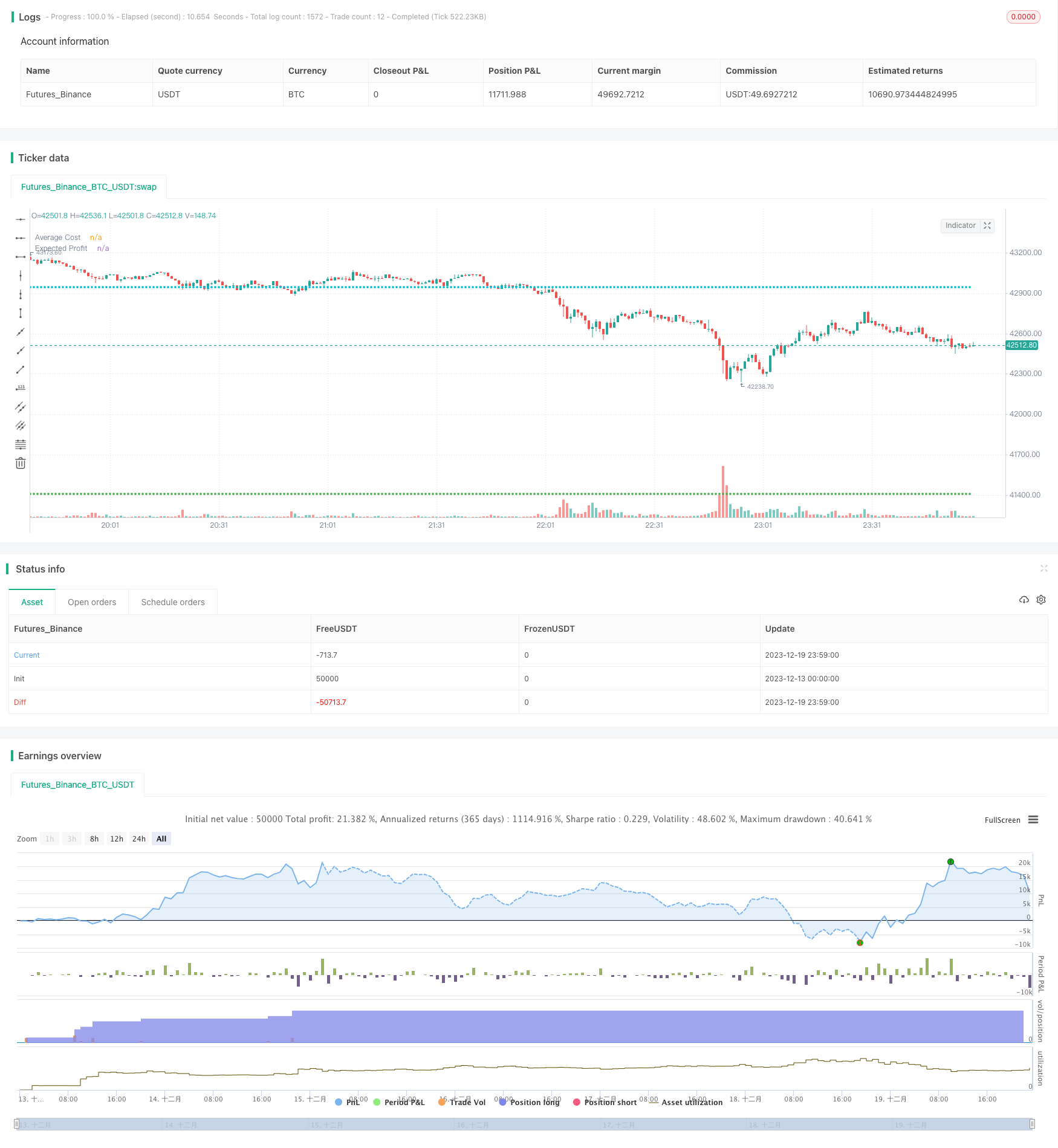

/*backtest

start: 2023-12-13 00:00:00

end: 2023-12-20 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("UP & DOWN - BNB/USDT 15min", shorttitle="U&D - BNB 15min", overlay=true, calc_on_order_fills=true, calc_on_every_tick=true, initial_capital = 1000,pyramiding = 40,backtest_fill_limits_assumption = 1, process_orders_on_close=true, currency = currency.USD, default_qty_type = strategy.cash, default_qty_value = 25, commission_type = strategy.commission.percent, commission_value = 0.1)

// This startergy optimized to BNB 15 min standerd candlestic chart and buy & sell signals were based on technical analysis.

UP_DOWN = input.string( title='Trade in', options=['Only on Up Trends', 'Uptrend and down trend'], defval='Uptrend and down trend')

var profit_cal = input.float( defval = 3.7, title = "Expected profit %", minval = 0.2, step = 0.1)

//Backtest dates

fromMonth = input.int(defval = 10,title = "From Month", minval = 1, maxval = 12, group = 'Time Period Values')

fromDay = input.int(defval = 1, title = "From Day", minval = 1, maxval = 31, group = 'Time Period Values')

fromYear = input.int(defval = 2021, title = "From Year", minval = 1970, group = 'Time Period Values')

thruMonth = input.int(defval = 1, title = "Thru Month", minval = 1, maxval = 12, group = 'Time Period Values')

thruDay = input.int(defval = 1, title = "Thru Day", minval = 1, maxval = 31, group = 'Time Period Values')

thruYear = input.int(defval = 2112, title = "Thru Year", minval = 1970, group = 'Time Period Values')

//showDate = input(defval = true, title = "Show Date Range", group = 'Time Period Values')

start = timestamp(fromYear, fromMonth, fromDay, 00, 00) // backtest start window

finish = timestamp(thruYear, thruMonth, thruDay, 23, 59) // backtest finish window

window() => true

// inputs

//Inputs of SAR Indicator

sar1 = input.float(defval=0.0002, title='SAR value 1',step=0.0001, group = 'SAR Values')

sar2 = input.float(defval=0.0004, title='SAR value 2',step=0.0001, group = 'SAR Values')

sar3 = input.float(defval=0.1, title='SAR value 3',step=0.1, group = 'SAR Values')

src_close = input(close, "SAR Source - close", group = 'SAR Values')

src_open = input(open, "SAR Source - open", group = 'SAR Values')

bool sar_visible = input(false, "Show SAR",group = 'SAR Values' )

// Inputs of Super trend indicator

ST_T = input.int(defval=16, title = 'Supertrend - Trend', step =1, group = 'Super Trend')

ST_D = input.int(defval=7, title = 'Supertrend - Direction', step =1, group = 'Super Trend')

ST_SMA = input.int(defval=1, title = 'Supertrend - SMA', step = 1, group = 'Super Trend')

bool ST_visible = input(false, "Show Super Trend",group = 'Super Trend' )

//Inputs of SMA500 indicator

src_sma500 = input(high, 'SMA500 - Source', group = 'SMA500')

lb_sma500 = input.int(defval = 143, title = 'SMA500 - Look back period', step=10, group = 'SMA500')

bool sma500_visible = input(false, "Show SMA500",group = 'SMA500' )

// Calculations

// SMA500 Indicator

SMA500 = ta.sma(src_sma500,lb_sma500)

SMA700 = ta.sma(close,700)

SMA_Open = ta.sma(open,9)

//SMA9 Indicator

SMA9 = ta.sma((high+low)/2,5)

risingSMA9 = ta.rising(SMA9,1)

fallingSMA9 = ta.falling(SMA9,1)

color plotcolor1 = color.black

if risingSMA9

plotcolor1 := color.green

// SAR Indicator

sar = ta.sar(sar1, sar2, sar3)

sma2_close = ta.sma(src_close,1)

sma2_open = ta.sma(src_open,1)

//Supertrend

[supertrend, direction] = ta.supertrend(ST_T, ST_D)

up_trend = ta.sma(direction < 0 ? supertrend : na,ST_SMA)

down_trend = ta.sma(direction < 0? na : supertrend, ST_SMA)

// Color change

color plotcolor2 = color.green

if open>down_trend or close>down_trend

plotcolor2 := color.lime

if open<down_trend or close<down_trend

plotcolor2 := color.red

color plotcolor3 = color.green

if open>up_trend or close>up_trend

plotcolor3 := color.yellow

if open<up_trend or close<up_trend

plotcolor3 := color.red

color plotcolor4 = color.black

if (open>sar or close>sar)

plotcolor4 := color.white

if (open<sar or close<sar)

plotcolor4 := color.red

color plotcolor5 = color.black

if (open>SMA500 or close>SMA500)

plotcolor5 := color.green

if (open<SMA500 or close<SMA500)

plotcolor5 := color.red

color plotcolor6 = color.green

rising_taalma = ta.rising (ta.alma(open,10,.99,1),1)

falling_taalma = ta.falling (ta.alma(open,10,.99,1),1)

if rising_taalma

plotcolor6 := color.green

if falling_taalma

plotcolor6 := color.red

// buy and sell conditions for uptrend

longCondition1 = (open >= down_trend or high>= down_trend or ta.crossover(open,down_trend)or ta.crossover(high,down_trend))

longCondition2 = (open >= up_trend or high>= up_trend or ta.crossover(open,up_trend)or ta.crossover(high,up_trend))

longCondition3 = (open >= SMA500 or high>= SMA500 or ta.crossover(open,SMA500)or ta.crossover(high,SMA500))

longCondition4 = (open >= sar or high>= sar or ta.crossover(open,sar)or ta.crossover(high,sar))

longCondition5 = rising_taalma

shortCondition1 = (close < down_trend or low< down_trend or ta.crossunder(close,down_trend)or ta.crossunder(low,down_trend))

shortCondition2 = (close < up_trend or low< up_trend or ta.crossunder(close,up_trend)or ta.crossunder(low,up_trend))

shortCondition3 = (close < SMA500 or low< SMA500 or ta.crossunder(close,SMA500)or ta.crossunder(low,SMA500))

shortCondition4 = (close < sar or low< sar or ta.crossunder(close,sar)or ta.crossunder(low,sar))

shortCondition5 = falling_taalma

comp_buy1 = longCondition1 and longCondition2 and longCondition3 and longCondition4 and longCondition5

op_buy1 = shortCondition3 and longCondition1 and longCondition2 and longCondition4

op_buy2 = shortCondition1 and shortCondition2 and longCondition3 and longCondition4 and longCondition5

comp_sell1 = shortCondition1 and shortCondition2 and shortCondition3 and shortCondition4 and shortCondition5

op_sell1 = shortCondition3 and shortCondition4 and longCondition1 and longCondition2

op_sell2 = shortCondition4 and longCondition1 and longCondition2 and longCondition3

op_sell3 = longCondition2 and shortCondition1 and shortCondition4 and shortCondition3

op_sell4 = longCondition2 and shortCondition1 and shortCondition4

var b1 = 0

var b2 = 0

var b3 = 0

if comp_buy1 == true and comp_buy1[1] == false

b1 := 1

else

b1 := 0

if op_buy1 == true and op_buy1[1] == false

b2 := 1

else

b2 := 0

if op_buy2 == true and op_buy2[1] == false

b3 := 1

else

b3 := 0

// DCA method based on indicators

//RSI Indicator

len_rsi_10 = input.int(10, title="Length", group = "RSI Indicator - 10", minval=1, maxval = 10, step = 1)

src_rsi_10 = input(ohlc4, "Source", group = "RSI Indicator - 10")

up_rsi_10 = ta.rma(math.max(ta.change(src_rsi_10), 0), len_rsi_10)

down_rsi_10 = ta.rma(-math.min(ta.change(src_rsi_10), 0), len_rsi_10)

rsi_10 = down_rsi_10 == 0 ? 100 : up_rsi_10 == 0 ? 0 : 100 - (100 / (1 + up_rsi_10 / down_rsi_10))

var p_rsi = 0

if rsi_10>= 0 and rsi_10<10

p_rsi := 0

else if rsi_10>= 10 and rsi_10<20

p_rsi := 10

else if rsi_10>= 20 and rsi_10<30

p_rsi := 20

else if rsi_10>= 30 and rsi_10<40

p_rsi := 30

else if rsi_10>= 40 and rsi_10<50

p_rsi := 40

else if rsi_10>= 50 and rsi_10<60

p_rsi := 50

else if rsi_10>= 60 and rsi_10<70

p_rsi := 60

else if rsi_10>= 70 and rsi_10<80

p_rsi := 70

else if rsi_10>= 80 and rsi_10<90

p_rsi := 80

else if rsi_10>= 90 and rsi_10<100

p_rsi := 90

len_rsi_50 = input.int(50, title="Length", group = "RSI Indicator - 50", minval=11, maxval = 50, step = 1)

src_rsi_50 = input(high, "Source", group = "RSI Indicator - 50")

up_rsi_50 = ta.rma(math.max(ta.change(src_rsi_50), 0), len_rsi_50)

down_rsi_50 = ta.rma(-math.min(ta.change(src_rsi_50), 0), len_rsi_50)

rsi_50 = down_rsi_50 == 0 ? 100 : up_rsi_50 == 0 ? 0 : 100 - (100 / (1 + up_rsi_50 / down_rsi_50))

var p_rsi_50 = 0

if rsi_50>= 0 and rsi_50<10

p_rsi_50 := 0

else if rsi_50>= 10 and rsi_50<20

p_rsi_50 := 10

else if rsi_50>= 20 and rsi_50<30

p_rsi_50 := 20

else if rsi_50>= 30 and rsi_50<40

p_rsi_50 := 30

else if rsi_50>= 40 and rsi_50<50

p_rsi_50 := 40

else if rsi_50>= 50 and rsi_50<60

p_rsi_50 := 50

else if rsi_50>= 60 and rsi_50<70

p_rsi_50 := 60

else if rsi_50>= 70 and rsi_50<80

p_rsi_50 := 70

else if rsi_50>= 80 and rsi_50<90

p_rsi_50 := 80

else if rsi_50>= 90 and rsi_50<100

p_rsi_50 := 90

len_rsi_100 = input.int(100, title="Length", group = "RSI Indicator - 100", minval=51, maxval = 200, step = 10)

src_rsi_100 = input(ohlc4, "Source", group = "RSI Indicator - 100")

up_rsi_100 = ta.rma(math.max(ta.change(src_rsi_100), 0), len_rsi_100)

down_rsi_100 = ta.rma(-math.min(ta.change(src_rsi_100), 0), len_rsi_100)

rsi_100 = down_rsi_100 == 0 ? 100 : up_rsi_100 == 0 ? 0 : 100 - (100 / (1 + up_rsi_100 / down_rsi_100))

var p_rsi_100 = 0

if rsi_100>= 0 and rsi_100<10

p_rsi_100 := 0

else if rsi_100>= 10 and rsi_100<20

p_rsi_100 := 10

else if rsi_100>= 20 and rsi_100<30

p_rsi_100 := 20

else if rsi_100>= 30 and rsi_100<40

p_rsi_100 := 30

else if rsi_100>= 40 and rsi_100<50

p_rsi_100 := 40

else if rsi_100>= 50 and rsi_100<60

p_rsi_100 := 50

else if rsi_100>= 60 and rsi_100<70

p_rsi_100 := 60

else if rsi_100>= 70 and rsi_100<80

p_rsi_100 := 70

else if rsi_100>= 80 and rsi_100<90

p_rsi_100 := 80

else if rsi_100>= 90 and rsi_100<100

p_rsi_100 := 90

// Relative Volatility Indicator

length_rvi_10 = input.int(defval = 10, minval=1, maxval = 10, step = 1, title="Length - RVI", group = "RVI Indicator - 10")

len_rvi_10 = input.int(defval = 10, minval=1, maxval = 10, step = 1, title="Length - EMA", group = "RVI Indicator - 10")

src_rvi_10 = input(high, title = "Source", group = "RVI Indicator - 10")

stddev_rvi_10 = ta.stdev(src_rvi_10, length_rvi_10)

upper_rvi_10 = ta.ema(ta.change(src_rvi_10) <= 0 ? 0 : stddev_rvi_10, len_rvi_10)

lower_rvi_10 = ta.ema(ta.change(src_rvi_10) > 0 ? 0 : stddev_rvi_10, len_rvi_10)

rvi_10 = upper_rvi_10 / (upper_rvi_10 + lower_rvi_10) * 100

var p_rvi_10 = 0

if rvi_10 >= 0 and rvi_10 <10

p_rvi_10 := 0

else if rvi_10 >= 10 and rvi_10 <20

p_rvi_10 := 10

else if rvi_10 >= 20 and rvi_10 <30

p_rvi_10 := 20

else if rvi_10 >= 30 and rvi_10 <40

p_rvi_10 := 30

else if rvi_10 >= 40 and rvi_10 <50

p_rvi_10 := 40

else if rvi_10 >= 50 and rvi_10 <60

p_rvi_10 := 50

else if rvi_10 >= 60 and rvi_10 <70

p_rvi_10 := 60

else if rvi_10 >= 70 and rvi_10 <80

p_rvi_10 := 70

else if rvi_10 >= 80 and rvi_10 <90

p_rvi_10 := 80

else if rvi_10 >= 90 and rvi_10 <100

p_rvi_10 := 90

length_rvi_50 = input.int(defval = 50, minval=11, maxval = 50, step = 1, title="Length - RVI", group = "RVI Indicator - 50")

len_rvi_50 = input.int(defval = 50, minval=11, maxval = 50, step = 1, title="Length - EMA", group = "RVI Indicator - 50")

src_rvi_50 = input(close, title = "source", group = "RVI Indicator - 50")

stddev_rvi_50 = ta.stdev(src_rvi_50, length_rvi_50)

upper_rvi_50 = ta.ema(ta.change(src_rvi_50) <= 0 ? 0 : stddev_rvi_50, len_rvi_50)

lower_rvi_50 = ta.ema(ta.change(src_rvi_50) > 0 ? 0 : stddev_rvi_50, len_rvi_50)

rvi_50 = upper_rvi_50 / (upper_rvi_50 + lower_rvi_50) * 100

var p_rvi_50 = 0

if rvi_50 >= 0 and rvi_50 <10

p_rvi_50 := 0

else if rvi_50 >= 10 and rvi_50 <20

p_rvi_50 := 10

else if rvi_50 >= 20 and rvi_50 <30

p_rvi_50 := 20

else if rvi_50 >= 30 and rvi_50 <40

p_rvi_50 := 30

else if rvi_50 >= 40 and rvi_50 <50

p_rvi_50 := 40

else if rvi_50 >= 50 and rvi_50 <60

p_rvi_50 := 50

else if rvi_50 >= 60 and rvi_50 <70

p_rvi_50 := 60

else if rvi_50 >= 70 and rvi_50 <80

p_rvi_50 := 70

else if rvi_50 >= 80 and rvi_50 <90

p_rvi_50 := 80

else if rvi_50 >= 90 and rvi_50 <100

p_rvi_50 := 90

length_rvi_100 = input.int(defval = 100, minval=51, maxval = 200, step = 10, title="Length - RVI", group = "RVI Indicator - 100")

len_rvi_100 = input.int(defval = 100, minval=51, maxval = 200, step = 10, title="Length - EMA", group = "RVI Indicator - 100")

src_rvi_100 = input(close, title = "Source", group = "RVI Indicator - 100")

stddev_rvi_100 = ta.stdev(src_rvi_100, length_rvi_100)

upper_rvi_100 = ta.ema(ta.change(src_rvi_100) <= 0 ? 0 : stddev_rvi_100, len_rvi_100)

lower_rvi_100 = ta.ema(ta.change(src_rvi_100) > 0 ? 0 : stddev_rvi_100, len_rvi_100)

rvi_100 = upper_rvi_100 / (upper_rvi_100 + lower_rvi_100) * 100

var p_rvi_100 = 0

if rvi_100 >= 0 and rvi_100 <10

p_rvi_100 := 0

else if rvi_100 >= 10 and rvi_100 <20

p_rvi_100 := 10

else if rvi_100 >= 20 and rvi_100 <30

p_rvi_100 := 20

else if rvi_100 >= 30 and rvi_100 <40

p_rvi_100 := 30

else if rvi_100 >= 40 and rvi_100 <50

p_rvi_100 := 40

else if rvi_100 >= 50 and rvi_100 <60

p_rvi_100 := 50

else if rvi_100 >= 60 and rvi_100 <70

p_rvi_100 := 60

else if rvi_100 >= 70 and rvi_100 <80

p_rvi_100 := 70

else if rvi_100 >= 80 and rvi_100 <90

p_rvi_100 := 80

else if rvi_100 >= 90 and rvi_100 <100

p_rvi_100 := 90

// Money flow index

len_mfi_10 = input.int(defval = 10, minval=1, maxval = 10, step = 1, title="Length - MFI", group = "MFI Indicator - 10")

src_mfi_10 = input(high, title = "source", group = "MFI Indicator - 10")

mf_10 = ta.mfi(src_mfi_10, len_mfi_10)

var p_mfi_10 = 0

if mf_10>= 0 and mf_10<10

p_mfi_10 := 0

else if mf_10>= 10 and mf_10<20

p_mfi_10 := 10

else if mf_10>= 20 and mf_10<30

p_mfi_10 := 20

else if mf_10>= 30 and mf_10<40

p_mfi_10 := 30

else if mf_10>= 40 and mf_10<50

p_mfi_10 := 40

else if mf_10>= 50 and mf_10<60

p_mfi_10 := 50

else if mf_10>= 60 and mf_10<70

p_mfi_10 := 60

else if mf_10>= 70 and mf_10<80

p_mfi_10 := 70

else if mf_10>= 80 and mf_10<90

p_mfi_10 := 80

else if mf_10>= 90 and mf_10<100

p_mfi_10 := 90

len_mfi_50 = input.int(defval = 50, minval=11, maxval = 50, step = 1, title="Length - MFI", group = "MFI Indicator - 50")

src_mfi_50 = input(high, title = "source", group = "MFI Indicator - 50")

mf_50 = ta.mfi(src_mfi_50, len_mfi_50)

var p_mfi_50 = 0

if mf_50>= 0 and mf_50<10

p_mfi_50 := 0

else if mf_50>= 10 and mf_50<20

p_mfi_50 := 10

else if mf_50>= 20 and mf_50<30

p_mfi_50 := 20

else if mf_50>= 30 and mf_50<40

p_mfi_50 := 30

else if mf_50>= 40 and mf_50<50

p_mfi_50 := 40

else if mf_50>= 50 and mf_50<60

p_mfi_50 := 50

else if mf_50>= 60 and mf_50<70

p_mfi_50 := 60

else if mf_50>= 70 and mf_50<80

p_mfi_50 := 70

else if mf_50>= 80 and mf_50<90

p_mfi_50 := 80

else if mf_50>= 90 and mf_50<100

p_mfi_50 := 90

len_mfi_100 = input.int(defval = 100, minval=51, maxval = 200, step = 10, title="Length - MFI", group = "MFI Indicator - 100")

src_mfi_100 = input(high, title = "source", group = "MFI Indicator - 100")

mf_100 = ta.mfi(src_mfi_100, len_mfi_100)

var p_mfi_100 = 0

if mf_100>= 0 and mf_100<10

p_mfi_100 := 0

else if mf_100>= 10 and mf_100<20

p_mfi_100 := 10

else if mf_100>= 20 and mf_100<30

p_mfi_100 := 20

else if mf_100>= 30 and mf_100<40

p_mfi_100 := 30

else if mf_100>= 40 and mf_100<50

p_mfi_100 := 40

else if mf_100>= 50 and mf_100<60

p_mfi_100 := 50

else if mf_100>= 60 and mf_100<70

p_mfi_100 := 60

else if mf_100>= 70 and mf_100<80

p_mfi_100 := 70

else if mf_100>= 80 and mf_100<90

p_mfi_100 := 80

else if mf_100>= 90 and mf_100<100

p_mfi_100 := 90

//Balance of power indicator

bop = ((((close - open) / (high - low))*100)+50)

bop_sma_100 = ta.sma(bop,100)

// Buy and Sell lavels based on Indicators

l_val_rsi = input.int (defval = 40, title = "Lower value of RSI", maxval = 100, minval = 0, step = 10, group = 'Indicator Values')

l_val_rvi = input.int (defval = 40, title = "Lower value of RVI", maxval = 100, minval = 0, step = 10, group = 'Indicator Values')

l_val_mfi = input.int (defval = 40, title = "Lower value of MFI", maxval = 100, minval = 0, step = 10, group = 'Indicator Values')

//h_val_rsi = input.int (defval = 60, title = "Higher value of RSI", maxval = 100, minval = 0, step = 10, group = 'Indicator Values')

//h_val_rvi = input.int (defval = 50, title = "Higher value of RVI", maxval = 100, minval = 0, step = 10, group = 'Indicator Values')

//h_val_mfi = input.int (defval = 50, title = "Higher value of MFI", maxval = 100, minval = 0, step = 10, group = 'Indicator Values')

buy_rsi = p_rsi_100 <= l_val_rsi and p_rsi_50<p_rsi_100 and p_rsi<=p_rsi_50

buy_rvi = p_rvi_100 <= l_val_rvi and p_rvi_50<=p_rvi_100 and p_rvi_10<=p_rvi_50

buy_mfi = p_mfi_100 <= l_val_mfi and p_mfi_50<=p_mfi_100 and p_mfi_10<=p_mfi_50

buy_compound = buy_rsi and buy_rvi and buy_mfi ? 100 : 0

var float buy_compound_f = na

if (buy_compound[1] == 100 and buy_compound == 0) //and open > close

buy_compound_f := 1

else

buy_compound_f := na

ma_9 = ta.ema(close,2)

co_l1 = strategy.position_avg_price*0.95

co_l2 = strategy.position_avg_price*0.90

co_l3 = strategy.position_avg_price*0.85

co_l4 = strategy.position_avg_price*0.80

//Take profit in Market bottoms

profit_f = 1.0 + (profit_cal/100)

// Trading

var final_option = UP_DOWN == 'Uptrend and down trend' ? 1 : 2

if final_option == 1

if ((buy_compound_f ==1 or ta.crossover(ma_9, co_l1) or ta.crossover(ma_9, co_l2) or ta.crossover(ma_9, co_l3) or ta.crossover(ma_9, co_l4)) and window())

strategy.entry("long", strategy.long,comment = "BUY")

else if ( comp_sell1 and window()) and strategy.position_avg_price * profit_f < close

strategy.close("long", qty_percent = 100, comment = "SELL")

else if final_option == 2

if (b1 or b2 or b3) and window()

strategy.entry("long", strategy.long, comment = "BUY")

else if (comp_sell1 or op_sell1 or op_sell2 or op_sell3 or op_sell4 ) and window()

strategy.close("long", qty_percent = 100, comment = "SELL")

bool PM_visible = input(false, "Show Profit marjin and average price", group = 'Safty Margins')

bool SM_visible = input(false, "Show Safty Grids", group = 'Safty Margins' )

//Graphs

plot(PM_visible or final_option == 1 ? strategy.position_avg_price : na, color = color.green, title = "Average Cost", style = plot.style_circles)

plot(PM_visible or final_option == 1 ? strategy.position_avg_price* profit_f :na, color = color.aqua, title = "Expected Profit", style = plot.style_circles)

plot(SM_visible ? strategy.position_avg_price*0.95 : na, color = color.gray, title = "SAFTY MARGIN - 95%", linewidth = 1, style = plot.style_circles)

plot(SM_visible ? strategy.position_avg_price*0.90 : na, color = color.gray, title = "SAFTY MARGIN - 90%", linewidth = 1, style = plot.style_circles)

plot(SM_visible ? strategy.position_avg_price*0.85 : na, color = color.gray, title = "SAFTY MARGIN - 85%", linewidth = 1, style = plot.style_circles)

plot(SM_visible ? strategy.position_avg_price*0.80 : na, color = color.gray, title = "SAFTY MARGIN - 80%", linewidth = 1, style = plot.style_circles)

plot(ST_visible or final_option == 2 ? down_trend:na, "Down trend", color = plotcolor2, linewidth=2)

plot(ST_visible or final_option == 2 ? up_trend: na , "Up direction", color = plotcolor3, linewidth=2)

plot(sar_visible or final_option == 2 ? sar:na, title='SAR', color=plotcolor4, linewidth=2)

plot(sma500_visible or final_option == 2 ? SMA500:na,title='SMA500', color=plotcolor5, linewidth=3)

Detail

https://www.fmz.com/strategy/436124

Last Modified

2023-12-21 15:16:24