Name

单均线穿越布林带策略Single-Moving-Average-Crossover-Bollinger-Bands-Strategy

Author

ChaoZhang

Strategy Description

该策略基于单均线和布林带指标,当价格突破布林带上轨或下轨时,进行买入或卖出操作。同时结合均线的方向判断趋势,只有在均线上升时才进行买入,在均线下降时才进行卖出。

该策略主要根据以下几个指标进行判断:

- 均线(SMA):计算CLOSE收盘价的简单移动平均线,代表价格趋势。

- 布林带上轨:代表仰角阻力线,突破该线表示强势突破。

- 布林带下轨:代表支撑线,跌破该线表示趋势反转的可能。

具体交易信号如下:

- 买入信号:当收盘价突破布林带上轨,且均线处于上升状态,进行买入。

- 卖出信号:当收盘价跌破布林带下轨,且均线处于下降状态,进行卖出。

这样,结合趋势和突破,使交易信号更加可靠,避免假突破。

- 规则简单清晰,容易理解执行。

- 利用均线判断大趋势方向,避免做空牛市,做多熊市。

- 布林带上下轨判断局部突破点位,精确捕获突破信号。

- 回撤相对较小,符合多数人的风险偏好。

- 单一指标容易发出错误信号,可通过优化参数降低错误率。

- 无法应对大的行情震荡,可适当调整止损点位。

- 无法在趋势巨大的情况下获利更多,可考虑加大仓位。

- 优化均线周期参数,适应更多品种。

- 增加其它指标过滤,如MACD等,减少错误信号。

- 动态调整止损点位,限制最大回撤。

- 结合资金管理思想,使盈亏更加平稳。

该策略整体来说较为简单实用,适合多数人. 通过一些优化调整,可以使策略更加鲁棒,适应更多市场情况,是一个值得推荐的策略。

||

This strategy is based on single moving average and Bollinger Bands indicator. It generates buy and sell signals when price breaks through the upper or lower band of Bollinger Bands. Also it incorporates the direction of moving average to determine the trend, only taking long when MA is rising and short when MA is falling.

The strategy mainly uses the following indicators for judgment:

- Moving Average (SMA): Simple moving average of CLOSE price, representing the price trend.

- Upper Bollinger Band: Represents the resistance level, breakout indicates a strong momentum.

- Lower Bollinger Band: Represents the support level, breakdown indicates a possible trend reversal.

The specific trading signals are:

- Buy Signal: When close price breaks through the upper band and the MA is rising.

- Sell Signal: When close price breaks through the lower band and the MA is falling.

By combining the trend and breakout, the trading signal becomes more reliable and avoids false breakout.

- Simple and clear rules, easy to understand and implement.

- MA judges the general trend to avoid short bull and long bear market.

- Bollinger Bands upper & lower band locates local breakout points accurately.

- Relatively small drawdowns, matches most people's risk preference.

- Single indicator tends to generate false signals, can be improved by parameter tuning.

- Cannot cope with large market fluctuations, can adjust stop loss accordingly.

- Unable to profit more from mega trends, can consider larger position size.

- Optimize MA periods to fit more products.

- Add other filters like MACD to reduce false signals.

- Dynamically adjust stop loss to limit maximum drawdown.

- Introduce money management to stabilize PnL performance.

In general this is a simple but practical strategy suitable for most people. With some tuning and optimizations it can be more robust and adaptive to more market situations. It is a strategy worth recommending.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 90 | s |

| v_input_2 | 0.9 | p |

| v_input_3 | false | Take Profit |

| v_input_4 | false | Stop Loss |

| v_input_5 | false | Trailing Stop Loss |

| v_input_6 | false | Trailing Stop Loss Offset |

Source (PineScript)

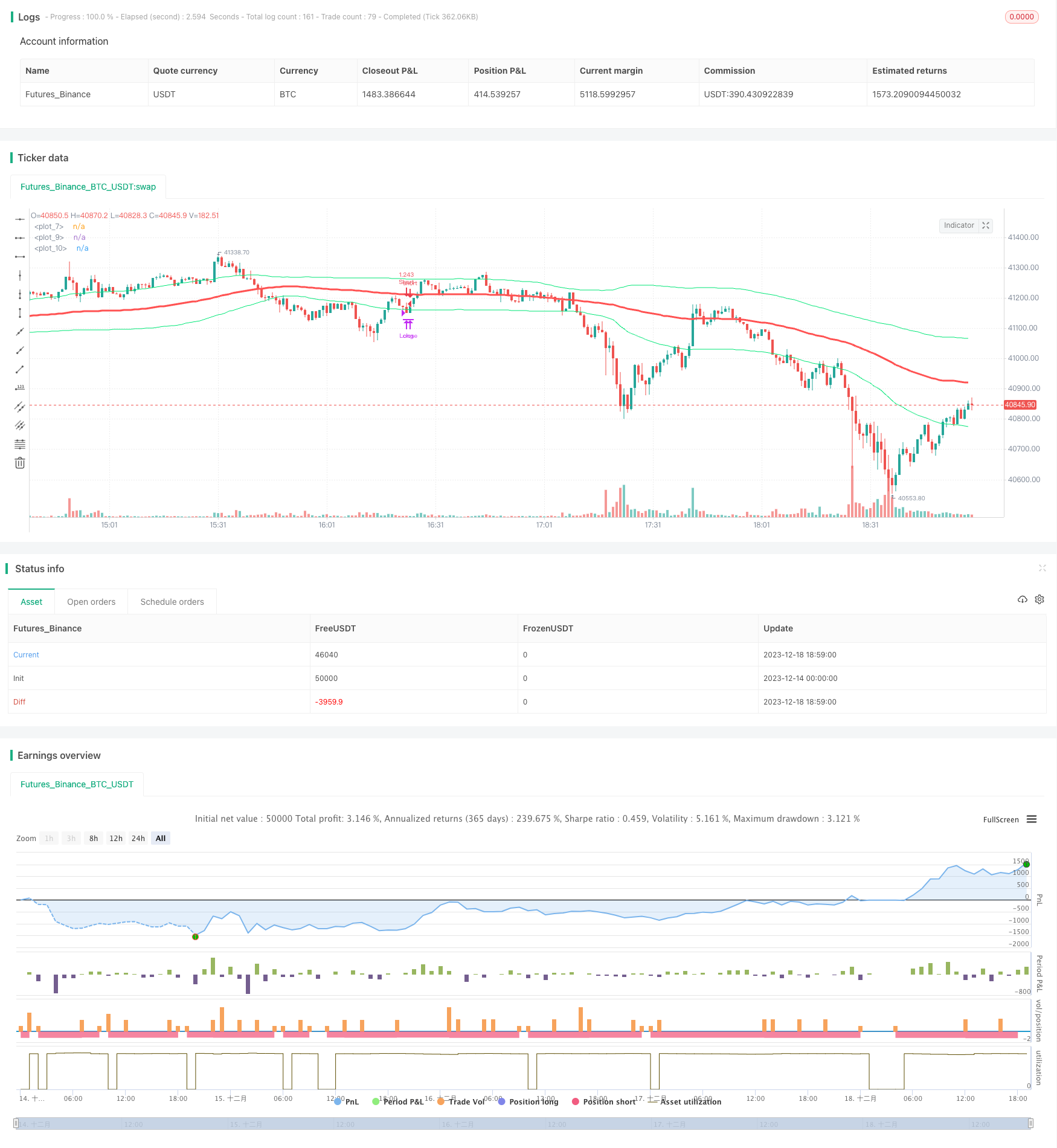

/*backtest

start: 2023-12-14 00:00:00

end: 2023-12-18 19:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy(title="single sma cross", shorttitle="single sma cross",default_qty_type = strategy.percent_of_equity, default_qty_value = 100,overlay=true,currency="USD")

s=input(title="s",defval=90)

p=input(title="p",type=float,defval=.9,step=.1)

sa=sma(close,s)

plot(sa,color=red,linewidth=3)

band=stdev(close,s)*p

plot(band+sa,color=lime,title="")

plot(-band+sa,color=lime,title="")

// ===Strategy Orders============================================= ========

inpTakeProfit = input(defval = 0, title = "Take Profit", minval = 0)

inpStopLoss = input(defval = 0, title = "Stop Loss", minval = 0)

inpTrailStop = input(defval = 0, title = "Trailing Stop Loss", minval = 0)

inpTrailOffset = input(defval = 0, title = "Trailing Stop Loss Offset", minval = 0)

useTakeProfit = inpTakeProfit >= 1 ? inpTakeProfit : na

useStopLoss = inpStopLoss >= 1 ? inpStopLoss : na

useTrailStop = inpTrailStop >= 1 ? inpTrailStop : na

useTrailOffset = inpTrailOffset >= 1 ? inpTrailOffset : na

longCondition = crossover(close,sa+band) and rising(sa,5)

shortCondition = crossunder(close,sa-band) and falling(sa,5)

crossmid = cross(close,sa)

strategy.entry(id = "Long", long=true, when = longCondition)

strategy.close(id = "Long", when = shortCondition)

strategy.entry(id = "Short", long=false, when = shortCondition)

strategy.close(id = "Short", when = longCondition)

strategy.exit("Exit Long", from_entry = "Long", profit = useTakeProfit, loss = useStopLoss, trail_points = useTrailStop, trail_offset = useTrailOffset, when=crossmid)

strategy.exit("Exit Short", from_entry = "Short", profit = useTakeProfit, loss = useStopLoss, trail_points = useTrailStop, trail_offset = useTrailOffset, when=crossmid)

Detail

https://www.fmz.com/strategy/436238

Last Modified

2023-12-22 14:10:14