Name

卖涨回落策略Sell-the-Rallies-Strategy

Author

ChaoZhang

Strategy Description

卖涨回落策略是一个精心设计的交易策略,旨在优化资产在涨价中回落阶段的销售。采用此策略的交易员将从一个以明确的入场和退出条件为后盾的系统性方法中获益。

该策略采用技术指标和明确的参数组合来引导交易员度过市场波动。策略的基础在于对历史价格数据的深入分析,以找出潜在的转折点。

当总百分比变化交叉超过预定的涨幅值时,该策略会触发做空仓位建立。这一交叉条件充当鲁棒信号,用于识别价格涨势中潜在的反转点。交易员可以利用此信号启动做空仓位,策略性地预期趋势反转。

为了防范不利的市场行情,该策略纳入了精心的风险管理体系。退出条件由计算出的止损位和止盈位定义,这些位是根据仓位的平均入场价动态确定的。

一旦做空仓位建立,就会计算出止损位和止盈位。止损位通过将仓位的平均入场价与止损百分比相乘确定。止盈位通过将平均入场价与止盈百分比相乘确定。这些风险管理水平为您提供了何时退出仓位的明确指引,确保资本保护和利润实现。

该策略具有以下优势:

-

提供清晰的入场和退出规则,使交易决策更加明确。

-

利用技术指标识别反转机会,提高决策的准确性。

-

动态计算止损止盈位,更好地控制风险。

-

系统性方法有利于跟踪和评估表现。

-

允许参数优化,使策略能够适应不同的市场条件。

该策略也存在以下风险:

-

反转信号可能发出错误信号,导致亏损。

-

止损止盈设定不当可能导致过度亏损或利润没全额实现。

-

参数设置不当会导致表现不佳。

主要的风险控制措施包括:

-

评估信号的可靠性,避免假信号。

-

测试和优化止损止盈参数。

-

评估不同市场条件下的参数稳健性。

该策略可从以下几个方面进行优化:

-

测试更多技术指标,找到更可靠的反转信号。

-

利用机器学习方法动态优化止损止盈位。

-

结合情绪指标等评估市场偏见,提高信号的准确性。

-

优化仓位规模管理,在大趋势中进行追踪。

-

评估股票特征,筛选最适合该策略的标的。

卖涨回落策略为交易员在价格涨势中积极寻找理想的反转做空机会提供了有力的工具。凭借扎实的框架和基于细致分析做出的决策,该策略使交易员能够主动把握市场机遇。同时,策略提供了可定制的参数,允许交易员量身打造自己的交易策略。通过细致的参数测试和优化,交易员可以充分发挥该策略的交易潜能。

||

The "Sell the Rallies" strategy is a carefully crafted trading strategy designed to optimize asset sales during pullbacks in price rallies. Traders following this strategy will benefit from a systematic approach backed by clear entry and exit conditions.

The strategy employs a combination of technical indicators and well-defined parameters to guide traders through market fluctuations. The strategy's foundation lies in a thorough analysis of historical price data to pinpoint potential reversal points.

The strategy triggers a short position entry when the overall percentage change crosses above a predefined rally value. This crossover condition acts as a robust signal for identifying potential reversal points during price rallies. Traders can leverage this signal to initiate short positions, positioning themselves strategically in anticipation of a downturn.

To safeguard against adverse market movements, the strategy incorporates a meticulous risk management system. The exit conditions are defined by calculated stop-loss and take-profit levels, which are dynamically determined based on the average entry price of the position.

Once a short position is entered, the stop-loss and take-profit levels are calculated. The stop-loss level is determined by multiplying the average entry price of the position by the stop-loss percentage. The take-profit level is calculated by multiplying the average entry price by the take-profit percentage. These risk management levels provide clear guidelines on when to exit a position, ensuring both capital protection and profit realization.

The strategy has the following advantages:

-

Provides clear entry and exit rules for more definitive trading decisions.

-

Identifies reversal opportunities using technical indicators for improved decision accuracy.

-

Dynamically calculates stop-loss and take-profit levels for better risk control.

-

Systematic approach facilitates tracking and performance evaluation.

-

Allows parameter optimization for adapting to different market conditions.

The strategy also carries the following risks:

-

Reversal signals may give false signals resulting in losses.

-

Improper stop-loss and take-profit settings may lead to excessive losses or failure to realize full profits.

-

Improper parameter settings can lead to poor performance.

The main risk control measures include:

-

Evaluate signal reliability to avoid false signals.

-

Test and optimize stop-loss and take-profit parameters.

-

Assess parameter robustness across different market conditions.

The strategy can be optimized in several aspects:

-

Test more technical indicators to find more reliable reversal signals.

-

Utilize machine learning methods to dynamically optimize stop-loss and take-profit levels.

-

Incorporate evaluation of market biases using sentiment indicators etc. to improve signal accuracy.

-

Optimize position sizing management for trend tracking.

-

Evaluate stock characteristics to screen for best suited tickers for the strategy.

The Sell the Rallies strategy provides traders with a powerful tool to actively seek ideal reversal shorting opportunities during price rallies. With a robust framework and decisions grounded in meticulous analysis, the strategy enables traders to proactively capitalize on market opportunities. At the same time, the strategy provides customizable parameters allowing traders to tailor-make their own trading strategies. Through rigorous parameter testing and optimization, traders can unlock the strategy's full trading potential.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | true | From Month |

| v_input_2 | 10 | From Day |

| v_input_3 | 2020 | From Year |

| v_input_4 | 2 | Thru Month |

| v_input_5 | 21 | Thru Day |

| v_input_6 | 2024 | Thru Year |

| v_input_7 | true | Lookback Period |

| v_input_8 | 2 | Rally |

| v_input_9 | 2 | Stop Loss (%) |

| v_input_10 | 2 | Take Profit (%) |

Source (PineScript)

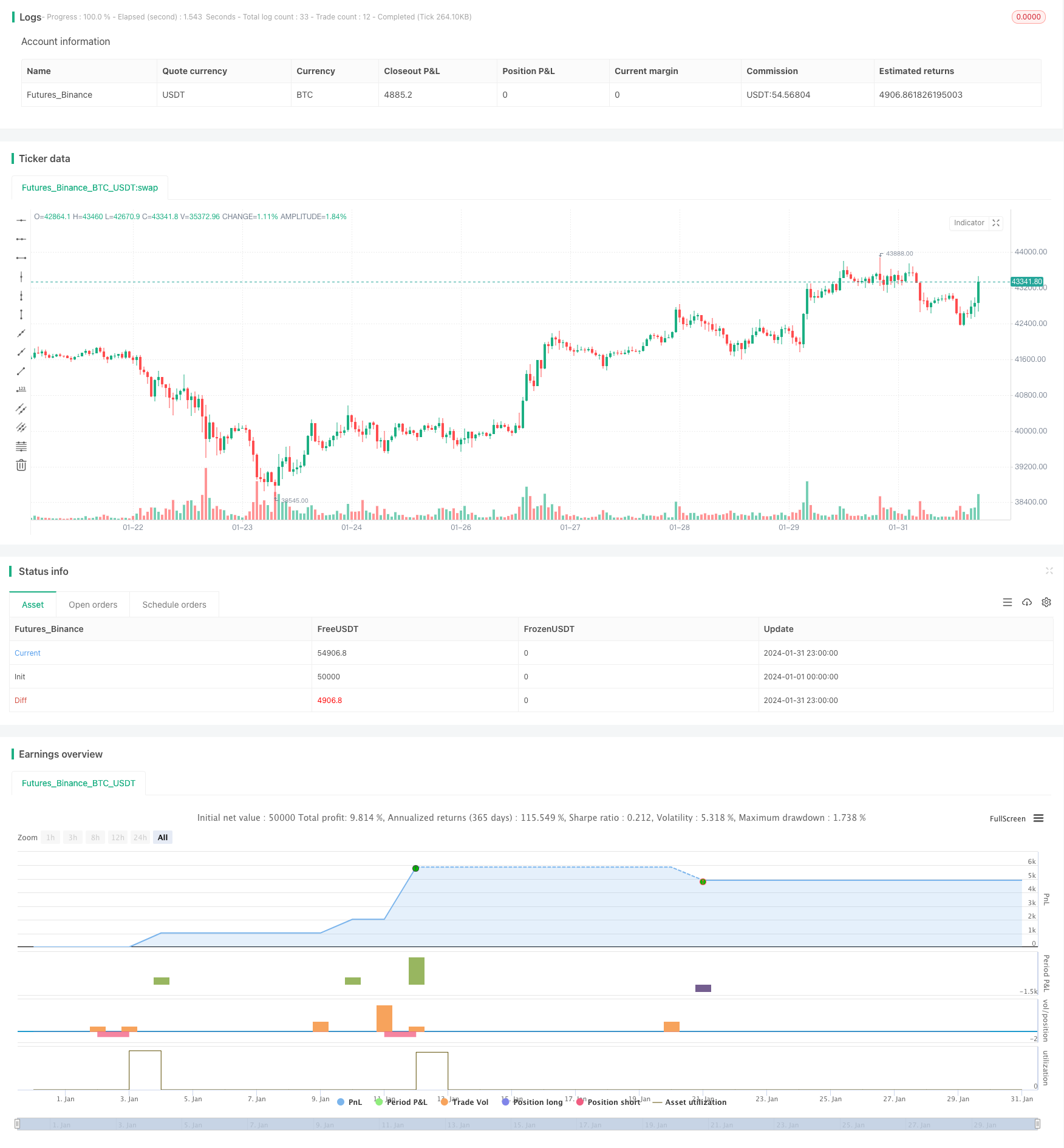

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Sell the Rallies", overlay=true, initial_capital=212, commission_type=strategy.commission.percent, commission_value=0, pyramiding=2)

// Backtest dates

fromMonth = input(1, "From Month")

fromDay = input(10, "From Day")

fromYear = input(2020, "From Year")

thruMonth = input(2, "Thru Month")

thruDay = input(21, "Thru Day")

thruYear = input(2024, "Thru Year")

// Define window of time for backtest

start = timestamp(fromYear, fromMonth, fromDay, 00, 00)

finish = timestamp(thruYear, thruMonth, thruDay, 23, 59)

withinWindow() => true

inp_lkb = input(1, "Lookback Period")

// Calculate percentage change

perc_change(lkb) =>

overall_change = ((close - ta.valuewhen(withinWindow(), close, lkb)) / ta.valuewhen(withinWindow(), close, lkb)) * 100

// Call the function

overall = perc_change(inp_lkb)

// Entry

rally = input(2, "Rally")

if ta.crossover(overall, rally) and withinWindow()

strategy.entry("Short", strategy.short)

// Exit

stopLoss = input(2, "Stop Loss (%)") / 100

takeProfit = input(2, "Take Profit (%)") / 100

shortStopPrice = strategy.position_avg_price * (1 + stopLoss)

shortTakeProfit = strategy.position_avg_price * (1 - takeProfit)

strategy.exit("Exit", "Short", stop=shortStopPrice, limit=shortTakeProfit)

Detail

https://www.fmz.com/strategy/442926

Last Modified

2024-02-27 14:18:57