Name

双向网格K线追踪交易策略Grid-Trading-Strategy-Based-on-Real-time-K-line-Tracking

Author

ChaoZhang

Strategy Description

本策略是一个基于K线实时变化的双向追踪网格交易策略。它可以在牛市和熊市中都获得稳定的利润。

-

根据用户设置的网格数量,自动计算价格网格区间和每个网格价格。

-

当价格突破网格价格时,按照固定数量开仓做多;当价格跌破网格价格时,平仓做多仓位,做空开仓。

-

这样,价格在网格区间震荡时,可以通过追踪价格变化来获得利润。

-

自动计算合理的网格区间,无需人工确定支持阻力。

-

双向交易,可适应行情多变的市场环境。

-

固定开仓数量,有利于风险控制。

-

代码直观简洁,容易理解和修改。

-

行情剧烈波动可能导致亏损扩大。

-

交易费用的累积也会影响最终利润。

-

需要合理确定网格数量,太多网格交易次数增多但每次利润有限。

-

加入止损策略,避免亏损扩大。

-

增加网格数量动态调整功能。

-

考虑加入杠杆,放大交易量。

本策略整体思路清晰简洁,通过双向追踪网格交易获得稳定收益,同时也存在一定的交易风险。通过不断优化,可望获得更好的效果。

||

This strategy is a bi-directional grid trading strategy based on real-time tracking of K-line changes. It can generate steady profits in both bull and bear markets.

-

Automatically calculate the price range and each grid price based on the number of grids set by users.

-

When price breaks through a grid price, open long position with fixed quantity; when price falls below a grid price, close long position and open short position.

-

By tracking price changes, profits can be obtained when price fluctuates within the grid range.

-

Automatically calculate a reasonable grid range without needing to determine support and resistance manually.

-

Bi-directional trading adapts to changing market conditions.

-

Fixed open position size facilitates risk control.

-

Simple and straightforward code that is easy to understand and modify.

-

Significant price swings may lead to expanding losses.

-

Accumulated trading fees also impact final profits.

-

Need to reasonably determine number of grids. More grids means more trades but each with limited profits.

-

Incorporate stop loss strategy to limit losses.

-

Add dynamic adjustment of number of grids.

-

Consider adding leverage to amplify trading volume.

The strategy has an overall clear and simple logic to generate steady income through bi-directional grid trading, but also bears certain trading risks. Further optimizations may lead to better results.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | true | (?Grid Bounds)Use Auto Bounds? |

| v_input_2 | 0 | (Auto) Bound Source: Hi & Low |

| v_input_3 | 250 | (Auto) Bound Lookback |

| v_input_4 | 0.1 | (Auto) Bound Deviation |

| v_input_5 | 0.285 | (Manual) Upper Boundry(상단 가격) |

| v_input_6 | 0.225 | (Manual) Lower Boundry(하단 가격) |

| v_input_7 | 30 | (?Grid Lines)Grid Line Quantity(그리드 수) |

| v_input_8 | 100 | (?Trading option)Initial balance(투자금액) |

| v_input_9 | timestamp(15 March 2023 06:00) | Start Time |

| v_input_10 | timestamp(31 Dec 2035 20:00) | End Time |

Source (PineScript)

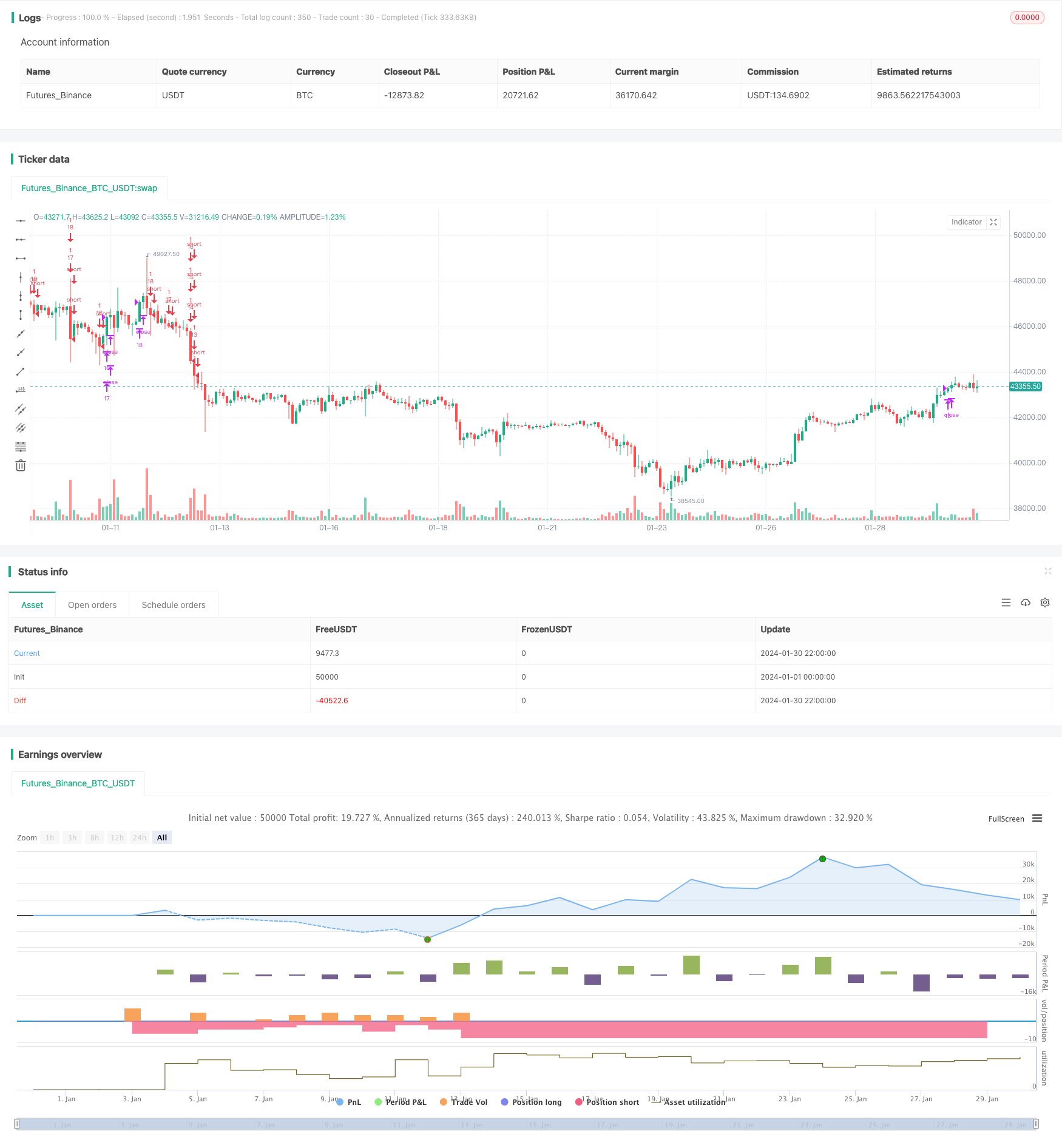

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//hk4jerry

strategy("Grid Bot Backtesting", overlay=false, pyramiding=3000, close_entries_rule="ANY", default_qty_type=strategy.cash, initial_capital=100.0, currency="USD", commission_type=strategy.commission.percent, commission_value=0.025)

i_autoBounds = input(group="Grid Bounds", title="Use Auto Bounds?", defval=true, type=input.bool) // calculate upper and lower bound of the grid automatically? This will theorhetically be less profitable, but will certainly require less attention

i_boundSrc = input(group="Grid Bounds", title="(Auto) Bound Source", defval="Hi & Low", options=["Hi & Low", "Average"]) // should bounds of the auto grid be calculated from recent High & Low, or from a Simple Moving Average

i_boundLookback = input(group="Grid Bounds", title="(Auto) Bound Lookback", defval=250, type=input.integer, maxval=500, minval=0) // when calculating auto grid bounds, how far back should we look for a High & Low, or what should the length be of our sma

i_boundDev = input(group="Grid Bounds", title="(Auto) Bound Deviation", defval=0.10, type=input.float, maxval=1, minval=-1) // if sourcing auto bounds from High & Low, this percentage will (positive) widen or (negative) narrow the bound limits. If sourcing from Average, this is the deviation (up and down) from the sma, and CANNOT be negative.

i_upperBound = input(group="Grid Bounds", title="(Manual) Upper Boundry(상단 가격)", defval=0.285, type=input.float) // for manual grid bounds only. The upperbound price of your grid

i_lowerBound = input(group="Grid Bounds", title="(Manual) Lower Boundry(하단 가격)", defval=0.225, type=input.float) // for manual grid bounds only. The lowerbound price of your grid.

i_gridQty = input(group="Grid Lines", title="Grid Line Quantity(그리드 수)", defval=30, maxval=999, minval=1, type=input.integer) // how many grid lines are in your grid

initial_balance = input(group="Trading option", title="Initial balance(투자금액)", defval=100, step=0.01)

start_time = input(group="Trading option",defval=timestamp('15 March 2023 06:00'), title='Start Time', type = input.time)

end_time = input(group="Trading option",defval=timestamp('31 Dec 2035 20:00'), title='End Time', type = input.time)

isAfterStartDate = true

tradingtime= (timenow - start_time)/(86400000*30)

yeartime=tradingtime/12

f_getGridBounds(_bs, _bl, _bd, _up) =>

if _bs == "Hi & Low"

_up ? highest(close, _bl) * (1 + _bd) : lowest(close, _bl) * (1 - _bd)

else

avg = sma(close, _bl)

_up ? avg * (1 + _bd) : avg * (1 - _bd)

f_buildGrid(_lb, _gw, _gq) =>

gridArr = array.new_float(0)

for i=0 to _gq-1

array.push(gridArr, _lb+(_gw*i))

gridArr

f_getNearGridLines(_gridArr, _price) =>

arr = array.new_int(3)

for i = 0 to array.size(_gridArr)-1

if array.get(_gridArr, i) > _price

array.set(arr, 0, i == array.size(_gridArr)-1 ? i : i+1)

array.set(arr, 1, i == 0 ? i : i-1)

break

arr

var upperBound = i_autoBounds ? f_getGridBounds(i_boundSrc, i_boundLookback, i_boundDev, true) : i_upperBound // upperbound of our grid

var lowerBound = i_autoBounds ? f_getGridBounds(i_boundSrc, i_boundLookback, i_boundDev, false) : i_lowerBound // lowerbound of our grid

var gridWidth = (upperBound - lowerBound)/(i_gridQty-1) // space between lines in our grid

var gridLineArr = f_buildGrid(lowerBound, gridWidth, i_gridQty) // an array of prices that correspond to our grid lines

var orderArr = array.new_bool(i_gridQty, false) // a boolean array that indicates if there is an open order corresponding to each grid line

var closeLineArr = f_getNearGridLines(gridLineArr, close) // for plotting purposes - an array of 2 indices that correspond to grid lines near price

var nearTopGridLine = array.get(closeLineArr, 0) // for plotting purposes - the index (in our grid line array) of the closest grid line above current price

var nearBotGridLine = array.get(closeLineArr, 1) // for plotting purposes - the index (in our grid line array) of the closest grid line below current price

if isAfterStartDate

for i = 0 to (array.size(gridLineArr) - 1)

if close < array.get(gridLineArr, i) and not array.get(orderArr, i) and i < (array.size(gridLineArr) - 1)

buyId = i

array.set(orderArr, buyId, true)

strategy.entry(id=tostring(buyId), long=true, qty=(initial_balance/(i_gridQty-1))/close, comment="#"+tostring(buyId))

if close > array.get(gridLineArr, i) and i != 0

if array.get(orderArr, i-1)

sellId = i-1

array.set(orderArr, sellId, false)

strategy.close(id=tostring(sellId), comment="#"+tostring(sellId))

if i_autoBounds

upperBound := f_getGridBounds(i_boundSrc, i_boundLookback, i_boundDev, true)

lowerBound := f_getGridBounds(i_boundSrc, i_boundLookback, i_boundDev, false)

gridWidth := (upperBound - lowerBound)/(i_gridQty-1)

gridLineArr := f_buildGrid(lowerBound, gridWidth, i_gridQty)

closeLineArr := f_getNearGridLines(gridLineArr, close)

nearTopGridLine := array.get(closeLineArr, 0)

nearBotGridLine := array.get(closeLineArr, 1)

var table table = table.new(position.top_right,6,8, frame_color = color.rgb(255, 255, 255),frame_width = 2,border_width = 2, border_color=color.rgb(255, 255, 255))

//제목

table.cell(table,0,0,"Upper limit price :", bgcolor=color.new(color.black,0),text_color =color.white)

table.cell(table,0,1,"Lower limit price :",bgcolor=color.new(color.black,0),text_color =color.white)

table.cell(table,0,2,"Grids quantity :",bgcolor=color.new(color.black,0),text_color =color.white)

table.cell(table,0,3,"Investment :",text_color =color.white,bgcolor=color.new(color.black,0))

table.cell(table,0,4,"USDT per grid :",text_color =color.white,bgcolor=color.new(color.black,0))

//수치

table.cell(table,1,0, tostring(upperBound, '###.#####')+ " USDT", bgcolor=color.new(#5a637e, 0),text_color =color.white)

table.cell(table,1,1, tostring(lowerBound, '###.#####')+ " USDT", bgcolor=color.new(#5a637e, 0),text_color =color.white)

table.cell(table,1,2, tostring(i_gridQty, '###'), bgcolor=color.new(#5a637e, 0),text_color =color.white)

table.cell(table,1,3, tostring(initial_balance,'###.##')+ " USDT", bgcolor=color.new(#5a637e, 0),text_color =color.white)

table.cell(table,1,4, tostring(initial_balance/i_gridQty,'###.##')+ " USDT", bgcolor=color.new(#5a637e, 0),text_color =color.white)

//제목

table.cell(table,2,0,"Current position :",text_color =color.white,bgcolor=color.new(color.black,0))

table.cell(table,2,1,"Position cost price :",text_color =color.white,bgcolor=color.new(color.black,0))

table.cell(table,2,2,"Unrealized profit :",bgcolor=color.new(color.black,0),text_color =color.white)

table.cell(table,2,3,"Unrealized profit % :",bgcolor=color.new(color.black,0),text_color =color.white)

table.cell(table,2,4,"Fee :",text_color =color.white,bgcolor=color.new(color.black,0))

//수치

table.cell(table,3,0, tostring(strategy.position_size) + syminfo.basecurrency + "\n" + tostring(strategy.position_size*strategy.position_avg_price/1, '###.##') + "USDT" ,text_color =color.white,bgcolor=color.new(#5a637e, 0))

table.cell(table,3,1, text=strategy.position_size>0 ? tostring(strategy.position_avg_price,'###.####')+ " USDT" : "NOT TRADING",text_color =color.white,bgcolor=color.new(#5a637e, 0))

table.cell(table,3,2, tostring(strategy.openprofit, '###.##')+ " USDT",text_color =color.white,bgcolor=strategy.openprofit > 0 ? color.teal : color.maroon)

table.cell(table,3,3, tostring(strategy.openprofit/initial_balance*100, '###.##')+ "%",text_color =color.white,bgcolor=strategy.openprofit > 0 ? color.teal : color.maroon)

table.cell(table,3,4, "-" + tostring(strategy.position_avg_price*strategy.position_size*0.025/100,'###.##')+ " USDT",text_color =color.white,bgcolor=color.new(#5a637e, 0))

//제목

table.cell(table,4,0,"Grid profit :",text_color =color.white,bgcolor=color.new(color.black,0))

table.cell(table,4,1,"Grid profit % :",text_color =color.white,bgcolor=color.new(color.black,0))

table.cell(table,4,2,"Net profit :", bgcolor=color.new(color.black,0),text_color =color.white)

table.cell(table,4,3,"Net profit % :",bgcolor=color.new(color.black,0),text_color =color.white)

table.cell(table,4,4,"Balance USDT :",bgcolor=color.new(color.black,0),text_color =color.white)

//수치

table.cell(table,5,0, tostring(strategy.netprofit, '###.#####')+ "USDT", text_color =color.white,bgcolor=strategy.netprofit > 0 ? color.teal : color.maroon)

table.cell(table,5,1, tostring((strategy.netprofit)/initial_balance*100/tradingtime, '####.##') + "%",text_color =color.white,bgcolor=strategy.netprofit > 0 ? color.teal : color.maroon)

table.cell(table,5,2, tostring(strategy.netprofit+strategy.openprofit, '###.##') + " USDT",text_color =color.white,bgcolor=strategy.netprofit+strategy.openprofit > 0 ? color.teal : color.maroon)

table.cell(table,5,3, tostring((strategy.netprofit+strategy.openprofit)/initial_balance*100, '####.##') + "%",text_color =color.white,bgcolor=strategy.netprofit+strategy.openprofit > 0 ? color.teal : color.maroon)

table.cell(table,5,4, tostring(initial_balance+strategy.netprofit+strategy.openprofit, '###.##')+ " USDT", text_color =color.white,bgcolor=color.new(#3d4d7c, 0))

// plot(strategy.initial_capital+ strategy.netprofit+strategy.openprofit, "Current Balance",color=color.rgb(81, 137, 128))

// plot(initial_balance, "Investment",color=color.rgb(81, 137, 128))

Detail

https://www.fmz.com/strategy/440716

Last Modified

2024-02-01 14:40:22