Name

均线交叉的移动平均趋势策略Moving-Average-Crossover-Trend-Strategy

Author

ChaoZhang

Strategy Description

这个交易策略是基于简单移动平均线和均线交叉系统的趋势跟踪策略。它利用不同周期的快速移动平均线和慢速移动平均线的交叉作为做多做空的信号。当快速移动平均线从下方上穿越慢速移动平均线时,做多;当快速移动平均线从上方下穿慢速移动平均线时,做空。该策略适用于趋势性比较明显的品种。

该策略使用一个快速周期如60日的简单移动平均线和一个慢速周期如200日的简单移动平均线。快速移动平均线能更快地响应价格变化,反映近期价格趋势;慢速移动平均线对价格变化响应更慢,能反映中长期趋势。

当短周期均线从下方上穿越长周期均线时,表示短周期价格开始上涨,进入多头市场,这时做多。当短周期均线从上方下穿长周期均线时,表示短周期价格开始下跌,进入空头市场,这时做空。

该策略使用均线的交叉原理判断趋势方向。当短周期价格上涨较快,短周期均线会推动长周期均线向上,并且从下方穿过它。这时说明市场进入上涨趋势,应该做多。相反,当短周期价格下跌较快,短周期均线会拉低长周期均线,并从上方穿过它,说明市场进入下跌趋势,应该做空。

通过快速均线和慢速均线的交叉来捕捉价格趋势的转折点,并相应地调整多空仓位。这是该策略判断趋势并产生交易信号的主要原理。

- 利用均线交叉判断主要趋势,避免被短期市场噪音误导。

- 兼顾短期和中长期两个时间维度,更稳定和可靠。

- 实现了简单有效的趋势跟踪,例如上涨趋势中做多,下跌趋势中做空。

- 移动平均线广泛适用,易于理解,参数设置灵活。

- 资金管理参数可调整,可控制风险。

- 该策略依赖清晰的价格趋势,如果市场出现剧烈波动,可能失败。

- 在价格震荡区间中,会产生多次错误信号,频繁开仓与平仓。

- 移动平均线存在滞后性,可能错过价格转折点。

- 如果参数设置不当,止损点过小或止盈点过大,会过早离场或平仓。

- 合理的参数需要根据不同品种的具体特点进行优化设定。

可以通过调整移动平均线的周期参数来适应不同品种的波动频率;改进止损和止盈策略,利用更复杂的指标以减少错误信号;加入交易量过滤等方法来优化该策略,提高策略稳定性。

该策略可以从以下几个方面进行进一步优化:

-

优化移动平均线快慢周期参数,适配不同波动频率的品种。可以测试更多组合,找到最佳参数。

-

改进入场条件,加入更多指标进行过滤,如交易量突增等,以减少错误信号。

-

改进止损止盈策略,例如追踪止损或动态止盈,让盈利更高效。

-

考虑交易成本如手续费,加入成本评估模块,使模拟更真实。

-

针对不同品种特点,设计Parameter Universe寻找最佳参数组合。

-

增加局部特征识别,辅助判断趋势转折点,提高开仓平仓时机把握。

通过系统的策略优化,可以大幅提高盈利率和稳定性,降低回撤。

该交易策略基于均线交叉判断价格趋势的转变,属于典型的趋势跟踪策略。它利用不同周期均线的交叉作为做多做空信号,通过快速均线和慢速均线组合判定趋势方向,实现了有效的趋势捕捉。该策略稳定、可靠,容易理解和实现,经过参数优化可以适应大多数品种,是量化交易的一个基础策略类型。通过与其他技术指标组合、优化止损平仓策略等方法,可以进一步提高该策略的盈利率和胜率。

||

This trading strategy is based on a simple moving average and moving average crossover system for trend tracking. It uses the crossover of fast and slow moving averages with different periods as signals to go long or short. When the fast MA crosses above the slow MA from below, go long; when the fast MA crosses below the slow MA from above, go short. This strategy works well for products with obvious trends.

The strategy uses a fast simple moving average like 60-day and a slow one like 200-day. The fast MA responds faster to price changes, reflecting short-term trends; while the slow MA responds slower and shows medium- to long-term trends.

When the short MA crosses above the long MA from below, it signals that short-term prices start to rise and enter a bull market, so go long. When the short MA crosses below the long MA from above, it signals short-term prices start to fall and enter a bear market, so go short.

The strategy uses MA crossover to determine the trend direction. When short-term prices rise faster, the short MA will push the long MA up and cross it from below. This means an uptrend is emerging and long position should be taken. Conversely, when short-term prices fall faster, the short MA will pull the long MA down and cross it from above, implying a downtrend and short position should be taken.

By capturing the inflection points of price trends using fast and slow MA crossovers, the strategy can adjust long/short positions accordingly. This is the main logic behind the strategy's trend determination and trade signal generation.

- Uses MA crossover to determine major trends, avoiding misleading by short-term market noises.

- Considers both short-term and medium- to long-term timeframes, more stable and reliable.

- Implements simple and effective trend tracking, e.g. go long in uptrends and short in downtrends.

- Moving averages are widely applicable, easy to understand, and parameters are flexible.

- Risk management parameters are adjustable for controlled risks.

- The strategy relies on clear price trends, failures can happen during violent market swings.

- Whipsaws can produce many false signals during ranging markets, causing frequent opening and closing of positions.

- Moving averages have lags, potentially missing price turning points.

- Improper parameter settings like stop loss too tight or take profit too wide can lead to premature exit or unwinding of profitable positions.

- Reasonable parameters need optimization according to the specifics of different products.

Methods like adjusting MA periods based on products' volatility frequency, improving stop loss/take profit using more complex indicators, adding volume filter etc. can optimize this strategy and improve stability.

The strategy can be further optimized in the following aspects:

-

Optimize fast and slow MA periods to adapt to products with different volatility frequencies. More combinations can be tested to find the optimum.

-

Improve entry conditions by adding more filters like volume spikes to reduce false signals.

-

Improve stop loss/take profit like trailing stop or dynamic take profit to improve profitability.

-

Consider trading costs like commissions and add cost evaluation modules for more realistic backtests.

-

Design Parameter Universe to find optimal parameter combinations tailored to different products.

-

Add local patterns identification to assist in determining trend turning points and improve timing of entries and exits.

Through systematic strategy optimization, profitability, stability can be greatly improved and drawdowns reduced.

The trading strategy determines trend shifts using MA crossovers, a typical trend-following strategy. It uses crossover between fast and slow MAs to generate long/short signals, identifying trend direction through the combination of the two. This strategy steadily and reliably captures trends and is easy to understand and implement. When optimized, it can adapt to most products and forms a fundamental quantitative trading strategy. Further improvements in profitability and win rate can be achieved by combining with other technical indicators, optimizing stop loss/take profit strategies etc.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_bool_1 | false | [RePaint] Uncheck to see real time results |

| v_input_1 | 60 | Fast Length |

| v_input_2 | 275 | Slow Length |

| v_input_float_1 | 42 | Long Take Profit (%) |

| v_input_float_2 | 13 | Long Stop (%) |

Source (PineScript)

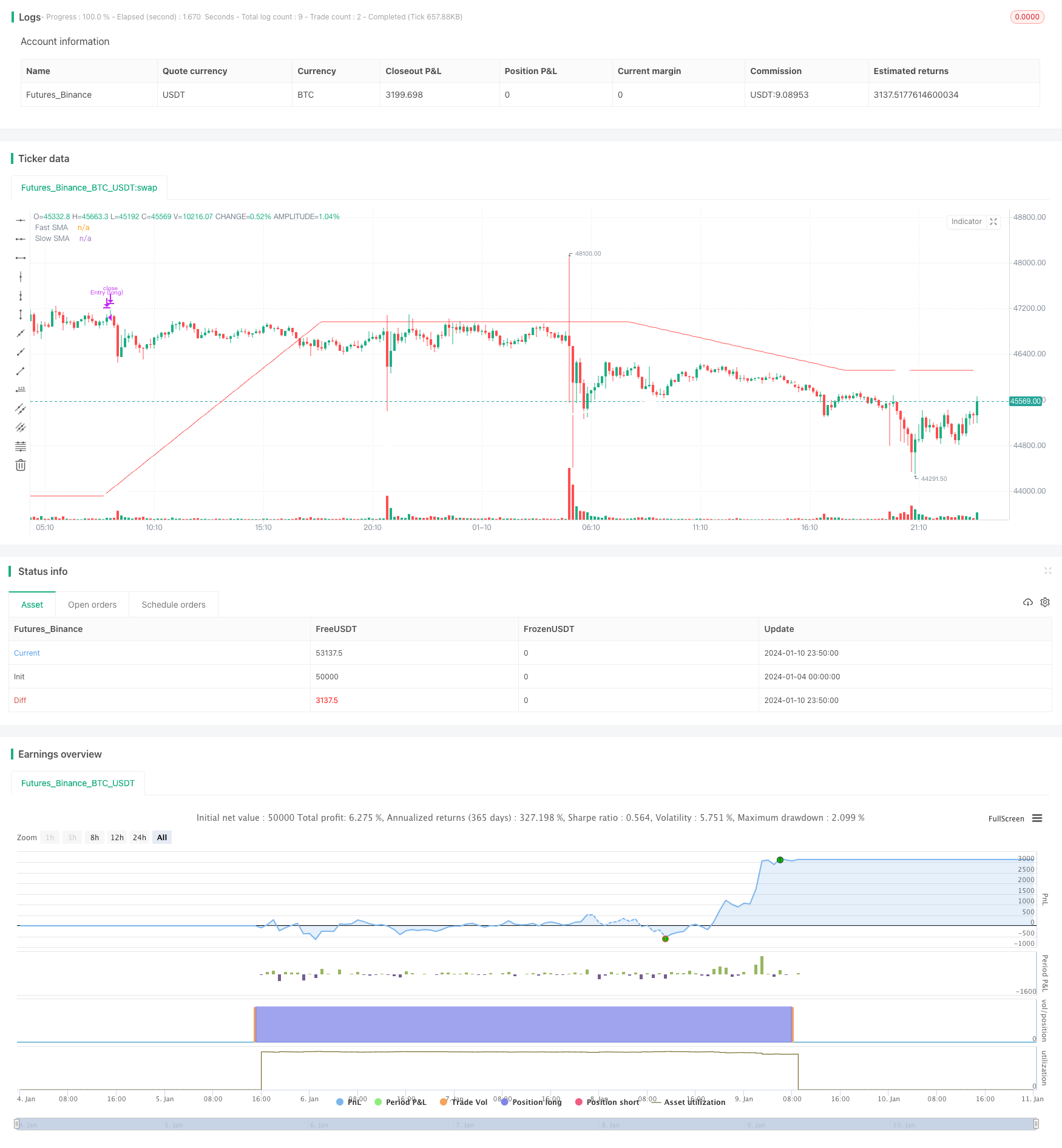

/*backtest

start: 2024-01-04 00:00:00

end: 2024-01-11 00:00:00

period: 10m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © thebearfib

//

//@version=5

//

strategy("x-over 150d_200d_sma - Free", overlay = true)

repaint = input.bool(defval = false, title = "[RePaint] Uncheck to see real time results") //when you deselect it - it shows what would have happened in real time while trading the system

srcmc = request.security(syminfo.tickerid, 'D', open, lookahead= repaint ? barmerge.lookahead_on : barmerge.lookahead_off, gaps=barmerge.gaps_off)

fast_length = input(title="Fast Length", defval=60)

slow_length = input(title="Slow Length", defval=275)

_fast = ta.sma(srcmc, fast_length)

_slow = ta.sma(srcmc, slow_length)

plot(_fast,

title="Fast SMA",

color=color.red,

linewidth = 1)

plot(_slow,

title="Slow SMA",

color=color.white,

linewidth = 3)

//

// ————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————

// ————————————————————————————————— Calculating —————————————————————————————————————————————————————————————————————————

// ————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————

//

longProfitPerc = input.float(title="Long Take Profit (%)", minval=0.01, step=1.0, defval=42) * .01

longStopPerc = input.float(title="Long Stop (%)", minval=0.01, step=1.0, defval=13) * .01

//

// ————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————

// ————————————————————————————————— Stop Conditions ————————————————————————————————————————————————————————————————————

// ————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————

longExitPrice = strategy.opentrades > 0 ? strategy.position_avg_price * (1 + longProfitPerc) : srcmc * (1 + longProfitPerc)

longStopPrice = strategy.opentrades > 0 ? strategy.position_avg_price * (1 - longStopPerc) : srcmc * (1 - longStopPerc)

// ————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————

// ————————————————————————————————— Long Conditions ————————————————————————————————————————————————————————————————————

// ————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————

longCondition = srcmc > _slow and ta.crossover(_fast, _slow)

closeCondition = ta.crossover(srcmc, _slow)

if (longCondition)

strategy.entry("Entry (long)", strategy.long, comment="→ ?? ?????")

if (closeCondition)

strategy.close("Entry (long)", comment=" ?? ???? ←")

if (strategy.position_size > 0)

strategy.exit(id="XL", limit=longExitPrice, stop = longStopPrice, comment_profit = "Take Profit", comment_loss = "Stop Loss")

//

// ————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————

// ————————————————————————————————— Never the End Just the beginning —————————————————————————————————————————————————

// ————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————

//

Detail

https://www.fmz.com/strategy/438451

Last Modified

2024-01-12 10:56:57