Name

基于一云突破和ADX指标的量化交易策略Quantitative-Trading-Strategy-Based-on-Ichimoku-Cloud-Breakout-and-ADX-Index

Author

ChaoZhang

Strategy Description

本策略的名称叫做“基于一云突破和ADX指标的量化交易策略”。它结合了一云图形技术分析和平均趋向指数(ADX)指标来决定何时建立多头或空头头寸。具体来说,它在价格突破云图形的关键区域,且ADX指标显示强劲趋势时建立头寸。

该策略使用乌盘指标中的“一云图形”以确定关键支持和阻力区域。它同时结合ADX指标判断趋势强度。具体交易策略规则如下:

多头建仓信号:

- 天线线转向上穿基准线

- 迟行线转向上穿0轴

- 价格高于云图形上沿

- ADX值低于45(表明趋势未过度扩张)

- +DI值高于-DI值(表明为上涨趋势)

空头建仓信号:

- 天线线转向下穿基准线

- 迟行线转向下穿0轴

- 价格低于云图形下沿

- ADX值高于45(表明趋势可能反转)

- +DI值低于-DI值(表明为下跌趋势)

该策略结合图形技术分析和趋势分析指标,能有效判断市场走势和强势区域。具体优势如下:

- 使用一云图形判断关键支持阻力区域,能抓住强势趋势

- 结合ADX指数判断真实趋势强度,避免错误交易

- 规则清晰易操作,容易实盘

该策略也存在一些风险,主要集中在ADX指数判定上的不稳定性。具体风险和解决方法如下:

- ADX计算有滞后性,可能错过快速反转。可以适当降低ADX参数,使其更灵敏

- ADX在震荡行情中效果不佳。可以增加其他指标过滤,如BOLL通道等

- 一云图形也可能出现失效。可以适当调整参数或增加其他指标辅助

该策略还可以从以下几个方面进行优化:

- 调整一云图形参数,适应更多品种

- 增加止损策略,控制单笔损失

- 结合更多指标,形成指标组合过滤信号

- 增加模型预测模块,利用机器学习进一步判断趋势信号 effector

本策略结合一云图形技术分析和ADX趋势判断指标,形成了一套清晰完整的量化交易策略。它判断关键支持阻力区域同时兼顾趋势判断,能有效抓住市场机会。该策略易于实盘,也存在可优化的空间,整体是一套优质的量化策略。

||

The name of this strategy is “Quantitative Trading Strategy Based on Ichimoku Cloud Breakout and ADX Index”. It combines Ichimoku cloud charting with Average Directional Movement Index (ADX) to determine when to take long or short positions. Specifically, it enters positions when price breaks through key areas of the cloud chart and ADX shows strong trend.

The strategy uses “Ichimoku Cloud” from Ichimoku Kinko Hyo indicators to identify key support and resistance areas. It also incorporates ADX index to judge trend strength. The specific trading rules are:

Long entry signals:

- Conversion line crosses above base line

- Lagging line crosses above 0 axis

- Price above cloud top

- ADX below 45 (indicating trend not overextended)

- +DI above -DI (indicating uptrend)

Short entry signals:

- Conversion line crosses below base line

- Lagging line crosses below 0 axis

- Price below cloud bottom

- ADX above 45 (indicating possible trend reversal)

- +DI below -DI (indicating downtrend)

The strategy combines chart pattern analysis and trend analysis indicators, which can effectively determine market trends and strong areas. The main advantages are:

- Using Ichimoku cloud to determine key support/resistance levels to catch strong trends

- Incorporating ADX index to gauge true trend strength, avoiding false trades

- Clear rules easy to follow for live trading

There are some risks with this strategy, mainly around instability in ADX trend determination. The risks and solutions are:

- ADX has lagging effect, may miss fast reversals. Can lower ADX parameters to make it more sensitive

- ADX does not work well in ranging markets. Can add filters like BOLL channel

- Ichimoku cloud can also fail. Can adjust parameters or add auxiliary indicators

The strategy can be further optimized in the following ways:

- Adjust Ichimoku parameters to suit more instruments

- Add stop loss to control single trade loss

- Incorporate more indicators to filter signals

- Add machine learning prediction to further determine trend signals

This strategy combines Ichimoku cloud charting and ADX trend index to form a complete quantitative trading system. It identifies key support/resistance levels while also judging trend. It can effectively capture market opportunities. The strategy is easy to implement in live trading and also has room for optimization. Overall it is a quality quantitative strategy.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | true | Show Date Range |

| v_input_2 | true | Stop_loss |

| v_input_3 | 5 | Take_profit |

| v_input_int_1 | 9 | Tenkan-Sen Bars |

| v_input_int_2 | 26 | Kijun-Sen Bars |

| v_input_int_3 | 52 | Senkou-Span B Bars |

| v_input_int_4 | 26 | Chikou-Span Offset |

| v_input_int_5 | 26 | Senkou-Span Offset |

| v_input_4 | true | Long Entry |

| v_input_5 | true | Short Entry |

Source (PineScript)

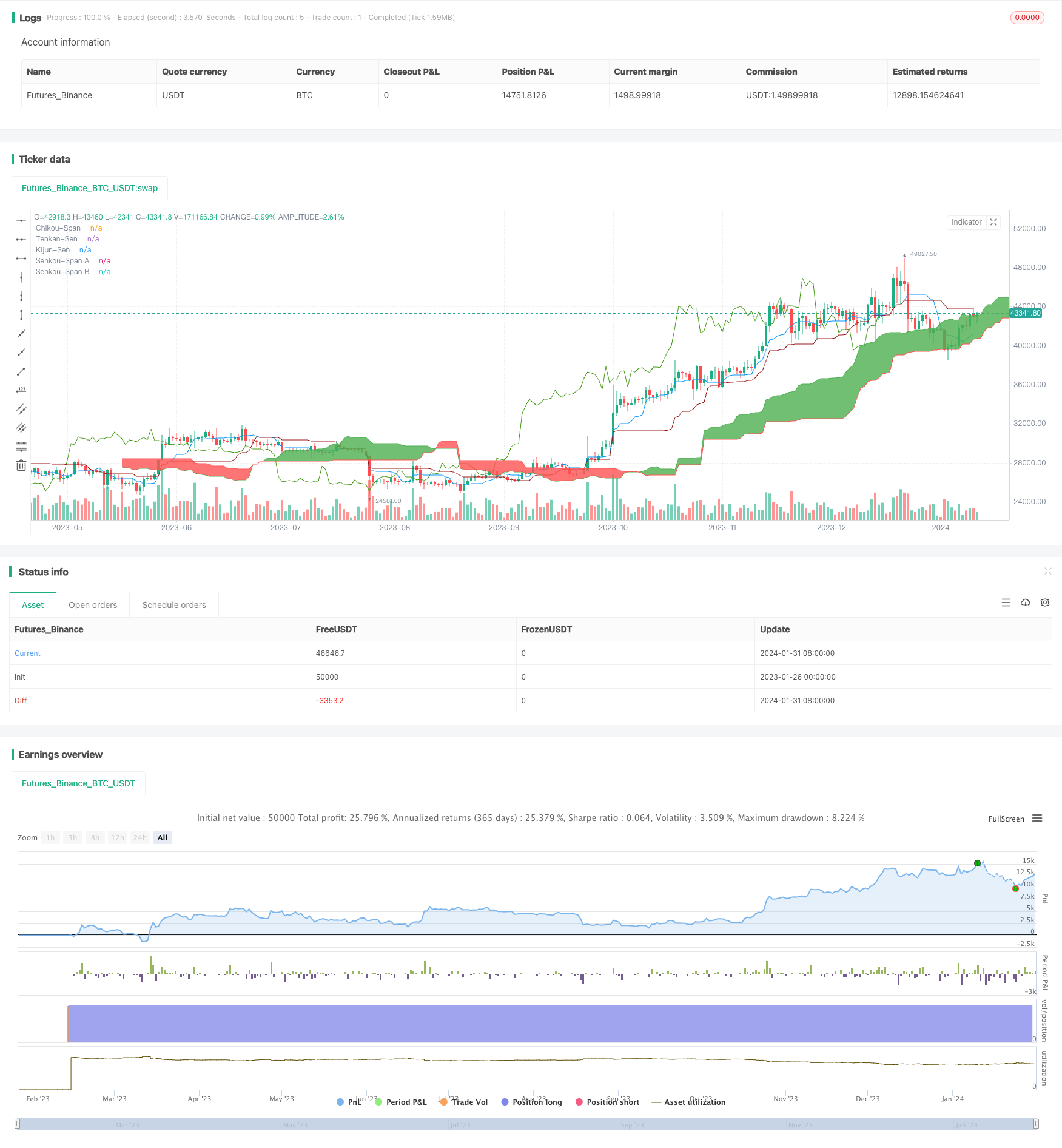

/*backtest

start: 2023-01-26 00:00:00

end: 2024-02-01 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Coinrule

//@version=5

strategy('Ichimoku Cloud with ADX (By Coinrule)',

overlay=true,

initial_capital=1000,

process_orders_on_close=true,

default_qty_type=strategy.percent_of_equity,

default_qty_value=30,

commission_type=strategy.commission.percent,

commission_value=0.1)

showDate = input(defval=true, title='Show Date Range')

timePeriod = time >= timestamp(syminfo.timezone, 2022, 1, 1, 0, 0)

// Stop Loss and Take Profit for Shorting

Stop_loss = input(1) / 100

Take_profit = input(5) / 100

longStopPrice = strategy.position_avg_price * (1 - Stop_loss)

longTakeProfit = strategy.position_avg_price * (1 + Take_profit)

// Inputs

ts_bars = input.int(9, minval=1, title='Tenkan-Sen Bars')

ks_bars = input.int(26, minval=1, title='Kijun-Sen Bars')

ssb_bars = input.int(52, minval=1, title='Senkou-Span B Bars')

cs_offset = input.int(26, minval=1, title='Chikou-Span Offset')

ss_offset = input.int(26, minval=1, title='Senkou-Span Offset')

long_entry = input(true, title='Long Entry')

short_entry = input(true, title='Short Entry')

middle(len) => math.avg(ta.lowest(len), ta.highest(len))

// Ichimoku Components

tenkan = middle(ts_bars)

kijun = middle(ks_bars)

senkouA = math.avg(tenkan, kijun)

senkouB = middle(ssb_bars)

// Plot Ichimoku Kinko Hyo

plot(tenkan, color=color.new(#0496ff, 0), title='Tenkan-Sen')

plot(kijun, color=color.new(#991515, 0), title='Kijun-Sen')

plot(close, offset=-cs_offset + 1, color=color.new(#459915, 0), title='Chikou-Span')

sa = plot(senkouA, offset=ss_offset - 1, color=color.new(color.green, 0), title='Senkou-Span A')

sb = plot(senkouB, offset=ss_offset - 1, color=color.new(color.red, 0), title='Senkou-Span B')

fill(sa, sb, color=senkouA > senkouB ? color.green : color.red, title='Cloud color', transp=90)

ss_high = math.max(senkouA[ss_offset - 1], senkouB[ss_offset - 1])

ss_low = math.min(senkouA[ss_offset - 1], senkouB[ss_offset - 1])

// ADX

[pos_dm, neg_dm, avg_dm] = ta.dmi(14, 14)

// Entry/Exit Signals

tk_cross_bull = tenkan > kijun

tk_cross_bear = tenkan < kijun

cs_cross_bull = ta.mom(close, cs_offset - 1) > 0

cs_cross_bear = ta.mom(close, cs_offset - 1) < 0

price_above_kumo = close > ss_high

price_below_kumo = close < ss_low

bullish = tk_cross_bull and cs_cross_bull and price_above_kumo and avg_dm < 45 and pos_dm > neg_dm

bearish = tk_cross_bear and cs_cross_bear and price_below_kumo and avg_dm > 45 and pos_dm < neg_dm

strategy.entry('Long', strategy.long, when=bullish and long_entry and timePeriod)

strategy.close('Long', when=bearish and not short_entry)

strategy.entry('Short', strategy.short, when=bearish and short_entry and timePeriod)

strategy.close('Short', when=bullish and not long_entry)

Detail

https://www.fmz.com/strategy/440872

Last Modified

2024-02-02 17:50:30