Name

基于多EMA买入策略Multiple-EMA-Buy-Strategy

Author

ChaoZhang

Strategy Description

该策略是一个基于价格行动和短期趋势的仅买入策略。它使用多个指数移动平均线(EMA)作为买入和卖出的技术指标。

该策略使用5日线、10日线、20日线、50日线、100日线和200日线六条EMA。它的买入信号是:

- 5日线上穿10日线

- 10日线上穿20日线

- 20日线上穿50日线

- 50日线上穿100日线

- 100日线上穿200日线

- 收盘价上穿5日线

当上述六个条件同时满足时,做多入场。

退出信号是收盘价下穿200日线时平仓。

该策略具有以下优势:

- 使用六条EMA作为滤波器,能有效识别中短期趋势

- 多重EMA上的构型要求较高,可有效过滤假突破

- 收盘价的参与可避免假突破的风险

- 仅做多,避免做空的风险

- 退出机制比较保守,有利于获利了结

该策略也存在一些风险:

- 多重EMA连续上穿的概率较低,容易错过机会

- 仅做多,无法利用下跌赚钱

- 震荡行情中容易被套

- 退出位置比较保守,可能放弃部分盈利

- 参数静态设置,不同品种和市场环境不适应

对应解决方法:

- 可根据市场情况适当减少EMA数量

- 可考虑结合CCI等指标引入做空机会

- 可设置移动止损或及时人工干预

- 可根据趋势品种调整参数

- 建议人工配合,根据市场调整参数

该策略可从以下方面进行优化:

- 引入成交量指标,避免假突破

- 利用波动率指标优化参数

- 增加机器学习模型动态优化参数

- 增加突破 validation 机制

- 结合深度学习模型判断趋势

- 引入止损和止盈机制

该策略整体来说是一个基于价格技术指标的中短期趋势追踪策略。它利用多重EMA滤波来识别趋势,并结合收盘价避免假突破。优点是策略思路简单清晰,容易理解实现,可根据市场环境人工调节参数。缺点是机会较少,容易被套。建议作为辅助决策工具,与人工结合使用。可从成交量、参数优化、机器学习等方面进行扩展,使策略更具鲁棒性。

||

This is a buy-only strategy based on price action and short-term trend. It uses multiple exponential moving averages (EMA) as technical indicators for entry and exit.

The strategy employs six EMAs - 5-day, 10-day, 20-day, 50-day, 100-day and 200-day EMA. The buy signal is triggered when:

- 5-day EMA crosses above 10-day EMA

- 10-day EMA crosses above 20-day EMA

- 20-day EMA crosses above 50-day EMA

- 50-day EMA crosses above 100-day EMA

- 100-day EMA crosses above 200-day EMA

- Close price crosses above 5-day EMA

When all six conditions are met, a long position is initiated.

The exit signal is when close price crosses below 200-day EMA.

The advantages of this strategy include:

- Using multiple EMAs as filters to identify medium-short term trends effectively

- Strict crossover criteria on multiple EMAs help avoid false breakouts

- Incorporating close price avoids false breakout risks

- Buy-only, avoids shorting risks

- Conservative exit mechanism favorable for profit taking

There are also some risks:

- Low probability of consecutive EMA crossovers, tends to miss opportunities

- Buy-only, cannot profit from drops

- Prone to being trapped in ranging markets

- Exits prematurely, giving up some profits

- Static parameter settings not adaptive across products and markets

Solutions:

- Reduce number of EMAs based on market conditions

- Consider incorporating CCI etc. to introduce shorting opportunities

- Set trailing stop loss or manual oversight

- Adjust parameters based on trending products

- Manual oversight advised to adjust parameters

Some ways to enhance the strategy:

- Incorporate volume to avoid false breakouts

- Utilize volatility measures to optimize parameters

- Introduce machine learning models to dynamically optimize parameters

- Add breakout validation mechanisms

- Incorporate deep learning models for trend forecast

- Introduce stop loss and take profit

In summary, this is a medium-short term trend following strategy based on price technical indicators. It identifies trends using multiple EMA filters and incorporates close price to avoid false breakouts. The logic is simple and easy to understand. The disadvantages are fewer opportunities and prone to being trapped. It is suggested to be used as a supplementary tool combined with manual oversight. Enhancements can be made in aspects like volume, parameter optimization and machine learning to make the strategy more robust.

[/trans]

Source (PineScript)

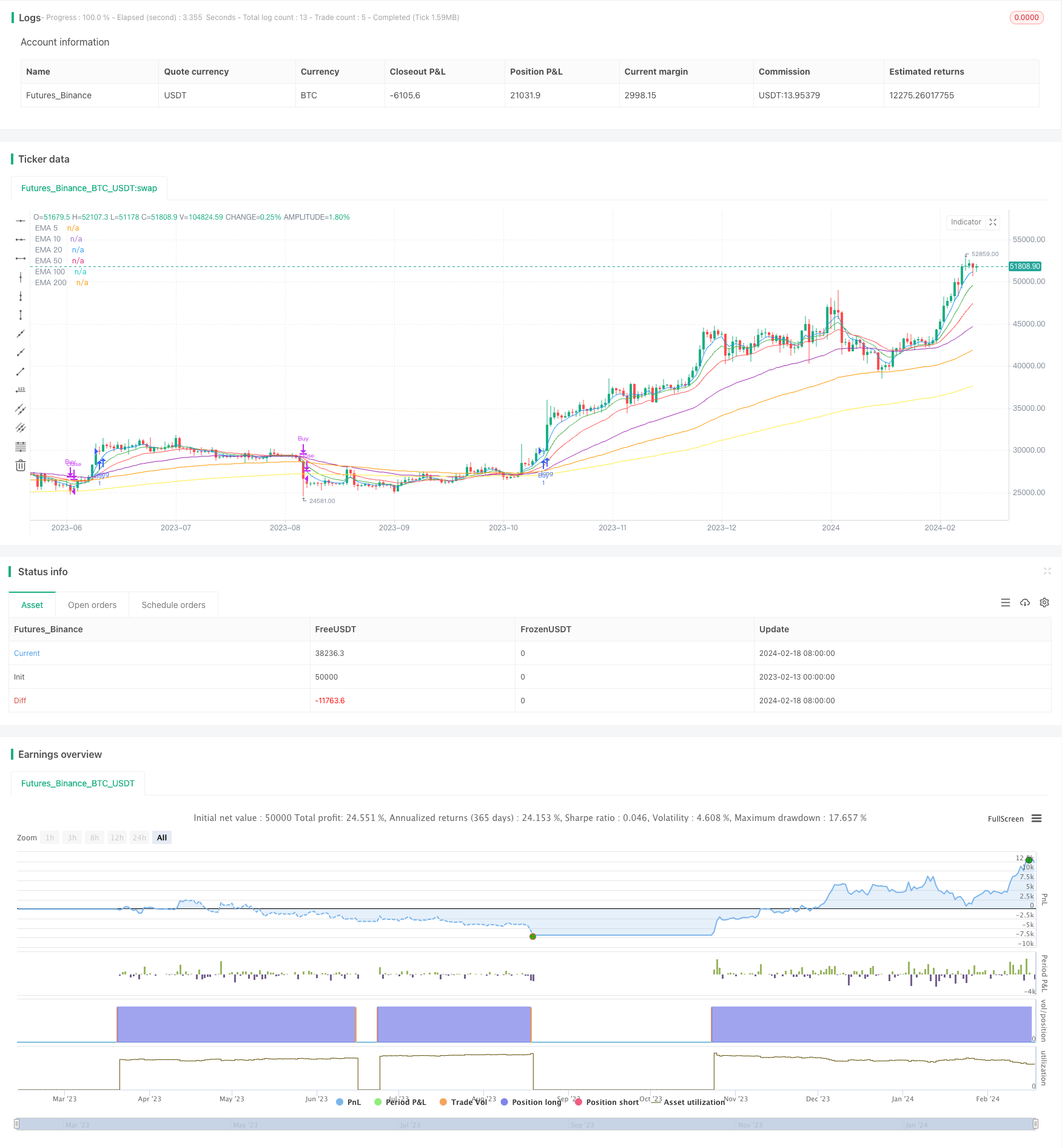

/*backtest

start: 2023-02-13 00:00:00

end: 2024-02-19 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Multiple EMA Buy Strategy with Price Condition", overlay=true)

// Calculate EMAs

ema5 = ta.ema(close, 5)

ema10 = ta.ema(close, 10)

ema20 = ta.ema(close, 20)

ema50 = ta.ema(close, 50)

ema100 = ta.ema(close, 100)

ema200 = ta.ema(close, 200)

// Plot EMAs

plot(ema5, color=color.blue, title="EMA 5")

plot(ema10, color=color.green, title="EMA 10")

plot(ema20, color=color.red, title="EMA 20")

plot(ema50, color=color.purple, title="EMA 50")

plot(ema100, color=color.orange, title="EMA 100")

plot(ema200, color=color.yellow, title="EMA 200")

// Entry conditions

buy_condition = ema5 > ema10 and ema10 > ema20 and ema20 > ema50 and ema50 > ema100 and ema100 > ema200 and close > ema5

// Exit conditions

exit_condition = close < ema200

// Strategy entry and exit conditions

strategy.entry("Buy", strategy.long, when = buy_condition)

strategy.close("Buy", when = exit_condition)

Detail

https://www.fmz.com/strategy/442254

Last Modified

2024-02-20 15:38:08