Name

基于布林带突破的量化交易策略-Bollinger-Bands-Breakout-Quantitative-Trading-Strategy

Author

ChaoZhang

Strategy Description

本策略通过计算布林带的上轨、中轨、下轨,并结合K线的收盘价进行判断,实现布林带突破交易策略。当价格突破上轨时,做多;当价格突破下轨时,做空。同时设置止损和止盈价格。

-

计算布林带的中轨SMA,长度为60周期,代表价格趋势的中轨。

-

计算布林带上下轨,上轨为中轨+2倍标准差,下轨为中轨-2倍标准差,带宽通过多值控制。

-

当收盘价大于上轨时,做多入场;当收盘价小于下轨时,做空入场。

-

设置止损止盈机制。止损比例为1.5%,止盈比例为6%。

-

当价格重新进入布林带时或触发止损止盈退出位置时,平仓离场。

-

使用布林带指标判断价格突破,具有较强的趋势判断能力。

-

策略操作简单,容易理解实现。

-

设置止损止盈机制控制风险。

-

布林带突破并不能准确判断价格趋势反转点,可能出现虚假突破的风险。

-

止损止盈设置不合理可能带来更大的风险。

-

交易频率可能较高,需要考虑交易成本的影响。

-

结合其他指标过滤虚假突破信号。例如KDJ指标判断趋势,MACD判断背离。

-

动态调整布林带参数,根据市场波动率计算合理带宽。

-

优化止损止盈策略,trailing stop或分批止损止盈。

-

考虑交易成本的影响,调整持仓时间。

本策略通过布林带指标判断价格突破实现趋势following,具有一定的效果。但可能出现虚假突破 bringing更大风险。可以考虑与其他指标组合,并不断测试优化参数,以控制风险和提高盈利能力。

||

This strategy calculates the upper band, middle band and lower band of Bollinger Bands and combines the closing price of K-line to implement Bollinger Bands breakout trading strategy. It goes long when price breaks through the upper band and goes short when price breaks through the lower band. Stop loss and take profit prices are also set.

-

Calculate the middle band SMA of Bollinger Bands with period 60, representing the middle band of price trend.

-

Calculate the upper band and lower band of Bollinger Bands. The upper band is middle band + 2 times standard deviation and the lower band is middle band - 2 times standard deviation. The band width is controlled by multiplier.

-

When closing price is greater than the upper band, go long. When closing price is less than the lower band, go short.

-

Set stop loss and take profit mechanism. The stop loss percentage is 1.5% and take profit percentage is 6%.

-

When price re-enters the Bollinger Bands or reaches stop loss/take profit price, close position.

-

Bollinger Bands indicator has strong ability of trend judgment by breakout.

-

Simple strategy logic and easy to understand and implement.

-

Stop loss and take profit control risks.

-

Bollinger Bands breakout cannot accurately determine price trend reversal points, with the risk of false breakout.

-

Unreasonable stop loss and take profit settings may bring greater risks.

-

High trading frequency may be affected by transaction costs.

-

Combine with other indicators to filter out false signals, e.g. KDJ for trend and MACD for divergence.

-

Dynamically adjust Bollinger Bands parameters based on market volatility to calculate reasonable band width.

-

Optimize stop loss and take profit strategy, e.g. trailing stop or partial closing.

-

Consider transaction costs' impact and adjust holding period.

This strategy follows trend by Bollinger Bands breakout and has some positive effects. But false breakout may bring greater risks. Combining with other indicators and keep optimizing parameters can control risks and improve profitability.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_int_1 | 60 | length |

| v_input_float_1 | 2 | mult |

Source (PineScript)

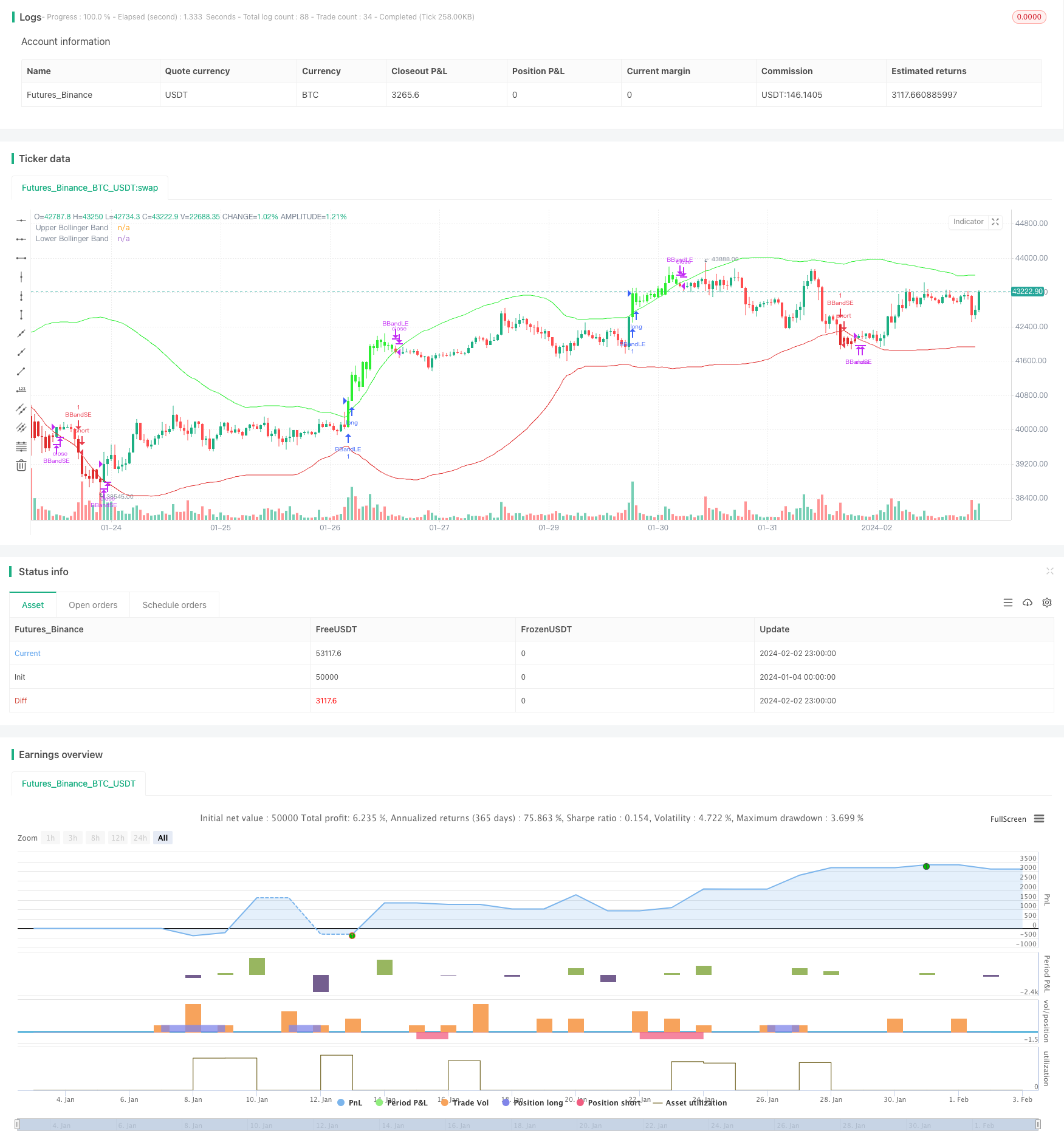

/*backtest

start: 2024-01-04 00:00:00

end: 2024-02-03 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Fuera Bolinga", overlay=true)

length = input.int(60, minval=1)

mult = input.float(2.0, minval=0.001, maxval=50)

take_profit_percentage = 6.0

basis = ta.sma(close, length)

dev = mult * ta.stdev(close, length)

upper = basis + dev

lower = basis - dev

stop_loss_percentage = 1.5

// Determinar si la vela cierra por fuera de las bandas

above_upper_band = close > upper

under_lower_band = close < lower

// Pintar las velas que cierran por fuera de las bandas

barcolor(above_upper_band ? color.new(#2cee32, 0) : na)

barcolor(under_lower_band ? color.new(#e02c2c, 0) : na)

// Entrada larga con stop loss y take profit

if (ta.crossover(close, upper))

strategy.entry("BBandLE", strategy.long, oca_name="BollingerBands", comment="BBandLE")

else

strategy.cancel(id="BBandLE")

// Entrada corta con stop loss y take profit

if (ta.crossunder(close, lower))

strategy.entry("BBandSE", strategy.short, oca_name="BollingerBands",comment="BBandSE")

else

strategy.cancel(id="BBandSE")

//// Salida de operación larga

if ((ta.crossunder(close, upper) or ta.crossunder(close, lower)) and (strategy.opentrades != 0))

strategy.close("BBandLE")

// Salida de operación corta

if ((ta.crossover(close, lower) or ta.crossover(close, upper)) and (strategy.opentrades != 0))

strategy.close("BBandSE")

// Plot de las bandas de Bollinger

plot(upper, color=color.new(#2cee32, 0), title="Upper Bollinger Band")

plot(lower, color=color.new(#e02c2c, 0), title="Lower Bollinger Band")

Detail

https://www.fmz.com/strategy/440977

Last Modified

2024-02-04 14:52:52