Name

基于移动平均线交叉交易策略Moving-Average-Crossover-Trading-Strategy

Author

ChaoZhang

Strategy Description

本策略基于移动平均线的交叉信号来进行买入和卖出操作。策略使用8日,18日和50日的指数移动平均线(EMA)。当价格上涨突破8日EMA且高于50日EMA时产生买入信号;当8日EMA下破18日EMA时产生卖出信号。

移动平均线能够有效地滤波价格波动,反映价格趋势。快速移动平均线能更快地响应价格变化。当快速移动平均线上涨越过慢速移动平均线时,表示价格开始上涨;反之,当快速移动平均线下跌穿过慢速移动平均线时,表示价格开始下跌。

本策略就是利用不同周期移动平均线的交叉来判断价格趋势的变化,以产生交易信号。具体来说,策略使用以下移动平均线:

- 8日EMA:快速响应价格变化,用于判断短期趋势

- 18日EMA:中速响应价格变化,用于判断中期趋势

- 50日EMA:慢速响应价格变化,用于判断长期趋势

当短期上涨趋势(8日EMA上涨)与中长期趋势(价格高于50日EMA)同向突破时,产生买入信号。当短期上涨趋势(8日EMA)被中期下跌趋势(18日EMA下跌)打破时,产生卖出信号。

本策略具有以下优势:

- 策略信号明确,交易规则简单清晰。

- 利用多周期EMA判断趋势,可有效识别价格反转。

- EMA滤波价格波动,可减少不必要的交易。

- 实时性较强,快速响应突发事件。

本策略也存在一些风险:

- EMA具有滞后性,可能错过价格反转的最佳时间点。

- 回撤可能比较大,需要严格的止损控制。

- 参数设置较为主观,不同市场需要调整周期。

- 行情剧烈波动时,EMA交叉信号可能频繁,增加交易成本和难度。

针对风险,可以通过以下方法加以优化和改进:

- 结合其他技术指标判断行情时机,提高策略胜率。

- 设置止损点,严格控制单笔损失。

- 对参数和过滤条件进行测试和优化,适应不同市场环境。

- 增加过滤条件,避免行情剧烈波动时的频繁交易。

本策略还可从以下方面进一步优化:

- 优化移动平均线的周期参数,寻找最佳参数组合。

- 增加其他技术指标判断,优化入场时机。比如结合RSI指标避免超买超卖现象。

- 增加止损机制。设置移动止损或挂单止损。

- 结合交易量分析。只在交易量放大的情况下考虑信号。

- 测试不同品种参数健壮性。调整参数适应不同交易品种。

本策略整体来说较为简单实用。核心在于利用不同周期EMA的交叉来判断价格趋势。策略实时性较强,可快速响应行情。但也存在一些后化管理风险,需要进一步测试和优化以适应不同市场环境。整体来说是一个稳定可靠的量化交易策略。

||

This strategy generates buy and sell signals based on the crossover of moving averages. It uses 8-day, 18-day and 50-day exponential moving averages (EMA). A buy signal is generated when the price breaks above the 8-day EMA and is higher than the 50-day EMA. A sell signal is generated when the 8-day EMA crosses below the 18-day EMA.

Moving averages can effectively filter price fluctuations and reflect price trends. Faster moving averages respond quicker to price changes. When the faster moving average crosses above the slower one, it signals an upward trend in prices. And when it crosses below, it signals a downward trend.

This strategy utilizes the crossover of EMAs of different periods to determine changes in price trends and generate trading signals. Specifically, it uses:

- 8-day EMA: fast-moving, to judge short-term trends

- 18-day EMA: medium-speed, to judge medium-term trends

- 50-day EMA: slow-moving, to judge long-term trends

Buy signals are generated when the short-term uptrend (8-day EMA rising) aligns with medium and long-term trends (price higher than 50-day EMA). Sell signals are generated when the short-term uptrend (8-day EMA) is broken by the medium-term downtrend (18-day EMA falling).

The advantages of this strategy are:

- Clear trading signals and simple rules.

- Can effectively identify trend reversal using multi-period EMAs.

- EMAs filter noise and reduce unnecessary trades.

- Good real-time performance to respond to events quickly.

There are also some risks:

- EMAs have lag and may miss best timing for reversals.

- Potentially large drawdowns, requiring strict stop loss.

- Parameter setting is subjective, needs adjustment across markets.

- Too frequent signals during high volatility, increasing costs.

Some methods to optimize and mitigate risks:

- Combine other indicators to improve timing and win rate.

- Set stop loss to control downside.

- Test and optimize parameters for different markets.

- Add filters to avoid over-trading.

Some directions to further optimize the strategy:

- Optimize EMA periods to find best combinations.

- Add other indicators like RSI to improve entry timing.

- Add stop loss mechanisms like trailing stop loss.

- Combine volume analysis, only consider signals with increasing volume.

- Test robustness across different products, adjust accordingly.

Overall this is a simple and practical strategy, using EMA crosses to determine trend changes. It has good real-time performance but also risks requiring further testing and optimization. With robust enhancements, it can become a stable algorithmic trading strategy.

[/trans]

Source (PineScript)

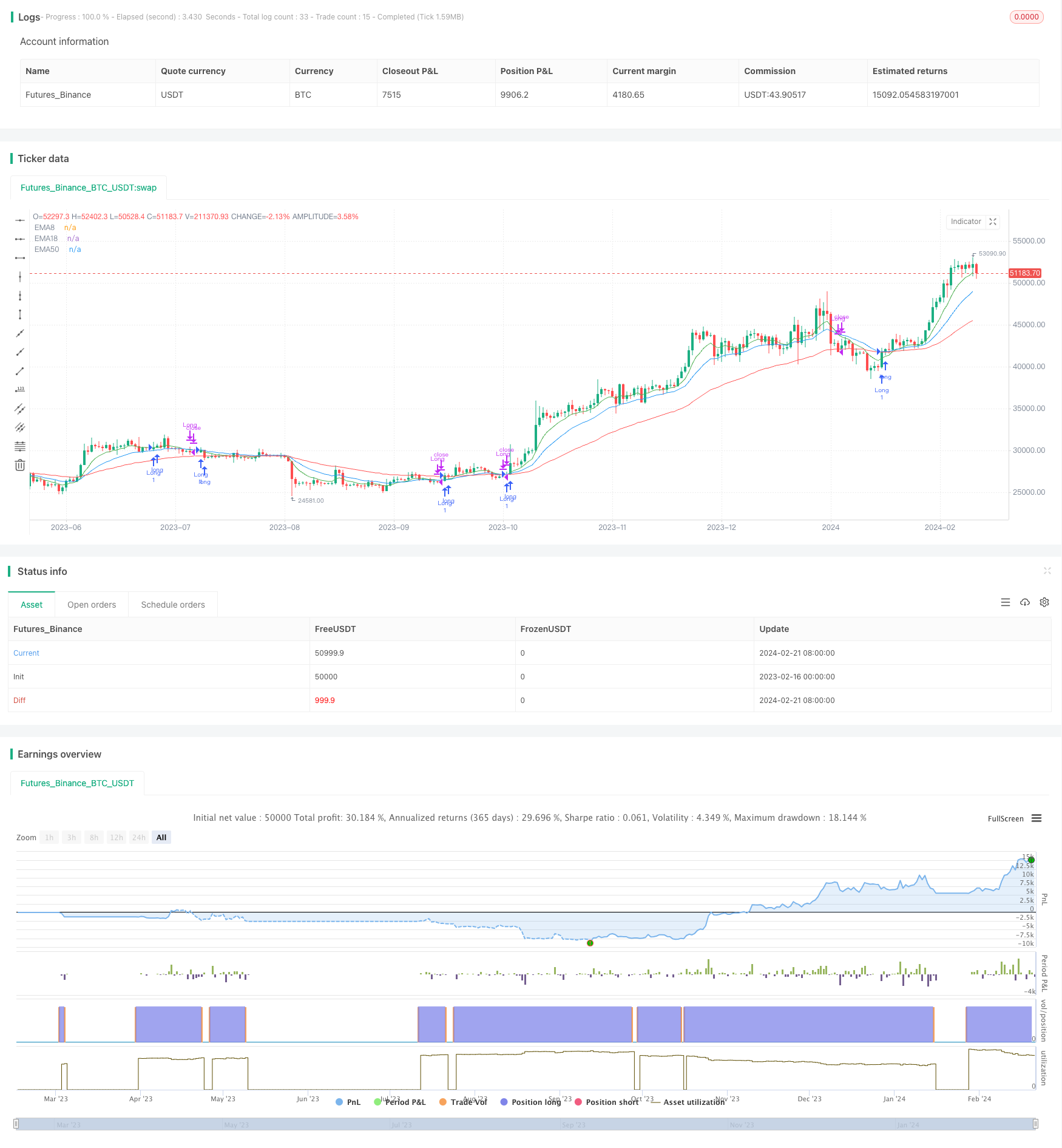

/*backtest

start: 2023-02-16 00:00:00

end: 2024-02-22 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy('Trading EMAs', overlay=true)

// Definir las medias móviles con colores personalizados

ema8 = ta.ema(close, 8)

ema18 = ta.ema(close, 18)

ema50 = ta.ema(close, 50)

plot(ema8, color=color.new(color.green, 0), title='EMA8')

plot(ema18, color=color.new(color.blue, 0), title='EMA18')

plot(ema50, color=color.new(color.red, 0), title='EMA50')

// Condiciones de entrada

longCondition = ta.crossover(close, ema8) and close > ema50 // Señal de compra cuando el precio de cierre cruza al alza la EMA de 8 y el precio está por encima de la EMA de 50

// Condiciones de salida

exitLongCondition = ta.crossunder(ema8, ema18) // Señal de venta cuando EMA8 cruza por debajo de EMA18

// Ejecutar las operaciones basadas en las condiciones de entrada

if longCondition

strategy.entry('Long', strategy.long)

// Salida de las operaciones basadas en las condiciones de salida

if exitLongCondition

strategy.close('Long')

Detail

https://www.fmz.com/strategy/442628

Last Modified

2024-02-23 12:46:19