Name

基于超级趋势和CCI指标的多时间框架交易策略Best-Supertrend-CCI-Multi-Timeframe-Trading-Strategy

Author

ChaoZhang

Strategy Description

本策略融合了超级趋势指标和商品通道指数(CCI)指标,实现了一个多时间框架的趋势追踪和交易信号生成。该策略的主要思想是利用CCI指标判断短期趋势方向,同时结合超级趋势指标判断中长期趋势方向。当短期和中长期趋势一致时,产生交易信号。

CCI指标能判断超买超卖现象,当CCI指标从下向上穿过0轴线时为多头信号,反之为空头信号。本策略即利用这一特性,判断短期趋势方向。

cci_period = input(28, "CCI Period")

cci = cci(source, cci_period)

ML = input(0, "CCI Mid Line pivot")

以上代码定义了CCI指标的周期和中轴线位置。

TrendUp := cci[1] > ML ? max(Up,TrendUp[1]) : Up

TrendDown := cci[1]< ML ? min(Dn,TrendDown[1]) : Dn

这部分代码判断cci是否上穿0轴线,如果是则更新超级趋势的上轨,下穿则更新下轨。

超级趋势指标通过将ATR指标与价格进行组合,能判断中长期趋势的方向。当价格突破超级趋势的上轨时为多头信号,下轨为空头信号。

本策略中超级趋势指标的计算公式如下:

Up=hl2-(Factor*atr(Pd))

Dn=hl2+(Factor*atr(Pd))

其中Factor和Pd为可调节的参数。

Trend变量判断超级趋势的当前方向:

Trend := cci > ML ? 1: cci < ML ? -1: nz(Trend[1],1)

通过整合CCI指标和超级趋势指标,本策略实现了多时间框架下的趋势判断。CCI指标捕捉短期趋势,超级趋势指标判断中长期趋势。

当二者方向一致时,产生更可靠的交易信号。

isLong = st_trend == 1

isShort = st_trend == -1

入场时机为短期和中长期同向,出场时机为短期和中长期反向。

本策略同时整合了短期和中长期趋势判断指标,使交易信号更加可靠。

超级趋势指标中的Factor参数和CCI指标的cci_period可根据市场调整,使策略更具灵活性。

策略结构简单清晰,容易理解和实现,非常适合量化交易初学者。

可适用于股票、外汇、加密货币等市场,也可根据参数设置调整适用不同品种。

当价格波动剧烈时,会出现许多虚假信号。可适当调大超级趋势的Factor参数,降低策略的交易频率。

超级趋势本身对强势的追随并不足够,可考虑与动量指标结合,在趋势加速阶段追踪趋势。

本策略没有设置止损,可结合ATR指标的大小设置 trails 止损。

根据不同市场的特点,调整超级趋势和CCI的参数,提高策略稳定性。

与MACD,KDJ等动量指标结合,在趋势加速阶段追踪趋势,可获得更高收益。

使用机器学习和集成学习方法对策略参数和交易规则进行优化。

本策略成功结合超级趋势和CCI指标,实现了多时间框架下的趋势判断。策略简单易懂,参数可调,收益潜力较大。可通过调参、止损和集成学习等方式进一步优化,使之成为一个可靠、稳定、高效的交易策略。

||

This strategy integrates the Supertrend indicator and the Commodity Channel Index (CCI) to realize a multi timeframe trend tracking and trade signal generation. The main idea is to use the CCI indicator to judge short-term trend direction while combining the Supertrend indicator to determine medium-to-long term trend direction. Trading signals are generated when the short-term and medium-to-long term trends align.

The CCI indicator can identify overbought and oversold scenarios. An upward crossover of the 0 line is a bullish signal while a downward one is a bearish signal. This strategy utilizes this feature to determine short-term trend direction.

cci_period = input(28, "CCI Period")

cci = cci(source, cci_period)

ML = input(0, "CCI Mid Line pivot")

The above code defines the CCI period and mid line position.

TrendUp := cci[1] > ML ? max(Up,TrendUp[1]) : Up

TrendDown := cci[1]< ML ? min(Dn,TrendDown[1]) : Dn

This code checks if cci crosses above/below the 0 line to update Supertrend's upper/lower band.

The Supertrend indicator combines ATR with price to determine mid-to-long term trends. An upward penetration of the upper band signals an uptrend while a downward one signals downtrend.

Supertrend is calculated as:

Up=hl2-(Factor*atr(Pd))

Dn=hl2+(Factor*atr(Pd))

Where Factor and Pd are adjustable parameters.

The Trend variable determines current Supertrend direction:

Trend := cci > ML ? 1: cci < ML ? -1: nz(Trend[1],1)

By integrating CCI and Supertrend, this strategy realizes multi timeframe trend judgment. CCI captures short-term swings while Supertrend focuses on bigger moves.

When directions agree, more reliable trading signals are generated.

isLong = st_trend == 1

isShort = st_trend == -1

Entries when short and medium-term align, exits when directions disagree.

Integrates short-term and mid-term indicators for more reliable signals.

Supertrend's Factor and CCI Period can be adjusted for market conditions.

Simple logic and easy to understand, great for beginners.

Applicable to stocks, forex, crypto by parameter tuning.

Many false signals may occur when prices fluctuate violently. Increase Supertrend's Factor to lower frequency.

Supertrend has some lagging. Combine momentum indicators to track accelerating trends.

Add stop loss based on ATR for risk control.

Adjust parameters for different markets.

Combine with MACD, KDJ etc. to catch strong momentum moves.

Utilize AI and ensemble methods to optimize parameters and rules.

This strategy successfully combines Supertrend and CCI for multi timeframe trend tracking. Simple logic, good reward potential and customizability. Can further improve via parameter tuning, stop loss, and machine learning to become a solid trading system.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1_close | 0 | source: close |

| v_input_2 | 28 | CCI Period |

| v_input_3 | false | CCI Mid Line pivot |

| v_input_4 | 3 | [ST] Factor |

| v_input_5 | 3 | [ST] PD |

Source (PineScript)

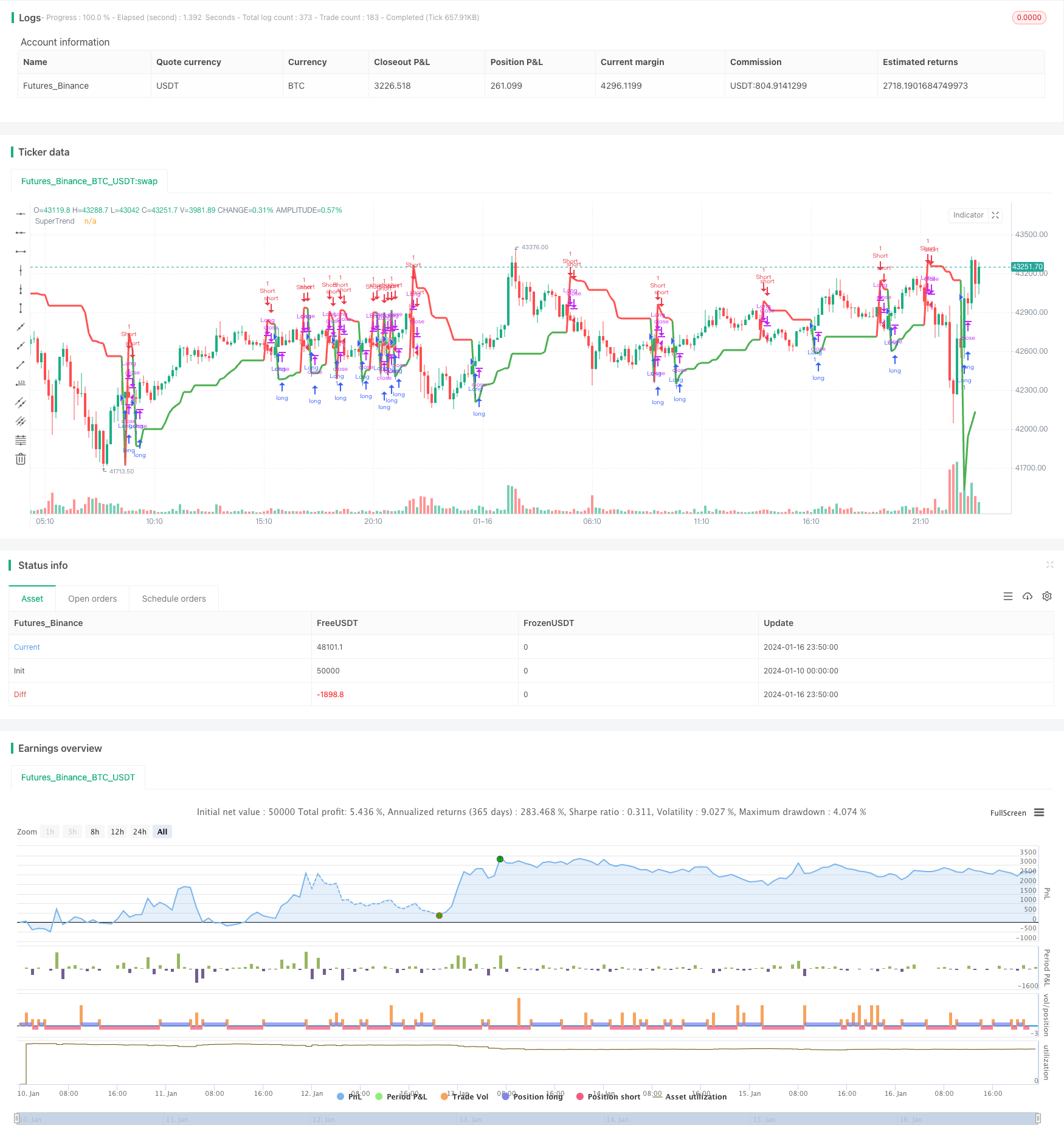

/*backtest

start: 2024-01-10 00:00:00

end: 2024-01-17 00:00:00

period: 10m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//@author=Daveatt

StrategyName = "Best Supertrend CCI Strategy"

ShortStrategyName = "Best Supertrend CCI Strategy"

strategy(title=StrategyName, shorttitle=ShortStrategyName, overlay=true )

//////////////////////////

//* COLOR CONSTANTS *//

//////////////////////////

AQUA = #00FFFFFF

BLUE = #0000FFFF

RED = #FF0000FF

LIME = #00FF00FF

GRAY = #808080FF

DARKRED = #8B0000FF

DARKGREEN = #006400FF

GOLD = #FFD700

WHITE = color.white

// Plots

GREEN_LIGHT = color.new(color.green, 40)

RED_LIGHT = color.new(color.red, 40)

BLUE_LIGHT = color.new(color.aqua, 40)

PURPLE_LIGHT = color.new(color.purple, 40)

source = input(close)

///////////////////////////////////////////////////////////////////////////////

///////////////////////////////////////////////////////////////////////////////

/////////////////////////////////// CCI /////////////////////////////////////

///////////////////////////////////////////////////////////////////////////////

///////////////////////////////////////////////////////////////////////////////

cci_period = input(28, "CCI Period")

cci = cci(source, cci_period)

//UL = input(80, "Upper level")

//LL = input(20, "Lower Level")

ML = input(0, "CCI Mid Line pivot")

///////////////////////////////////////////////////////////////////////////////

///////////////////////////////////////////////////////////////////////////////

///////////////////////////// SUPERTREND /////////////////////////////////////

///////////////////////////////////////////////////////////////////////////////

///////////////////////////////////////////////////////////////////////////////

Factor=input(3,title="[ST] Factor", minval=1,maxval = 100, type=input.float)

Pd=input(3, title="[ST] PD", minval=1,maxval = 100)

///////////////////////////////////////////////////////////////////////////////

///////////////////////////////////////////////////////////////////////////////

/////////////////////// SUPERTREND DETECTION //////////////////////////////////

///////////////////////////////////////////////////////////////////////////////

///////////////////////////////////////////////////////////////////////////////

f_supertrend(Factor, Pd) =>

Up=hl2-(Factor*atr(Pd))

Dn=hl2+(Factor*atr(Pd))

TrendUp = 0.0

TrendUp := cci[1] > ML ? max(Up,TrendUp[1]) : Up

TrendDown = 0.0

TrendDown := cci[1]< ML ? min(Dn,TrendDown[1]) : Dn

Trend = 0.0

Trend := cci > ML ? 1: cci < ML ? -1: nz(Trend[1],1)

Tsl = Trend==1? TrendUp: TrendDown

[Trend, Tsl]

[st_trend, st_tsl] = f_supertrend(Factor, Pd)

// Plot the ST

linecolor = close >= st_tsl ? color.green : color.red

plot(st_tsl, color = linecolor , linewidth = 3,title = "SuperTrend", transp=0)

isLong = st_trend == 1

isShort = st_trend == -1

longClose = isLong[1] and isShort

shortClose = isShort[1] and isLong

strategy.entry("Long", 1, when=isLong)

strategy.close("Long", when=longClose )

strategy.entry("Short", 0, when=isShort)

strategy.close("Short", when=shortClose )

Detail

https://www.fmz.com/strategy/439227

Last Modified

2024-01-18 15:09:33