Name

基于金本位量化交易策略Gold-Standard-Quantitative-Trading-Strategy

Author

ChaoZhang

Strategy Description

该策略是一个基于30日和200日移动平均线交叉的交易策略。它在XAUUSD黄金1分钟图表上运行,用于捕捉短期价格趋势。该策略同时使用止损和止盈设置来管理风险。

该策略使用30日和200日移动平均线交叉作为交易信号。当30日移动平均线上穿200日移动平均线时,做多;当30日移动平均线下穿200日移动平均线时,做空。此外,在出现反向信号时,会平仓当前头寸,再按照新信号的方向开仓。

该策略结合了趋势跟踪和均线交叉的优点。30日均线能更快地响应价格变化,200日均线具有更强的趋势过滤性。它们的交叉为进出市提供了清晰的信号。同时,它利用反转开仓来锁定利润,避免在价格盘整时造成较大亏损。

- 利用双均线交叉提高信号的可靠性

- 反转开仓机制有助于避免盘整造成的亏损

- 同时设置止损和止盈有利于风险控制

- 可在多种时间周期使用

- 易于通过参数优化提高效果

该策略主要面临以下风险:

- 双均线生成假信号的概率较大,可能导致交易频繁,增加交易成本和滑点风险

- 未考虑交易品种的基本面因素,忽视了价格波动的内在逻辑

- 没有设置资金管理规则,无法控制单笔交易风险暴露

可以通过以下方法降低风险:

- 增加过滤条件,避免信号频繁反转

- 结合交易品种的基本面分析

- 引入资金管理模块,限制单笔头寸规模

该策略可从以下方面进行优化:

- 测试不同参数的均线组合,找到最佳的参数

- 增加其他指标过滤,如成交量、波动率指标等

- 引入自适应止损机制,让止损根据市场波动率调整

- 应用资金管理规则,限制单笔头寸规模

- 进行回测优化,找到最佳的参数组合

该策略整体运作流畅,核心交易逻辑清晰简洁。它利用双均线交叉产生交易信号,并采用反转开仓的方式锁定利润。这种交易方式可避免价格盘整期间的大幅亏损。同时设置止损止盈也有利于风险控制。但该策略也存在一定的缺陷,主要表现为信号频繁,忽视了价格波动的基本面因素。通过引入过滤条件、资金管理模块以及参数优化,可以降低风险,提高策略的稳定性和收益率。

||

This strategy is a trading strategy based on the crossover of the 30-day and 200-day moving averages. It runs on the XAUUSD gold 1-minute chart to capture short-term price trends. The strategy also uses stop loss and take profit settings to manage risk.

The strategy uses the crossover of the 30-day and 200-day moving averages as trading signals. It goes long when the 30-day moving average crosses above the 200-day moving average, and goes short when the 30-day moving average crosses below the 200-day moving average. In addition, when a reverse signal appears, the current position will be closed, and a new position will be opened according to the direction of the new signal.

The strategy combines the advantages of trend tracking and moving average crossover. The 30-day MA can respond to price changes faster, while the 200-day MA has stronger trend filtering. Their crossover provides clear signals for entering and exiting the market. At the same time, it uses reverse opening to lock in profits and avoid large losses during price consolidation.

- Improves signal reliability by using double moving average crossover

- Reverse opening mechanism helps avoid losses caused by consolidation

- Setting stop loss and take profit is beneficial for risk control

- Can be used in multiple time frames

- Easy to improve effectiveness through parameter optimization

The main risks facing this strategy are:

- Higher probability of false signals from double MAs, may cause frequent trading, increasing trading costs and slippage risks

- Ignores underlying fundamentals of trading instrument, overlooks inherent logic of price fluctuations

- No capital management rules set to control per trade risk exposure

Risks can be reduced by:

- Adding filters to avoid frequent signal reversal

- Combining fundamental analysis of trading instrument

- Introducing capital management module to limit per trade position sizing

The strategy can be optimized in the following aspects:

- Test different parameter combinations of MAs to find the optimal parameters

- Add other indicators for filtration, such as volume, volatility indicators, etc.

- Introduce adaptive stop loss mechanism to adjust stops based on market volatility

- Implement capital management rules to limit per trade position sizes

- Conduct backtesting optimization to find optimal parameter combinations

The overall operation of the strategy is smooth and the core trading logic is clear and simple. It generates trading signals using double MA crossovers, and uses reverse opening to lock in profits. This trading method can avoid significant losses during price consolidation. Setting stop loss and take profit also facilitates risk control. However, the strategy also has some flaws, mainly manifested as frequent signals while overlooking price fluctuation fundamentals. By introducing filtration conditions, capital management modules, and parameter optimization, risks can be reduced and the stability and profitability of the strategy can be improved.

[/trans]

Source (PineScript)

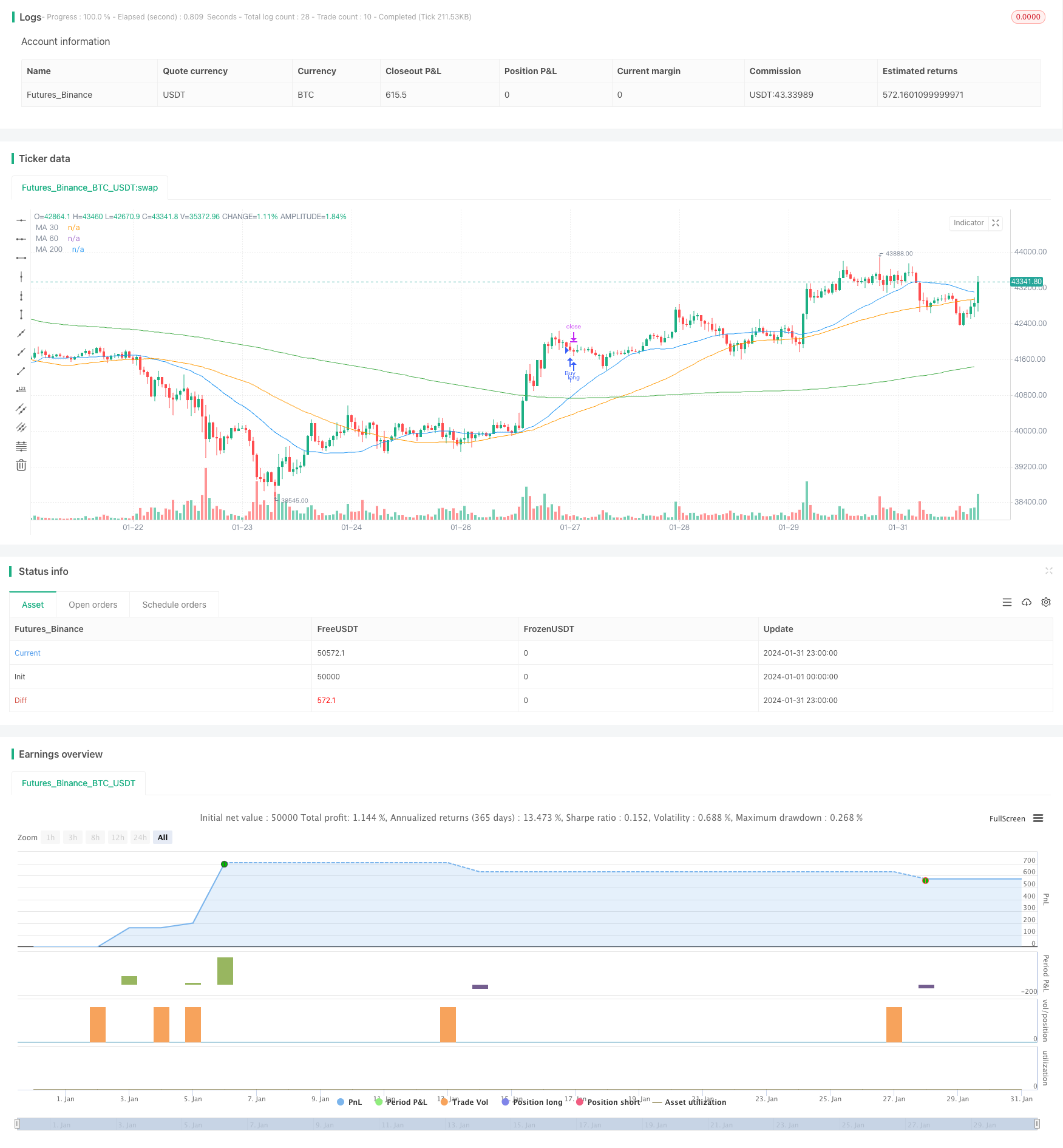

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Estrategia de Cruce de Medias Móviles", overlay=true)

// Medias móviles

ma30 = ta.sma(close, 30)

ma60 = ta.sma(close, 60)

ma200 = ta.sma(close, 200)

// Cruce de medias móviles

crossoverUp = ta.crossover(ma30, ma200)

crossoverDown = ta.crossunder(ma30, ma200)

// Señales de compra y venta

longCondition = crossoverUp

shortCondition = crossoverDown

// Ejecución de órdenes

if (longCondition)

strategy.entry("Buy", strategy.long)

strategy.exit("Cover", "Buy", stop=close - 40.000, limit=close + 40.000)

if (shortCondition)

strategy.entry("Sell", strategy.short)

strategy.exit("Cover", "Sell", stop=close + 40.000, limit=close - 40.000)

// Plot de las medias móviles

plot(ma30, color=color.blue, title="MA 30")

plot(ma60, color=color.orange, title="MA 60")

plot(ma200, color=color.green, title="MA 200")

// Condiciones para cerrar la posición contraria

if (strategy.position_size > 0)

if (crossoverDown)

strategy.close("Buy")

if (strategy.position_size < 0)

if (crossoverUp)

strategy.close("Sell")

Detail

https://www.fmz.com/strategy/442824

Last Modified

2024-02-26 12:10:26