Name

基于EMA均线交叉的移动止损策略EMA-Crossover-Strategy-with-Trailing-Stop-Loss

Author

ChaoZhang

Strategy Description

该策略利用快速EMA均线(9周期)和慢速EMA均线(21周期)的交叉作为入场信号,并结合移动止损来锁定利润,避免回撤过大。

当快速EMA线从下方向上突破慢速EMA线时,生成买入信号;当快速EMA线从上方向下跌破慢速EMA线时,生成卖出信号。

一旦入场,策略会实时跟踪最高价,并在当前价格低于最高价2%时触发移动止损,将利润锁定。

- 利用EMA均线的趋势跟踪和信号生成能力,能够有效捕捉中长线趋势

- 移动止损机制可以锁定大部分利润,避免全部收益被吞噬

- EMA均线参数可调,可以适应不同市场环境

- 买卖信号规则清晰,容易实施

- EMA均线存在滞后,可能错过短线机会

- 移动止损距离设置不当可能过早止损或止损无效

- 参数不匹配市场环境可能导致交易频繁或信号不足

风险解决方法:

- 选择合适的EMA参数组合

- 测试和评估止损距离参数

- 调整参数以适应市场波动率变化

- 根据市场波动率和风险偏好动态调整移动止损距离

- 添加其他指标过滤,降低虚假信号

- 优化EMA均线周期参数的选择

- 结合趋势指标判断大趋势,避免反趋势交易

该策略整合了趋势判断与止损管理的优点,既可以顺势而为,也可以有效控制风险。通过参数调整和优化,可以适用于不同类型的市场和交易品种,值得进一步测试实践。

||

This strategy uses the crossover of a fast EMA (9-period) and slow EMA (21-period) as entry signals, and incorporates a trailing stop loss to lock in profits and avoid excessive drawdowns.

When the fast EMA crosses above the slow EMA from below, a buy signal is generated. When the fast EMA crosses below the slow EMA from above, a sell signal is triggered.

Once entered, the strategy tracks the highest high in real-time and triggers a trailing stop loss when the current price falls 2% below the highest high, locking in profits.

- Utilizes EMA's trend following and signal generation ability to effectively capture medium-long term trends

- Trailing stop loss locks in most profits, avoiding entire gains being swallowed

- Adjustable EMA parameters cater to different market environments

- Clear buy and sell signal rules, easy to implement

- EMA has lagging, may miss short-term opportunities

- Improper trailing stop loss distance setting may prematurely stop loss or render it ineffective

- Parameter mismatch with market may cause excessive trading or insufficient signals

Risk Solutions:

- Choose appropriate EMA parameter combination

- Test and evaluate stop loss parameter

- Adjust parameters to match market volatility dynamics

- Dynamically adjust trailing stop distance based on market volatility and risk appetite

- Add other filters to reduce false signals

- Optimize EMA period parameters

- Incorporate trend indicators to avoid counter-trend trading

This strategy integrates the advantages of trend identification and risk control. Through parameter tuning and optimization, it can be adapted to different market types and trading instruments, and is worth further testing and practice.

[/trans]

Source (PineScript)

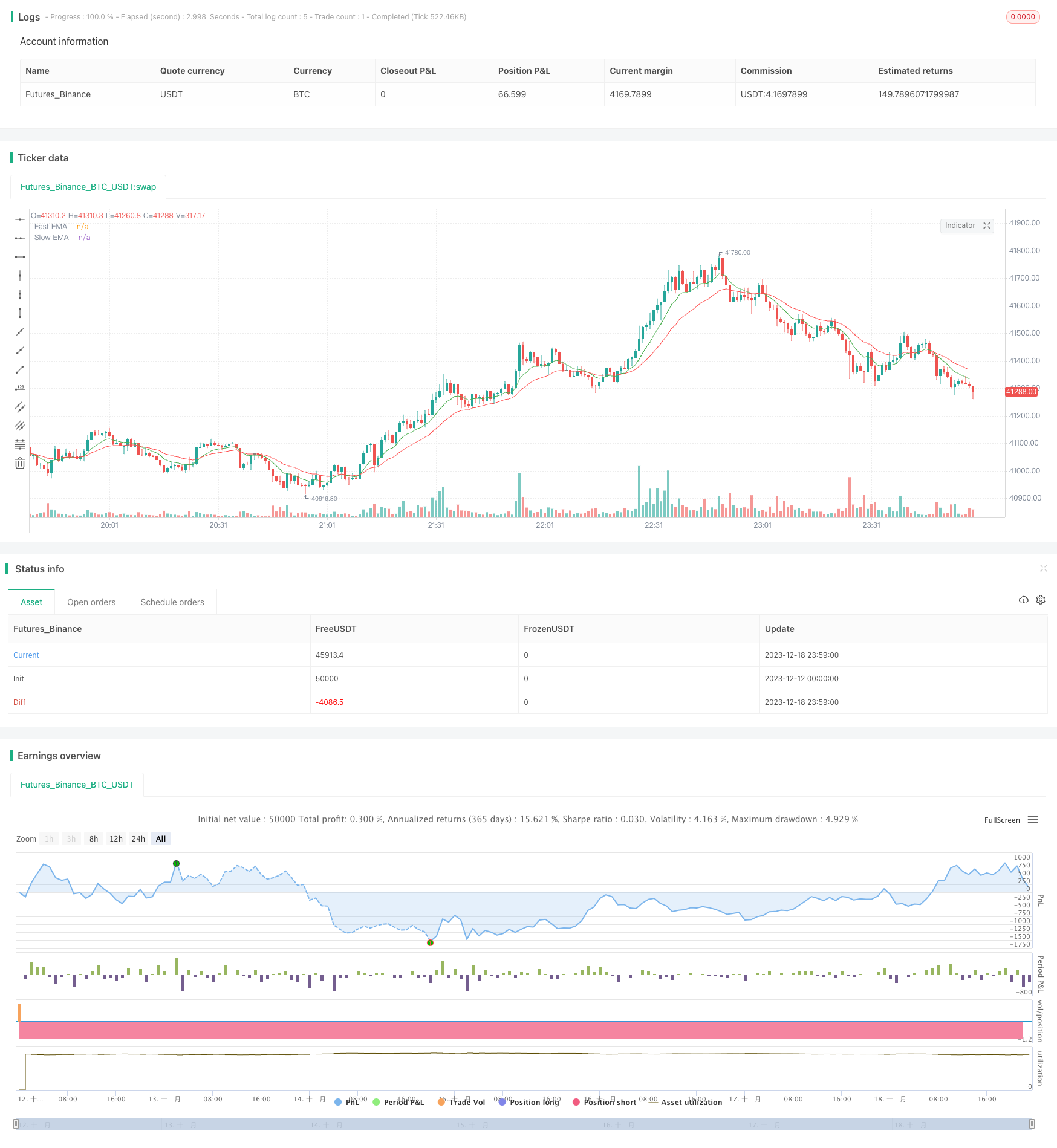

/*backtest

start: 2023-12-12 00:00:00

end: 2023-12-19 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("EMA Crossover with Trailing Stop-Loss", overlay=true)

fastEMA = ema(close, 9)

slowEMA = ema(close, 21)

// Entry conditions

longCondition = crossover(fastEMA, slowEMA)

shortCondition = crossunder(fastEMA, slowEMA)

// Trailing stop-loss calculation

var float trailingStop = na

var float highestHigh = na

if (longCondition)

highestHigh := na

trailingStop := na

if (longCondition and high > highestHigh)

highestHigh := high

if (strategy.position_size > 0)

trailingStop := highestHigh * (1 - 0.02) // Adjust the trailing percentage as needed

// Execute trades

strategy.entry("Long", strategy.long, when=longCondition)

strategy.entry("Short", strategy.short, when=shortCondition)

// Apply trailing stop-loss to long positions

strategy.exit("Long", from_entry="Long", loss=trailingStop)

// Plot EMAs and Trailing Stop-Loss

plot(fastEMA, color=color.green, title="Fast EMA")

plot(slowEMA, color=color.red, title="Slow EMA")

plot(trailingStop, color=color.orange, title="Trailing Stop-Loss", linewidth=2)

Detail

https://www.fmz.com/strategy/436009

Last Modified

2023-12-20 17:39:30