Name

基于EMA通道和MACD的短线交易策略EMA-Channel-and-MACD-Based-Short-term-Trading-Strategy

Author

ChaoZhang

Strategy Description

该策略名称为“基于EMA通道和MACD的短线交易策略”。它结合了EMA通道和MACD指标来识别趋势,并给出交易信号。

该策略使用5日EMA和21日EMA形成EMA通道。当5日EMA上穿21日EMA时,认为行情进入多头,当5日EMA下穿21日EMA时,认为行情进入空头。MACD指标的直方图可以用来过滤假信号。只有当MACD直方图大于0时,才会发出买入信号;只有当MACD直方图小于0时,才会发出卖出信号。一旦发出信号,就按固定止损和止盈下单。如果价格重新回到EMA通道内,会再次发出信号以追踪趋势。

该策略结合趋势识别和指标过滤,可以有效识别短线行情的方向。利用EMA通道判断主要趋势方向,再用MACD指标过滤假信号,可以大幅提高获利概率。固定的止损止盈机制也保证了收益的风险收益比。整体来说,该策略适合短线交易,特别是在具有较强动量的股票和外汇品种中,效果会更好。

该策略主要适用于短线交易,在长线和震荡行情下效果不佳。在长线横盘的市场中,EMA通道的交叉信号频繁,但大部分为假信号,此时MACD直方图虽可起到一定的过滤作用,但效果仍然有限。此外,固定的止损止盈机制使其难以抓住长线趋势带来的增量收益。所以这是该策略的主要风险。解决方法是根据市场情况灵活调整参数,或改用其他更适合当前市况的策略。

该策略可以从以下几个方面进行优化:

- 优化EMA的参数,寻找更匹配具体交易品种的收益率最大化的参数组合;

- 优化MACD的参数,使其过滤效果更佳;

- 结合波动率指标,当市场波动加大时,扩大止损范围;

- 加入追踪止损机制,让止损更贴近价格,在保证盈利的前提下减少不必要的止损被触发的概率。

该策略整体收益性较高,特别适合短线交易,在追求较高频率交易的量化交易策略中是一个不错的选择。但交易者在使用时,要注意根据市场行情合理调整参数,使策略收益最大化的同时,也要控制交易风险。

||

The strategy is named "EMA Channel and MACD Based Short-term Trading Strategy". It combines EMA channel and MACD indicator to identify trends and generate trading signals.

The strategy uses 5-day EMA and 21-day EMA to form an EMA channel. When 5-day EMA crosses above 21-day EMA, it is considered a bullish sign. When 5-day EMA crosses below 21-day EMA, it is considered a bearish sign. The MACD histogram can filter out false signals. Buy signals are only generated when MACD histogram is above 0. Sell signals are only generated when MACD histogram is below 0. Once signals are triggered, orders are placed with fixed stop loss and take profit. If price comes back into the EMA channel, signals will be triggered again to follow the trend.

The strategy combines trend identification and indicator filtering, which can effectively identify short-term trend directions. Using EMA channel to determine major trend direction and MACD histogram to filter out false signals can greatly improve profitability. The fixed stop loss and take profit mechanism also ensures good risk-reward ratio. Overall, this strategy is suitable for short-term trading, especially for stocks and forex with strong momentum.

The strategy is mainly suitable for short-term trading and performs poorly in long-term and ranging markets. In long-term sideways markets, EMA channel crossovers happen frequently but most are false signals. Although MACD histogram can play a role in filtering, its effectiveness is still limited. Also, the fixed stop loss and take profit makes it hard to capture incremental gains from long-term trends. So these are the main risks of this strategy. The solutions are to flexibly adjust parameters based on market conditions, or switch to other strategies more suitable for current market conditions.

The strategy can be optimized in the following aspects:

-

Optimize EMA parameters to find parameter combinations that maximize returns for specific trading instruments.

-

Optimize MACD parameters to improve filtering effectiveness.

-

Incorporate volatility indicators to widen stop loss range when market volatility rises.

-

Add trailing stop loss mechanism to make stop loss closer to price, reducing unnecessary stop loss trigger while ensuring profitability.

The strategy has relatively high profitability and is especially suitable for short-term trading. It is a good choice among high frequency quantitative trading strategies. But traders need to adjust parameters reasonably based on market conditions when using it, to maximize strategy returns while controlling trading risks.

[/trans]

Source (PineScript)

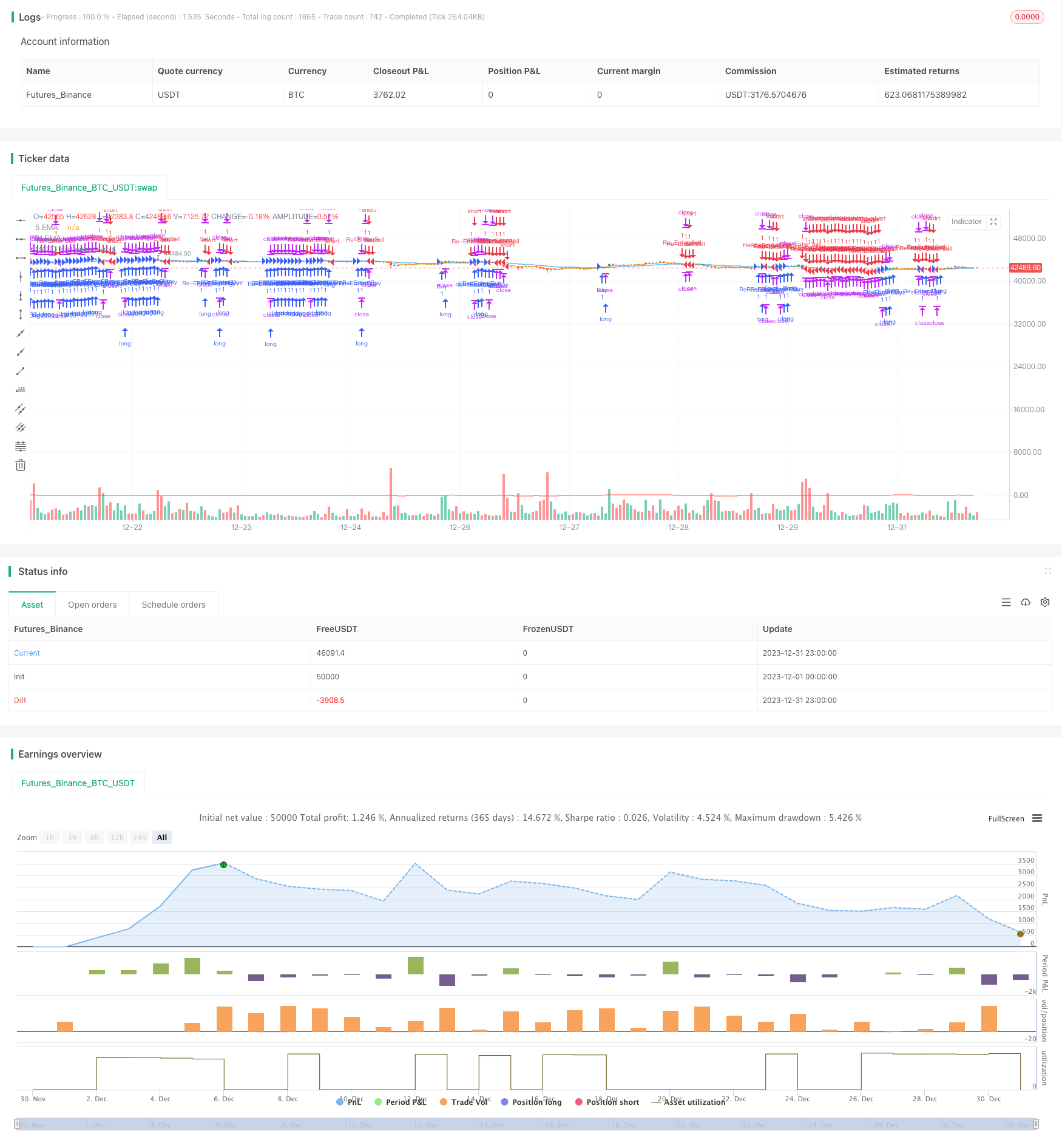

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © moondevonyt

//@version=5

strategy("Scalping with EMA channel and MACD", overlay=true)

// Exponential moving average inputs

ema21 = ta.ema(close, 21)

ema5 = ta.ema(close, 5)

// MACD inputs

fastLength = 18

slowLength = 34

signalSmoothing = 12

[macdLine, signalLine, _] = ta.macd(close, fastLength, slowLength, signalSmoothing)

macdHistogram = macdLine - signalLine

// Buy and sell conditions

buyCondition = ta.crossover(ema5, ema21) and macdHistogram > 0

sellCondition = ta.crossunder(ema5, ema21) and macdHistogram < 0

// Re-entry conditions

reEntryBuyCondition = close > ema21

reEntrySellCondition = close < ema21

// Set stop loss and take profit

stopLoss = 8

takeProfit = 15

// Execute Strategy

if buyCondition

strategy.entry("Buy", strategy.long)

strategy.exit("Take Profit/Stop Loss", "Buy", stop=close - stopLoss, limit=close + takeProfit)

if reEntryBuyCondition

strategy.entry("Re-Enter Buy", strategy.long)

strategy.exit("Take Profit/Stop Loss", "Re-Enter Buy", stop=close - stopLoss, limit=close + takeProfit)

if sellCondition

strategy.entry("Sell", strategy.short)

strategy.exit("Take Profit/Stop Loss", "Sell", stop=close + stopLoss, limit=close - takeProfit)

if reEntrySellCondition

strategy.entry("Re-Enter Sell", strategy.short)

strategy.exit("Take Profit/Stop Loss", "Re-Enter Sell", stop=close + stopLoss, limit=close - takeProfit)

// Plotting EMAs and MACD

plot(ema21, color=color.blue, title="21 EMA")

plot(ema5, color=color.orange, title="5 EMA")

plot(macdHistogram, color=color.red, title="MACD Histogram")

// Plot buy and sell signals

plotshape(series=buyCondition, style=shape.triangleup, location=location.belowbar, color=color.green, size=size.small, title="Buy Signal")

plotshape(series=sellCondition, style=shape.triangledown, location=location.abovebar, color=color.red, size=size.small, title="Sell Signal")

Detail

https://www.fmz.com/strategy/439742

Last Modified

2024-01-23 14:30:02