Name

基于RSI和EMA的趋势突破策略RSI-EMA-Trend-Breakout-Strategy

Author

ChaoZhang

Strategy Description

该策略是一个基于RSI和EMA指标的趋势追踪和趋势突破交易策略。策略名为“RSI-EMA趋势突破策略”。它融合了趋势跟踪和震荡指标,旨在捕捉中长线趋势的方向,在趋势突破点进行入场。

策略使用5日EMA,20日EMA和50日EMA构建多空趋势框架。当5日EMA上穿20日EMA,并且这两个EMA都处于50日EMA之上时,确定最近出现多头趋势突破,做多;当5日EMA下穿20日EMA,并且这两个EMA都处于50日EMA之下时,确定最近出现空头趋势突破,做空。

同时,策略还结合RSI指标判断是否过量超买或超卖区域。RSI可以有效识别超买超卖情况,避免在趋势置顶或盘整时产生错误信号。当RSI指标出现由超买区进入中性区时,多单止盈;当RSI指标出现由超卖区进入中性区时,空单止盈。

该策略结合EMA和RSI指标,既可以捕捉中长线趋势,又可以避免趋势末端的风险,具有非常好的风险收益比特征。其主要优势有:

- 使用EMA实现对趋势的判断,EMA平滑价格,有助于识别趋势方向

- RSI指标可以避免买入超买区域,卖出超卖区域,规避风险

- 策略操作频率较低,适合中长线持有,降低交易成本和滑点成本

该策略也存在一些风险,主要体现在:

- 在震荡行情中,EMA和RSI将产生更多错误信号,这会导致过多无效交易的出现。

- 突破失败是常见情况,需要设置止损来控制损失。

- 部分趋势行情中,RSI并不会进入超买超卖区域,这时用RSI判断入场和止盈会错过部分机会。

为了降低这些风险,我们可以设置交易止损,调整RSI参数,或者结合其他指标进行确认。

该策略还有进一步优化的空间:

- 可以测试不同的参数,如EMA周期参数、RSI参数等的组合,选择最佳参数。

- 可以加入别的指标,如MACD、布林带等来确认交易信号,降低错误率。

- 可以通过机器学习等方法来动态优化参数设置。

- 可以建立趋势判断系统,在不同市场环境中动态调整策略参数。

该RSI-EMA趋势突破策略综合考虑趋势跟踪和入场时机判断,在控制风险的基础上获取趋势收益,是一个非常实用的中长线策略。我们可以通过参数优化、加入其他指标等方法来进一步提高策略稳定性和收益率。

||

This is a trend following and trend breakout trading strategy based on RSI and EMA indicators. The strategy name is “RSI-EMA Trend Breakout Strategy”. It incorporates trend tracking and oscillating indicators to capture the medium-to-long term trend direction and enter at trend breakout points.

The strategy uses 5-day EMA, 20-day EMA and 50-day EMA to construct the long and short trend framework. When 5-day EMA crosses over 20-day EMA, and both EMAs are above 50-day EMA, it determines a recent bullish trend breakout for long entry. When 5-day EMA crosses below 20-day EMA, and both EMAs are below 50-day EMA, it determines a recent bearish trend breakout for short entry.

Meanwhile, the strategy also incorporates the RSI indicator to judge if it reaches overbought or oversold zones. RSI can effectively identify overbought and oversold conditions to avoid wrong signals when trend topping or consolidating. When RSI indicator moves from overbought to neutral zone, long position exits. When RSI indicator moves from oversold to neutral zone, short position exits.

This strategy combines EMA and RSI indicators, which can capture medium-to-long term trends and avoid risks at trend ending, with very good risk-reward ratio characteristics. The main advantages are:

- EMA judges trend direction smoothly based on prices

- RSI avoids buying overbought zones and selling oversold zones to mitigate risks

- The strategy has relatively low trading frequency, suitable for medium-to-long term holding, reducing trading and slippage costs

There are also some risks in this strategy:

- In ranging markets, EMA and RSI will produce more wrong signals, leading to excessive invalid trades

- Breakout failures happen a lot, so stop loss should be set to control losses

- In some trending markets, RSI does not enter overbought or oversold zones. Using RSI for entry and take profit will miss some opportunities

To reduce these risks, we can set stop loss, adjust RSI parameters, or incorporate other indicators for confirmation.

There is room for further optimization of this strategy:

- Test different parameter combinations like EMA periods, RSI parameters to find the optimal

- Incorporate other indicators like MACD, Bollinger Bands to confirm trading signals and reduce errors

- Use machine learning etc. methods to dynamically optimize parameter settings

- Build trend judging system to dynamically adjust strategy parameters in different market environments

This RSI-EMA trend breakout strategy comprehensively considers trend tracking and entry timing judgment to capture trend profits on the basis of risk control. It is a very practical medium-to-long term strategy. We can further improve the stability and profitability through parameter optimization, adding other indicators etc.

[/trans]

Source (PineScript)

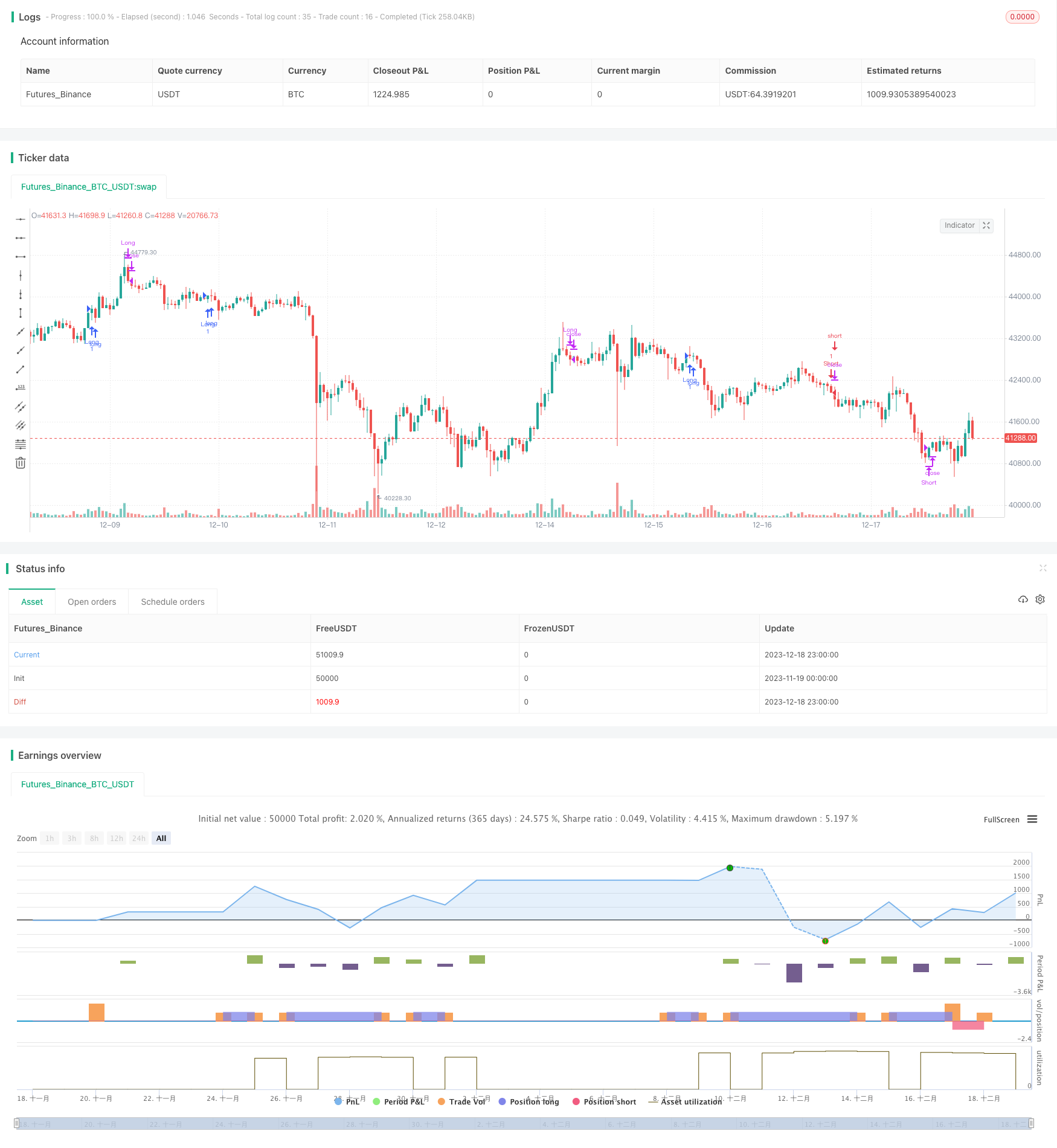

/*backtest

start: 2023-11-19 00:00:00

end: 2023-12-19 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © BrendanW98

//@version=4

strategy("My Strategy", overlay=true)

ema5 = ema(close, 9)

ema20 = ema(close, 21)

ema50 = ema(close, 55)

//RSI Signals

// Get user input

rsiSource = close

rsiLength = 14

rsiOverbought = 70

rsiOversold = 30

rsiMid = 50

// Get RSI value

rsiValue = rsi(rsiSource, rsiLength)

//See if RSI crosses 50

doBuy = crossover(rsiValue, rsiOversold) and rsiValue < 50

doSell = crossunder(rsiValue, rsiOverbought) and rsiValue > 50

emacrossover = crossover(ema5, ema20) and ema5 > ema50 and ema20 > ema50 and close > ema50

emacrossunder = crossunder(ema5, ema20) and ema5 < ema50 and ema20 < ema50 and close < ema50

//Entry and Exit

longCondition = emacrossover

closelongCondition = doSell

strategy.entry("Long", strategy.long, 1, when=longCondition)

strategy.close("Long", when=closelongCondition)

shortCondition = emacrossunder

closeshortCondition = doBuy

strategy.entry("Short", strategy.short, 1, when=shortCondition)

strategy.close("Short", when=closeshortCondition)

Detail

https://www.fmz.com/strategy/435952

Last Modified

2023-12-20 13:47:28