Name

基于Stochastic指标的周期性期权交易策略Stochastic-Weekly-Options-Trading-Strategy

Author

ChaoZhang

Strategy Description

本策略名为“基于Stochastic指标的周期性期权交易策略”,它使用Stochastic震荡指标识别期权交易的潜在入市和退出点。该策略专门用于期权交易,可在多空两端识别交易机会。

该策略使用14周期的Stochastic %K线和3周期简单移动平均线绘制Stochastic %D线。当%K线从低位突破%D线时视为看涨信号;%K线从高位下破%D线时则为看跌信号。具体入场和退出条件如下:

多头入场:当%K线从20以下水平突破%D线时做多 多头退出:当%K线从80以上水平下破%D线时平仓 空头入场:当%K线从80以上水平下破%D线时做空 空头退出:当%K线从20以下水平突破%D线时平仓

- 使用Stochastic指标识别超买超卖区域,避免在行情顶部做多底部做空

- 结合指标参数优化,可提高交易信号质量

- 可自定义入场退出条件,优化持仓管理

- 可用于期权交易,提高资金使用效率

- Stochastic指标容易产生假信号,需结合其它指标过滤

- 固定参数设置可能错过部分交易机会

- 回撤可能扩大,需控制单笔仓位规模

- 需关注股票基本面和宏观环境变化

- 结合移动平均线等指标过滤假信号

- 测试不同参数组合,优化参数设置

- 加大突破参数,减少假信号

- 优化止损止盈条件,控制单笔损失

本策略利用Stochastic指标的超买超卖原理识别潜在入场时机。相比传统趋势追踪策略,它可在行情转折点捕捉较大行情。通过参数优化、信号过滤等手段可进一步提高策略稳定性。该策略可用于期权交易,在控制风险的前提下争取高收益。

||

This strategy named "Stochastic Weekly Options Trading Strategy" uses the Stochastic oscillator to identify potential entry and exit points for options trading on both long and short sides. It is tailored for options trading with ability to capture trading opportunities in two directions.

The strategy plots a 14-period Stochastic %K line and a 3-period simple moving average line as Stochastic %D. An upcross of %K over %D is treated as a bullish signal. A downcross of %K below %D signals a bearish move. Specific entry and exit rules are defined as below:

Long Entry: %K crosses above %D while %K is below 20 Long Exit: %K crosses below %D while %K is above 80 Short Entry: %K crosses below %D while %K is above 80 Short Exit: %K crosses above %D while %K is below 20

- Identify overbought and oversold zones using Stochastic to avoid buying tops and selling bottoms

- Filter signals and improve quality through parameter optimization

- Customizable entry and exit rules to refine position management

- Efficient leverage for options trading with risk control

- Stochastic is prone to generating false signals - requires filter from other indicators

- Fixed parameter setting may miss some trading opportunities

- Drawdown risk due to volatile markets

- Pay attention to fundamentals and macro environment

- Add filters like moving averages to screen false signals

- Test different parameter combinations to find optimum

- Increase width of breakout zones to avoid false signals

- Optimize stop loss and take profit for better risk control

This strategy captures potential turning points by identifying overbought/oversold levels using Stochastic. Compared to trend-following tactics, it aims to capture bigger moves at inflection points. Further enhancements through parameter tuning, signal filtering can improve strategy stability. With balanced risk management, the options-focused approach allows efficient capital deployment for higher reward potential.

[/trans]

Source (PineScript)

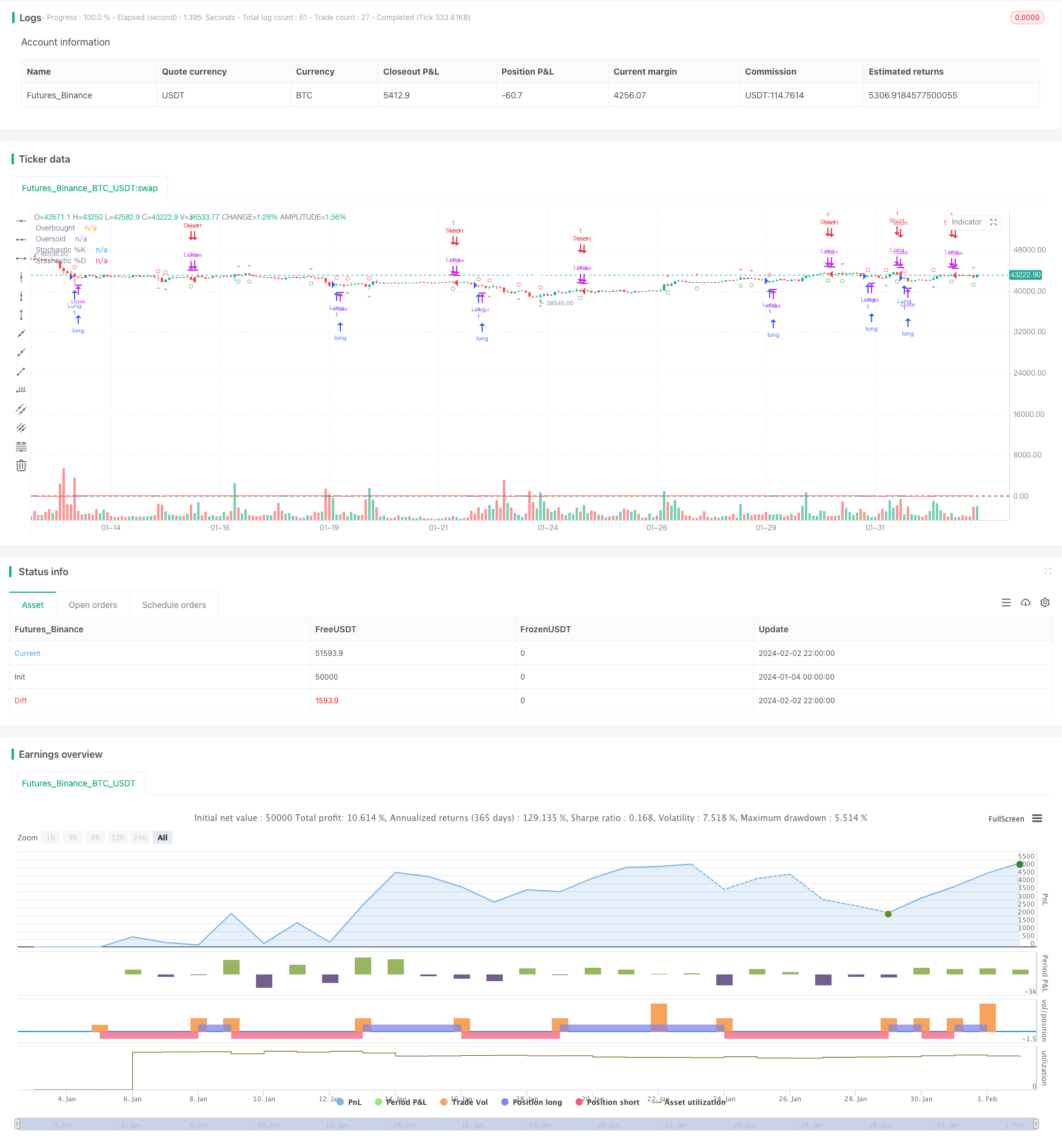

/*backtest

start: 2024-01-04 00:00:00

end: 2024-02-03 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Stochastic Weekly Options Strategy", overlay=true, shorttitle="WOS")

// Stochastic settings

K = ta.stoch(close, high, low, 14)

D = ta.sma(K, 3)

// Entry and exit conditions

longEntry = ta.crossover(K, 20)

longExit = ta.crossunder(K, 80)

shortEntry = ta.crossunder(K, 80)

shortExit = ta.crossover(K, 20)

// Strategy execution

strategy.entry("Long", strategy.long, when=longEntry)

strategy.close("Long", when=longExit)

strategy.entry("Short", strategy.short, when=shortEntry)

strategy.close("Short", when=shortExit)

// Alert conditions

alertcondition(longEntry, title="Long Entry Alert", message="Stochastic bullish crossover! Consider buying a call option.")

alertcondition(longExit, title="Long Exit Alert", message="Stochastic bearish crossover! Consider selling the call option.")

alertcondition(shortEntry, title="Short Entry Alert", message="Stochastic bearish crossover! Consider buying a put option.")

alertcondition(shortExit, title="Short Exit Alert", message="Stochastic bullish crossover! Consider selling the put option.")

// Plotting shapes for buy and sell signals

plotshape(longEntry, title="Calls Entry Label", color=color.new(color.green, 25),

textcolor=color.white, style=shape.triangleup, text="Calls", location=location.belowbar, size=size.small)

plotshape(longExit, title="Calls Exit Label", color=color.new(color.green, 25),

textcolor=color.white, style=shape.circle, text="Exit", location=location.belowbar, size=size.small)

plotshape(shortEntry, title="Puts Entry Label", color=color.new(color.red, 25),

textcolor=color.white, style=shape.triangledown, text="Puts", location=location.abovebar, size=size.small)

plotshape(shortExit, title="Puts Exit Label", color=color.new(color.red, 25),

textcolor=color.white, style=shape.circle, text="Exit", location=location.abovebar, size=size.small)

// Plotting

plot(K, color=color.blue, title="Stochastic %K")

plot(D, color=color.red, title="Stochastic %D")

hline(80, "Overbought", color=color.red)

hline(20, "Oversold", color=color.green)

Detail

https://www.fmz.com/strategy/440985

Last Modified

2024-02-04 15:14:43