Name

慢速随机指标趋势追踪策略Slow-Stochastic-Trend-Following-Strategy

Author

ChaoZhang

Strategy Description

该策略是基于慢速随机指标的趋势追踪策略。它使用了一个长期的K线均线,来平滑慢速随机指标,从而过滤掉市场 noise,锁定主要趋势。策略通过慢速随机指标的超买超卖线,来判断入场和出场时机。

该策略首先计算一个长度为400周期的K值SMA平滑线,然后再计算一个长度为275周期的SMA线来进一步平滑K线。这使得最终的K线变得非常平滑,基本上只反映了市场的主要趋势方向。策略以这个超平滑慢速随机指标的K值作为交易信号。

当K线从下方上穿23这一超卖区间时,做多;当K线从上方下穿78.5这一超卖区间时,做空。平仓信号为K线再次穿越各自的超卖区间。这样,策略就实现了追踪主要趋势的效果。

该策略最大的优势,就是使用超平滑慢速随机指标来锁定市场主要趋势,避免被市场 noise 带偏。超平滑使它只对较大的趋势变化敏感,从而过滤掉高频的反转和震荡。

另外,相比常见的移动平均线策略,该策略能更快地捕捉趋势转折点, profit 窗口更大。

该策略的主要风险在于,市场可能会长期震荡在超买超卖区间,导致多次误入场亏损。这时需要适当调整参数,使K线更加平滑,或者加大超买超卖区间范围。

此外,如果趋势突变,巨大行情来袭,超平滑的K线可能会延迟识别信号,造成部分潜在利润的损失。这种情况下,需要缩短K线均线参数,使其更灵敏。

该策略可以从以下几个方面进行优化:

-

调整K值和D值的平滑周期,找到最佳参数组合

-

测试不同的价格输入,如收盘价、典型价等

-

增加交易量或仓位控制,如ATR止损,资金利用率控制等

-

增加例如MACD等指标的辅助判断,避免误入场

-

使用机器学习对参数进行优化

该慢速随机指标趋势追踪策略,通过超平滑处理实现了对市场主要趋势的捕捉,回避了高频的市场 noise 对交易的干扰。同时也存在一定的滞后识别信号的风险。我们可以通过调整参数或增加辅助条件来对策略进行优化,提高策略的稳定性和profitability。

||

This is a trend following strategy based on slow stochastic indicator. It uses a long period K line moving average to smooth the slow stochastic and filters out market noise to lock in major trends. The strategy determines entry and exit points based on overbought and oversold levels of the smoothed slow stochastic.

The strategy first calculates a 400-period K value SMA smoothing line, and then calculates another 275-period SMA line to further smooth the K line. This makes the final K line very smooth, basically only reflecting the major trend direction of the market. The strategy uses this ultra-smoothed slow stochastic K value as trading signal.

When the K line crosses above the 23 oversold level from below, it goes long. When the K line crosses below the 78.5 overbought level from above, it goes short. Exit signals happen when the K line crosses back above/below the overbought/oversold levels. Thus the strategy achieves trend following effect.

The biggest advantage of this strategy is using the ultra-smoothed slow stochastic to lock in major market trends, avoiding noise interference. The ultra-smoothing makes it only sensitive to major trend changes, filtering out high frequency reversals and oscillations.

Also, compared to common moving average strategies, this strategy can capture trend turning points faster, with larger profit windows.

The main risk of this strategy is that the market may oscillate within the overbought/oversold zones for extended periods, causing multiple false signals and losses. In this case parameters need to be adjusted to make the K line smoother, or widen the overbought/oversold zones.

Also, if trend changes abruptly with huge moves, the ultra-smoothed K line may delay signal recognition, causing some potential profit loss. Here the K line MA parameters should be shortened to make it more sensitive.

The strategy can be optimized in the following aspects:

- Adjust smoothing periods of K & D values to find optimal combo;

- Test different price inputs like close, typical price etc;

- Add trading volume or position sizing control like ATR stop loss, capital utilization rate control etc;

- Add auxiliary indicators like MACD to avoid false signals;

- Use machine learning to optimize parameters.

The slow stochastic trend following strategy achieves capturing major market trends and avoids high frequency noise interference through ultra-smoothing processing. There are also risks of delayed signal recognition. We can optimize the strategy by adjusting parameters or adding auxiliary conditions to improve stability and profitability.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 400 | smoothK |

| v_input_2_ohlc4 | 0 | price: ohlc4 |

| v_input_3 | 275 | SMAsmoothK |

| v_input_4 | 10 | smoothD |

| v_input_5 | 78.5 | OB |

| v_input_6 | 23 | OS |

Source (PineScript)

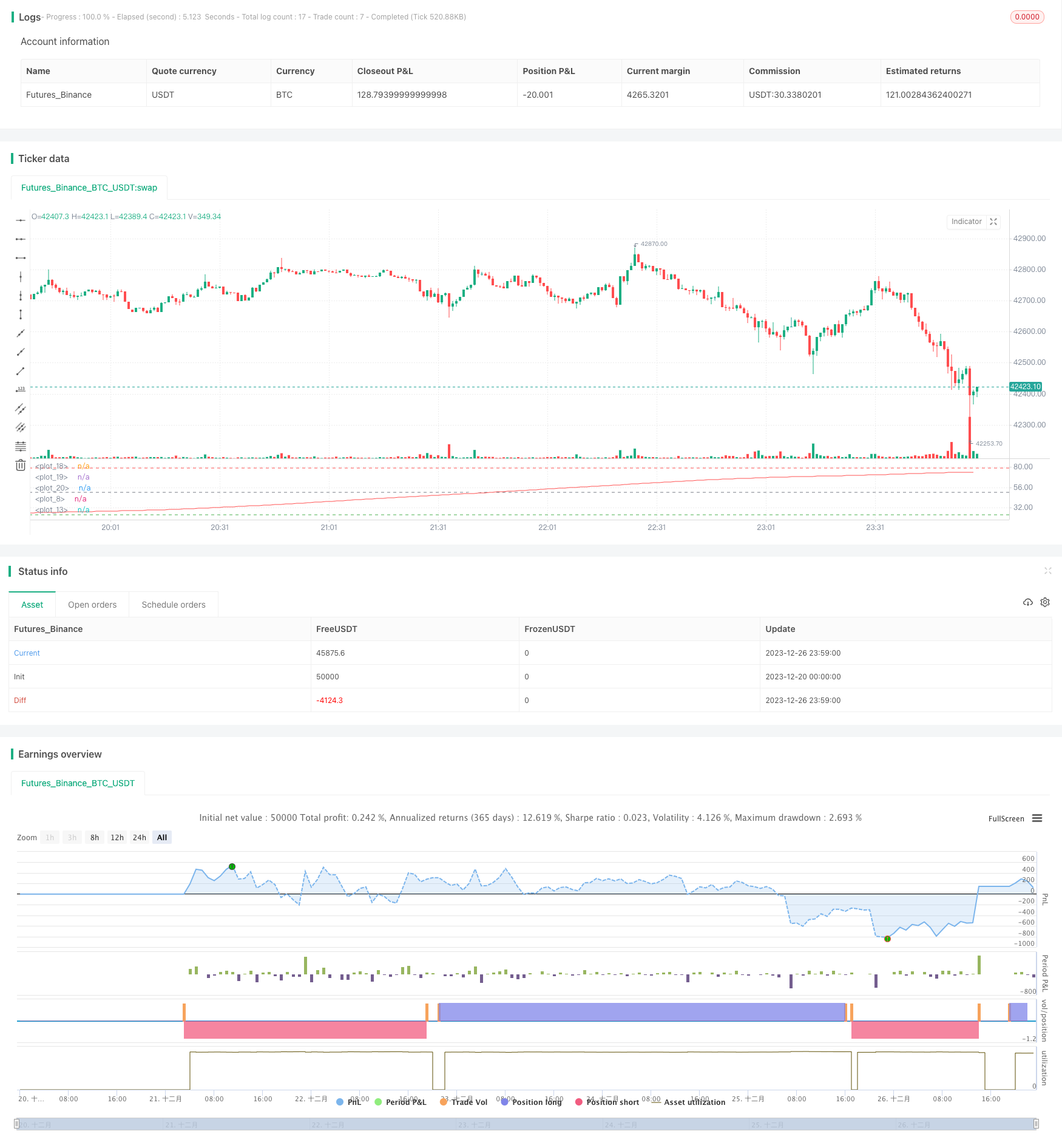

/*backtest

start: 2023-12-20 00:00:00

end: 2023-12-27 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title="Slow Stochastic OB/OS Strategy", overlay=false )

smoothK = input(400, step=5)

price = input(ohlc4)

SMAsmoothK = input(275, step=5)

k = sma(stoch(price, high, low, smoothK), SMAsmoothK)

plot(k, color=white)

smoothD = input(10, step=2)

d = sma(k, smoothD)

plot(d, color=red)

OB = input(78.5, step=0.5)

OS = input(23, step=0.5)

hline(OB, linewidth=1, color=red)

hline(OS,linewidth=1, color=green)

hline(50,linewidth=1, color=gray)

long = crossover(d, OS)

short = crossunder(d, OB)

strategy.entry("Long", strategy.long, when=long) //_signal or long) //or closeshort_signal)

strategy.entry("Short", strategy.short, when=short) //_signal or short) // or closelong_signal)

//If you want to try to play with exits you can activate these!

closelong = crossover(d, OB)

closeshort = crossunder(d, OS)

strategy.close("Long", when=closelong)

strategy.close("Short", when=closeshort)

Detail

https://www.fmz.com/strategy/436904

Last Modified

2023-12-28 17:50:36