Name

收盘买入次日开盘止盈策略Close-Buying-Next-Open-Profit-Taking-Strategy

Author

ChaoZhang

Strategy Description

[trans]

该策略的主要思想是在当天收盘前买入,次日开盘后判断价格是否高于买入价格,如果高于则止盈卖出,如果没有高于则继续持有直到止损或止盈。

该策略首先设置了200日简单移动平均线作为市场状态判断的指标,只有当价格高于200日线时才允许交易。另外设置了每天的买入时间为收盘前半小时内,卖出时间为次日开盘后半小时内。在买入时间如果市场状态符合就市价买入,在卖出时间判断价格是否高于买入价格,如果高于就市价卖出止盈,如果没有高于则继续持有直到止损或者在明天的卖出时间再次判断。同时设置了5%的止损线来防止亏损扩大。

该策略有以下几个优势:

-

利用了收盘效应,收盘时波动较大,容易形成较大的缺口,次日开盘价格可能会有较大幅度的涨跌。

-

通过较短的持有期限,可以快速止损止盈,降低风险。

-

比较简单的逻辑,容易理解和实现。

-

可以灵活设置止损线和市场状态判断指标来控制风险。

该策略也存在一些风险:

-

收盘时买入可能价格高位买入,增加亏损风险。

-

持有期短,容易被套牢。如果次日没有涨跌停可能会被套持。

-

依赖较大的缺口出现,如果没有缺口则可能亏损或套持。

-

如果选错标的,例如股指横盘,则可能多次亏损。

对应解决方法:

-

可以结合技术指标判断收盘时是否处于相对低位。

-

可以适当拉长持有期,例如持有2-3天。

-

选择有效突破时机位才买入。

-

做好标的筛选,选择有上涨趋势的标的。

该策略还可以从以下几个方面来优化:

-

在买入条件上加入更多技术指标判断,确保收盘买入时机确定性更高。

-

测试不同的持有周期,找到最优止盈时间。

-

对止损线进行优化,找到最优止损点。

-

测试在具体哪些标的和市场环境下表现更好,采用动态的标的和仓位管理。

本策略整体思路清晰,利用收盘效应形成的缺口来进行快节奏的止盈止损交易。具有操作简单,容易实现等优点。但也存在被套风险较大,选股和止损mgmt很关键。后期可从确定买入信号、优化持有周期和止损点、动态仓位管理等方面进行优化,在控制风险的前提下,提高系统稳定性和盈利能力。

||

The main idea of this strategy is to buy at the close on the current day and sell at open on the next day if the price is higher than the buying price, otherwise continue holding until stop loss or profit taking.

The strategy first sets a 200-day simple moving average as the market state indicator, allowing trading only when the price is above the 200-day line. The buying time is set to the last half hour before the close every day, and the selling time is set to the first half hour after the next open. When the market state meets the requirement during buying time, it will place a market order to buy. During selling time, it will check if the price is higher than the buying price, if yes, it will place a market order to sell and take profit, otherwise, it continues holding until stop loss or profit taking tomorrow. It also sets a 5% stop loss line to limit losses.

The strategy has the following advantages:

-

Utilize the closing effect where price fluctuation and gap are larger during closing. The next open price may have a large swing.

-

The short holding period allows quick stop loss and profit taking to reduce risks.

-

The logic is simple and easy to understand and implement.

-

Flexible configuration on stop loss line and market state indicator to control risks.

There are also some risks:

-

Buying at the closing price may take positions at high prices, increasing loss risk.

-

The short holding period makes it easy to be trapped. There may be no limit up or down the next day.

-

It relies on large gaps, which may not always form, leading to losses or trapped positions.

-

Choosing the wrong symbol, like index consolidation, may lead to multiple losses.

Solutions:

-

Combine technical indicators to ensure buying at a relative bottom at closing.

-

Extend holding period to 2-3 days.

-

Only buy at valid breakout moments.

-

Careful symbol selection, choose symbols with an uptrend.

The strategy can be optimized in the following aspects:

-

Add more technical indicators for buying signal to improve certainty.

-

Test different holding periods to find the optimal profit-taking time.

-

Optimize the stop loss line to find the optimal stop loss point.

-

Test performance across different symbols and market environments, adopt dynamic symbol and position management.

The strategy has clear logic, utilizing the closing gap effect for quick stop loss/profit trading. It is easy to implement and understand. But it also has high trap risks. Position sizing, stop loss management and stock picking are critical. It can be further optimized on improving buying certainty, optimal holding period and stop loss point, and dynamic position sizing to improve stability and profitability while controlling risk.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 200 | MarketFilterLen |

| v_input_2 | 0.95 | StopLossPerc |

Source (PineScript)

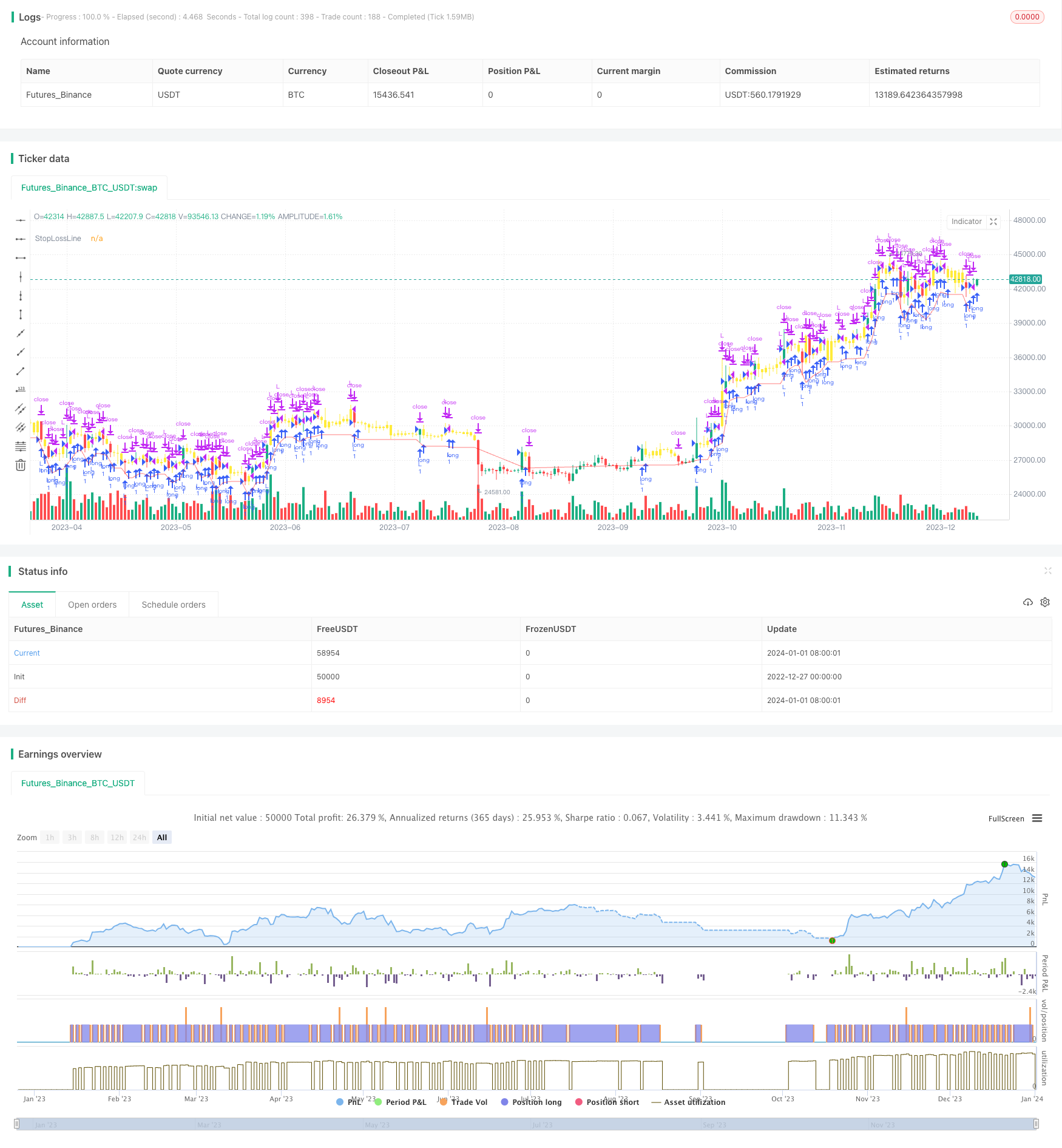

/*backtest

start: 2022-12-27 00:00:00

end: 2024-01-02 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// @version=4

// © HermanBrummer

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

strategy("M8 BUY @ END OF DAY", "", 1)

/// BUYS AT THE END OF THE DAY

/// SELLS THE NEXT MORNING IF PRICE IS HIGHER THEN THE ENTRY PRICE

/// IF PRICE IS NOT HIGHER THEN IT WILL KEEP THE POSITION AND WAIT FOR EITHER A STOP OUT OR FOR PRICE TO BE HIGHER THAN THE ENTRY

/// USES A 5% STOP LOSS ON THE REDLINE -- SETTABLE IN SETTINGS

/// USES A 200 DAY MARKET FILTER -- SETTABLE IN SETTINGS -- IMPORTS DATA FROM HIGHER TIMEFRAME, BUT USES CLOSE[2] << SO THIS IS FIXED, NON-REPAITING DATA

MarketFilterLen = input(200)

StopLossPerc = input(.95, step=0.01)

buyTime = time(timeframe.period, "1429-1500")

sellTime = time(timeframe.period, "0925-0935")

F1 = close > sma(security(syminfo.tickerid, "D", close[2]), MarketFilterLen) // HIGH OF OLD DATA -- SO NO REPAINTING

enter = buyTime and F1

exit = sellTime

StopLossLine = strategy.position_avg_price * StopLossPerc

plot(StopLossLine, "StopLossLine", color.new(#FF0000, 50))

strategy.entry("L", true, when=enter)

strategy.exit("StopLoss", stop=StopLossLine )

if close > strategy.position_avg_price

strategy.close("L", when=exit)

barcolor(strategy.opentrades != 0 ? color.new(color.yellow, 0) : na )

Detail

https://www.fmz.com/strategy/437544

Last Modified

2024-01-03 16:19:01