Name

望远适应-CCI-底部捕捉商品交易策略Extended-Adaptive-CCI-Bottom-Fishing-Trading-Strategy-for-Commodities

Author

ChaoZhang

Strategy Description

该策略基于商品通道指数(CCI)指标,采用动态适应性 entries 标准来判断趋势反转的时机,同时利用追踪止损来锁定利润。策略名称“望远适应 CCI 底部捕捉商品交易策略”包含了该策略的核心要点:利用 CCI 指标判断超卖区域来捕捉反转机会,并采用动态适应性 entries 水平来优化 entries 时机。

核心指标为 CCI 指标,用于判断超卖区域从而提示趋势反转的机会。另外,根据不同标的以及市场环境,CCI 超卖区域的幅度也会有所不同。因此,本策略采用“望远”的方式,判断过去一段时间 CCI 最低点的位置,动态设定 CCI 买入水平。如果过去 40 天内最低 CCI 点大于 -90,那么 -90 作为新的超卖区域水平;如果过去 50 天内 CCI 最低点大于 -70,那么以 -70 作为新的超卖区域水平,依此类推。这样的设计使得 entries 水平动态适应不同的市场环境,在跌势较强的市场中追求更小的风险 entries,而在区间整理的市场中 entries 水平会更宽松一些。

具体来说,默认买入信号的 CCI 水平为 -145。然后判断过去 40 天、50 天等不同天数内 CCI 最低点的位置,如果最低点高于默认水平的下一级别比如 -90,那么以 -90 作为新的 entries 水平。如果最低点再高于 -90,以 -70 作为新的 entries 水平,依此类推。这样entries 水平可以在 -145 / -90 / -70 / -50 / -4 / 0 / +25 / +50 / +70 之间动态切换。当 CCI 低于对应水平时产生买入信号。

此外,策略还采用追踪止损来锁定利润,止损水平随着价格运行不断上移。

- 利用 CCI 指标判断超卖区域的思路清晰可靠

- Entries 水平的动态适应性设计,使得策略可以自动适应不同类型的市场环境

- 追踪止损设计使得策略可以很好地锁定利润

相比固定的 entries 水平,这样的动态设计使得 entries 时机可以得到优化。在跌势较强的市场中追求更高的 entries 标准可以减小风险;而在震荡区间整理的市场中降低 entries 标准可以抓住更多机会。这样的设计增强了策略的适应性。

CCI 本身作为判断超买超卖的指标也较为清晰可靠,基于 CCI 判读趋势反转的思路行之有效。结合动态 entries 设计,本策略整体优势显著。

- CCI 指标并非完美,该指标存在一定的滞后性。当价格快速突破 CCI readings 的时候,判断可能会失效

- Entries 水平的动态调整也无法完美适应市场环境的变化,调整较慢时也会错过最优 entries 时机

- 商品市场波动较大,止损设置不当可能造成较大损失

基于 CCI 判断趋势转折点的思路有一定的滞后性,当价格快速拉升或者暴跌时, Entries 时机可能会不准。此外,Entries 水平的动态适应机制也难以完美匹配当前市场环境,这导致 Entries 不一定是最优时机。最后,商品市场本身波动较大,即便设置了止损,但具体参数设置不当时也可能造成较大的亏损。

- 优化 CCI 参数以及平滑周期,测试不同时间长度的 CCI 效果

- 测试更多种类的 Entries 水平,寻找更好的默认值或者适应性设计

- 测试不同的止损参数,适当提高止损幅度来适应商品市场的高波动特点

主要可以从 CCI 参数本身、Entries 水平设定以及止损参数几个方面进行优化。针对具体标的来精确定位更优参数可以提升策略的效果。

该策略综合运用 CCI 指标判断超买超卖的思路以及动态适应性 Entries 水平设计,对突破性趋势进行捕捉。相比固定参数,动态 Entries 水平明显增强了策略的适应性。基于 Entries 反转捕捉模式与追踪止损结合,可以抓住较强势头的机会并及时止损。该策略在参数设置精确的前提下,整体效果可行性强。后续可继续优化 CCI 参数设定以及 Entries 水平判定来进一步提高策略的稳定性与收益率。

||

This strategy is based on the Commodity Channel Index (CCI) indicator and employs dynamic adaptive entry levels to determine trend reversal timing, while using a trailing stop loss to lock in profits. The strategy name "Extended Adaptive CCI Bottom Fishing Trading Strategy for Commodities" captures the key aspects of this strategy: using the CCI indicator to identify oversold zones to fish for reversal opportunities, and adopting adaptive entry levels to optimize entry timing.

The core indicator is the CCI, used to spot oversold zones hence hinting at trend reversal opportunities. Also, the extent of CCI oversold zones varies across different instruments and market environments. Therefore, this strategy takes a "far-sighted" approach, examining the lowest CCI levels over certain lookback periods, to dynamically set the CCI buy entry level. If the lowest CCI over the past 40 days is above -90, then -90 becomes the new oversold zone threshold, and so on. This adaptive design allows entry levels to dynamically fit different market conditions, pursuing more conservative entries during strong downtrends while more aggressive entries during range-bound markets.

Specifically, the default CCI buy signal level is -145. The strategy then checks the lowest CCI readings over the past 40 days, 50 days etc different lookback days. If the lowest CCI is above the next level like -90, then -90 becomes the new entry level. And so on, the entry level can switch between -145 / -90 / -70 / -50 / -4 / 0 / +25 / +50 / +70 dynamically. A long entry signal is triggered when CCI drops below the corresponding level.

In addition, a trailing stop loss is used to lock in profits, with the stop level moving up along with the price.

- Clear and reliable approach of using CCI to spot oversold zones

- The adaptive design of entry levels allows the strategy to automatically fit different market environments

- Trailing stop loss helps lock in profits effectively

Compared to fixed entry levels, such dynamic design enables optimized entry timing. Pursuing more conservative entries during strong downtrends reduces risk, while lower entries during range-bound markets allow capturing more opportunities. This enhances the adaptability of the strategy.

CCI itself is a clear and reliable indicator for identifying overbought/oversold levels. The logic of judging trend reversals based on CCI is proven. Combined with the dynamic entry design, the overall advantage of this strategy is significant.

- CCI is not perfect and has some lagging attributes. Judgments may fail when price breaks out rapidly from CCI readings.

- Dynamic adjustment of entry levels also cannot perfectly match changes in market environments. Delay in adjustments may cause missing of optimal entry timing.

- High volatility in commodity markets. Improper stop loss setting can lead to huge losses.

The logic of spotting trend reversal points has some lagging attributes. Entry timing may not be accurate during sudden price surges or crashes. Also, the adaptive mechanism may not perfectly fit the current market environment, leading to non-optimal entries. Finally, high fluctuations in commodity markets can cause huge losses if stop loss parameters are not set properly.

- Optimize CCI parameters and smoothing periods, test effectiveness of different CCI lengths

- Test more types of entry levels, find better default values or adaptive designs

- Test different stop loss parameters, properly raise stop loss range to match high volatility attributes of commodity markets

Mainly CCI itself, entry level design and stop loss parameters can be improved. Precisely locating optimum parameters for specific instruments can enhance strategy performance.

This strategy combines the logic of using CCI to spot overbought/oversold zones and the dynamic adaptive entry level design to capture trend reversals. Compared to fixed parameters, the dynamic entry levels significantly improve adaptability. This entry reversal capturing model with trailing stop loss can seize opportunities with strong momentum and cut losses in time. With properly configured parameters, this strategy demonstrates viability and robustness. Further improvements can be made by keep optimizing CCI parameters and entry level rules to achieve higher stability and profitability.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 20 | CCI Period |

| v_input_2 | -145 | Default CCI Entry Oversold Level |

| v_input_3 | -90 | Adaptive CCI Entry Level for 40 Days |

| v_input_4 | -70 | Adaptive CCI Entry Level for 50 Days |

| v_input_5 | -50 | Adaptive CCI Entry Level for 60 Days |

| v_input_6 | -4 | Adaptive CCI Entry Level for 90 Days |

| v_input_7 | false | Adaptive CCI Entry Level for 120 Days |

| v_input_8 | 25 | Adaptive CCI Entry Level for 140 Days |

| v_input_9 | 50 | Adaptive CCI Entry Level for 160 Days |

| v_input_10 | 70 | Adaptive CCI Entry Level for 180 Days |

| v_input_11 | 40 | Lookback Period for -90 Level |

| v_input_12 | 50 | Lookback Period for -70 Level |

| v_input_13 | 60 | Lookback Period for -50 Level |

| v_input_14 | 90 | Lookback Period for -4 Level |

| v_input_15 | 120 | Lookback Period for 0 Level |

| v_input_16 | 140 | Lookback Period for +25 Level |

| v_input_17 | 160 | Lookback Period for +50 Level |

| v_input_18 | 180 | Lookback Period for +70 Level |

| v_input_19 | 10 | Trailing Stop Offset in USD |

Source (PineScript)

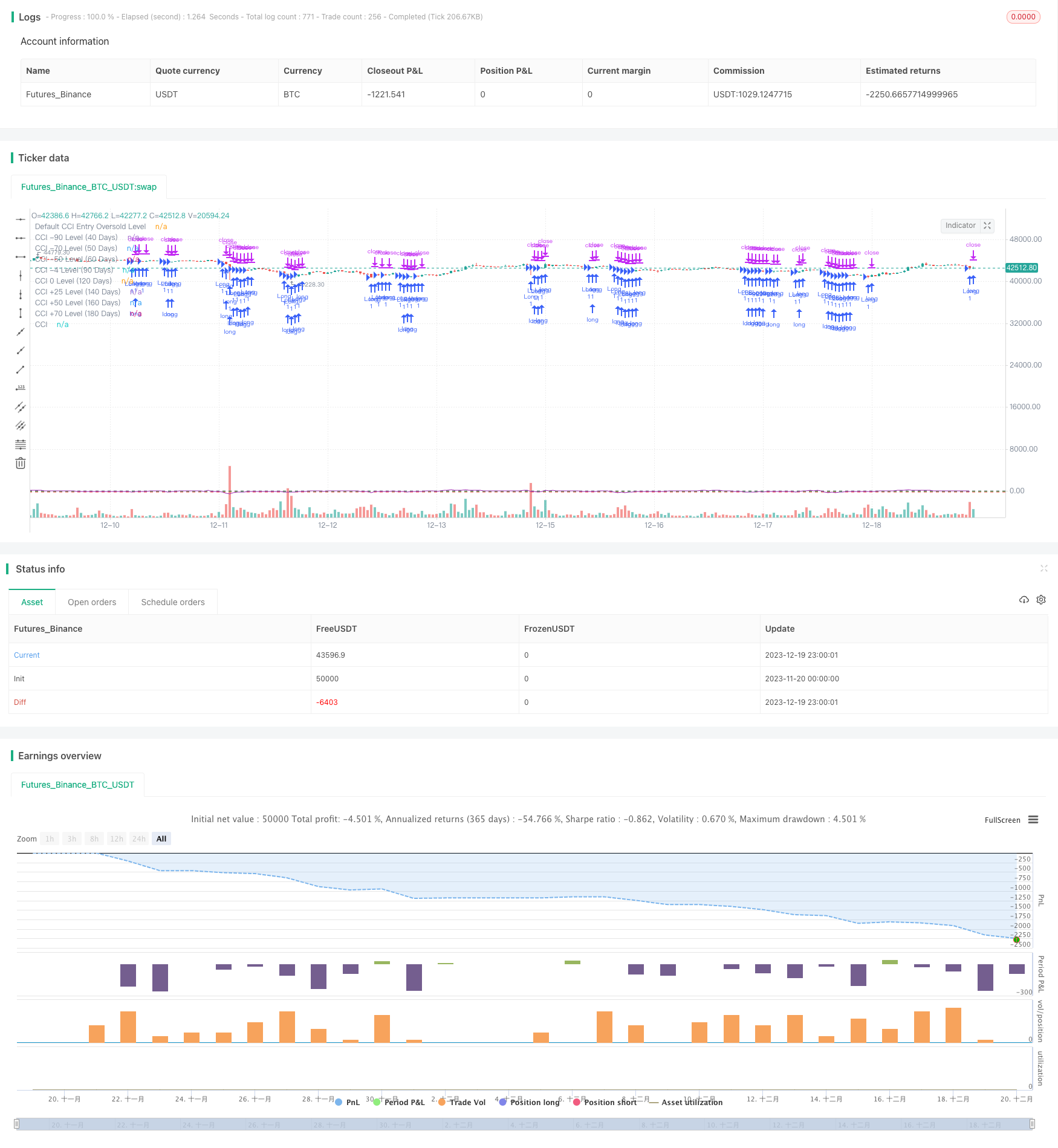

/*backtest

start: 2023-11-20 00:00:00

end: 2023-12-20 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Extended Adaptive CCI Entry Strategy for Commodities", shorttitle="Ext_Adaptive_CCI_Entry_Com", overlay=true)

// Inputs

cciLength = input(20, title="CCI Period")

defaultCCIEntryOversold = input(-145, title="Default CCI Entry Oversold Level")

adaptiveCCIEntryLevel90 = input(-90, title="Adaptive CCI Entry Level for 40 Days")

adaptiveCCIEntryLevel70_50Days = input(-70, title="Adaptive CCI Entry Level for 50 Days")

adaptiveCCIEntryLevel50 = input(-50, title="Adaptive CCI Entry Level for 60 Days")

adaptiveCCIEntryLevel4 = input(-4, title="Adaptive CCI Entry Level for 90 Days")

adaptiveCCIEntryLevel0 = input(0, title="Adaptive CCI Entry Level for 120 Days")

adaptiveCCIEntryLevel25 = input(25, title="Adaptive CCI Entry Level for 140 Days")

adaptiveCCIEntryLevel50_160Days = input(50, title="Adaptive CCI Entry Level for 160 Days")

adaptiveCCIEntryLevel70_180Days = input(70, title="Adaptive CCI Entry Level for 180 Days")

lookback40 = input(40, title="Lookback Period for -90 Level")

lookback50 = input(50, title="Lookback Period for -70 Level")

lookback60 = input(60, title="Lookback Period for -50 Level")

lookback90 = input(90, title="Lookback Period for -4 Level")

lookback120 = input(120, title="Lookback Period for 0 Level")

lookback140 = input(140, title="Lookback Period for +25 Level")

lookback160 = input(160, title="Lookback Period for +50 Level")

lookback180 = input(180, title="Lookback Period for +70 Level")

// Indicator Calculation

cci = ta.cci(close, cciLength)

// Determine adaptive entry level based on lookback periods

var float entryLevel = defaultCCIEntryOversold // Initialize with the default level

if ta.lowest(cci, lookback40) > adaptiveCCIEntryLevel90

entryLevel := adaptiveCCIEntryLevel90

if ta.lowest(cci, lookback50) > adaptiveCCIEntryLevel70_50Days

entryLevel := adaptiveCCIEntryLevel70_50Days

if ta.lowest(cci, lookback60) > adaptiveCCIEntryLevel50

entryLevel := adaptiveCCIEntryLevel50

if ta.lowest(cci, lookback90) > adaptiveCCIEntryLevel4

entryLevel := adaptiveCCIEntryLevel4

if ta.lowest(cci, lookback120) > adaptiveCCIEntryLevel0

entryLevel := adaptiveCCIEntryLevel0

if ta.lowest(cci, lookback140) > adaptiveCCIEntryLevel25

entryLevel := adaptiveCCIEntryLevel25

if ta.lowest(cci, lookback160) > adaptiveCCIEntryLevel50_160Days

entryLevel := adaptiveCCIEntryLevel50_160Days

if ta.lowest(cci, lookback180) > adaptiveCCIEntryLevel70_180Days

entryLevel := adaptiveCCIEntryLevel70_180Days

// Entry Condition

longCondition = cci < entryLevel

// Entry and Exit

if (longCondition)

strategy.entry("Long", strategy.long, qty=1)

alert("Long entry executed at " + str.tostring(close), alert.freq_once_per_bar)

trailOffset = input(10.0, title="Trailing Stop Offset in USD")

strategy.exit("Trailing Stop", "Long", trail_offset = trailOffset, trail_price = close)

if (close < entryLevel - trailOffset)

alert("Long position closed at " + str.tostring(close), alert.freq_once_per_bar)

// Plotting

plot(series=cci, color=color.purple, title="CCI")

hline(price=defaultCCIEntryOversold, color=color.red, title="Default CCI Entry Oversold Level")

hline(price=adaptiveCCIEntryLevel90, color=color.orange, title="CCI -90 Level (40 Days)")

hline(price=adaptiveCCIEntryLevel70_50Days, color=color.yellow, title="CCI -70 Level (50 Days)")

hline(price=adaptiveCCIEntryLevel50, color=color.green, title="CCI -50 Level (60 Days)")

hline(price=adaptiveCCIEntryLevel4, color=color.blue, title="CCI -4 Level (90 Days)")

hline(price=adaptiveCCIEntryLevel0, color=color.purple, title="CCI 0 Level (120 Days)")

hline(price=adaptiveCCIEntryLevel25, color=color.aqua, title="CCI +25 Level (140 Days)")

hline(price=adaptiveCCIEntryLevel50_160Days, color=color.black, title="CCI +50 Level (160 Days)")

hline(price=adaptiveCCIEntryLevel70_180Days, color=color.gray, title="CCI +70 Level (180 Days)")

Detail

https://www.fmz.com/strategy/436119

Last Modified

2023-12-21 14:30:03