Name

真实相对运动MA均线策略True-Relative-Movement-Moving-Average-Strategy

Author

ChaoZhang

Strategy Description

真实相对运动MA均线策略(True Relative Movement Moving Average, TRMMA)是一个结合相对强弱指数(RSI)和真实强弱指数(TSI)的趋势跟踪策略。它利用 RSI 和 TSI 的指标为买入和卖出信号,辅以移动平均线进行策略优化。

该策略主要分为以下几部分:

-

TSI 计算 通过双指数平滑计算价格变化率的指数平滑值,再除以价格变化率绝对值的指数平滑值,得到 TSI 指标。其中长期为25天,短期为5天,信号线为14天。

-

RSI 计算 以收盘价为价格输入,长度为5的 RSI 指标。

-

信号判断 当 TSI 上穿其信号线且 RSI 上穿50时为买入信号。当 TSI 下穿其信号线且 RSI 下穿50时为卖出信号。

-

K线颜色 根据信号判断给K线染色,辅助判断。

-

策略参数 设置仓位比例和资金等参数。

该策略结合 TSI 和 RSI 两个指标,能够有效判断市场趋势和超买超卖情况,从而产生交易信号。相比单一使用 TSI 或 RSI,能够过滤掉更多假信号。此外,相比默认参数,本策略采用更加激进的 TSI 和 RSI 参数设置,可以获得更早且高质量的交易信号。

该策略主要存在以下风险:

-

参数优化风险。不同市场、不同品种、不同周期下,TSI 和 RSI 的最优参数都可能不同,需要针对具体情况优化。

-

趋势反转风险。策略本身侧重趋势,一旦发生突发事件引起短期调整或中长期趋势反转,该策略将面临较大亏损。

-

信号频繁风险。相比默认参数,本策略采用更加激进的参数设置,可能会产生更为频繁的交易信号,带来更高的交易成本和实现难度。

该策略可以从以下几个方面进行优化:

-

结合移动均线等指标进一步过滤信号,以减少频繁交易的问题。

-

测试不同市场和品种下 TSI 和 RSI 参数的最优组合,寻找最佳参数设置。

-

增加止损策略,以控制单笔亏损风险。

-

优化仓位管理,在趋势较强时加大仓位,趋势转弱时减小仓位。

TRMMA 策略结合 TSI 和 RSI 指标判断买入卖出时机,对趋势具有很强的捕捉能力。相比单一使用 TSI 或 RSI,能有效过滤假信号。通过参数优化、止损策略、仓位管理等方式可进一步增强策略稳定性。该策略适合具有一定量化基础且追求高收益的投资者。

||

The True Relative Movement Moving Average (TRMMA) strategy is a trend-following strategy that combines the Relative Strength Index (RSI) and True Strength Index (TSI). It uses the indicators of RSI and TSI to generate buy and sell signals, with moving averages for strategy optimization.

The strategy consists of the following main parts:

-

TSI Calculation Calculate the exponential smoothed value of the rate of price changes through double exponential smoothing, then divide it by the exponential smoothed value of the absolute rate of price changes to obtain the TSI indicator. The long term is 25 days, the short term is 5 days, and the signal line is 14 days.

-

RSI Calculation RSI indicator with close price as input and length of 5 days.

-

Signal Judgment A buy signal is generated when TSI crosses above its signal line and RSI crosses above 50. A sell signal is generated when TSI crosses below its signal line and RSI crosses below 50.

-

Candlestick Coloring Color the candlesticks based on signals to assist judgment.

-

Strategy Parameters Set parameters like position ratio and capital.

The strategy combines the TSI and RSI indicators to effectively judge market trends and overbought/oversold situations, thus generating trading signals. Compared with using TSI or RSI alone, it can filter out more false signals. In addition, compared with the default parameters, this strategy adopts a more aggressive setting of TSI and RSI parameters to obtain earlier and higher quality trading signals.

The main risks of this strategy include:

-

Parameter optimization risk. The optimal parameters of TSI and RSI may differ across markets, products, and timeframes. Parameters need to be optimized for specific situations.

-

Trend reversal risk. The strategy itself focuses on trends. Sudden events that cause short-term adjustments or medium-to-long term trend reversals will result in greater losses for the strategy.

-

Frequent signal risk. Compared with default parameters, this strategy uses a more aggressive parameter setting, which may generate more frequent trading signals, bringing higher trading costs and implementation difficulties.

The strategy can be optimized in the following aspects:

-

Further filter signals by combining with moving averages and other indicators to reduce frequent trading.

-

Test the optimal combination of TSI and RSI parameters in different markets and products to find the best parameter settings.

-

Increase stop loss strategies to control the risk of single loss.

-

Optimize position management, increase positions when the trend is stronger, and reduce positions when the trend turns weak.

The TRMMA strategy combines the TSI and RSI indicators to determine entry and exit timing, with strong trend capturing capability. Compared with using TSI or RSI alone, it can effectively filter out false signals. The stability of the strategy can be further enhanced through parameter optimization, stop loss strategies, position management, etc. The strategy is suitable for investors with some quantitative basis who pursue high returns.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | false | TSI standard values are 25, 13, 13, and RSI is 14. Can change the default values to these for 'Slow TRM' |

| v_input_2 | 25 | TSI-Long Length |

| v_input_3 | 5 | TSI-Short Length |

| v_input_4 | 14 | TSI-Signal Length |

| v_input_5 | 5 | RSILength |

| v_input_6 | 50 | RSI cross above Buy Level |

| v_input_7 | 50 | RSI cross below Sell Level |

Source (PineScript)

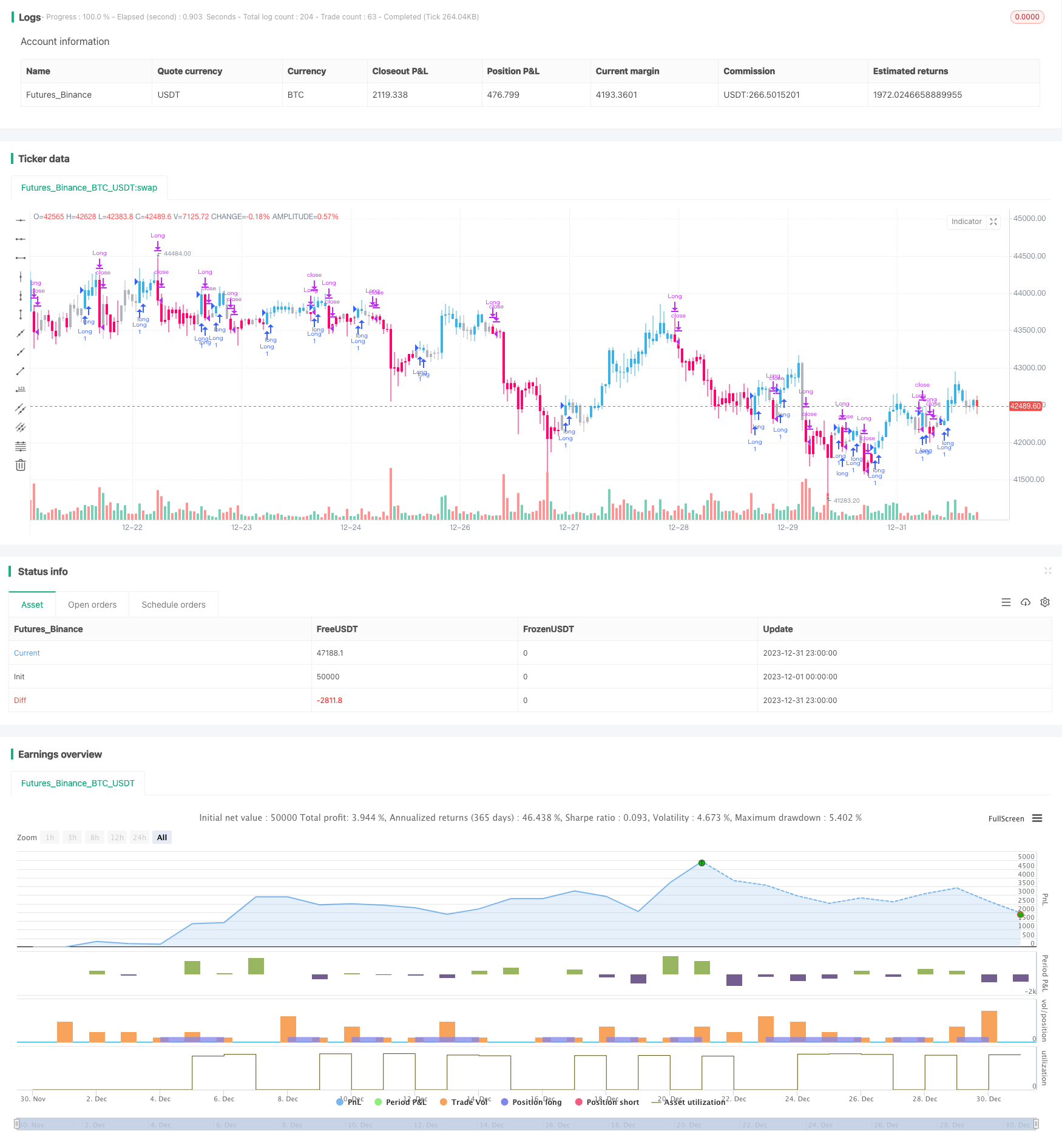

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// "True relative Movement" or "TRM" for short is a system that combines my two favorite indicators: RSI and TSI. I strived to put together an indicator that combined the best of both

// in order to help discretionary traders predict market direction, weakness and strength. As with most technical indicators there are "Buy and sell" signals. Similiar to Elder Impulse system,

///TRM paints bars 3 different colors to display 3 different conditions: Blue for "Buy", Pink for "Sell", and gray for "Take profit/Hold". When the bars turn blue, that means all conditions

/// have been met. When they turn pink, no conditions have been met. When they are gray, only one condition has been met. The system is simple, yet effective. A buy signal is prodcued when

/// TSI is above the signal line, and RSI is above 50, and vice versa for sell signals. I have modified the default parameters for TSI and RSI for more "aggressive" entries and exits. I may later on

/// name this condition "Fast-TRM" and "Slow-TRM" for when default settings for TSI and RSI are applies, as this is a very robust system as well.

///******ES 1HR, 15MIN/5MIN SYSTEM***** Go long, when all time frame on a buy signal and vice versa. Take profit when the 5 min chart flips to buy or sell depending on what side of the trade you are on. Close or flip

//// long/short when time all time frames flip to Buy/Hold if short and Sell/Hold if long. Use 20EMA for additional confirmation.

//@version=4

strategy("TKP-TRM Strategy", overlay=true)

Note = input( 0, title = "TSI standard values are 25, 13, 13, and RSI is 14. Can change the default values to these for 'Slow TRM'")

long = input(title="TSI-Long Length", type=input.integer, defval=25)

short = input(title="TSI-Short Length", type=input.integer, defval=5)

signal = input(title="TSI-Signal Length", type=input.integer, defval=14)

price = close

double_smooth(src, long, short) =>

fist_smooth = ema(src, long)

ema(fist_smooth, short)

pc = change(price)

double_smoothed_pc = double_smooth(pc, long, short)

double_smoothed_abs_pc = double_smooth(abs(pc), long, short)

tsi_value = 100 * (double_smoothed_pc / double_smoothed_abs_pc)

TSI_Signal_Line = (ema(tsi_value, signal))

/////////////////////////////RSI////////////////////////////////////////////////

src = close, len = input(5, minval=1, title="RSILength")

up = rma(max(change(src), 0), len)

down = rma(-min(change(src), 0), len)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

rsiBuyfilterlevel = input(50, minval = 1, title = "RSI cross above Buy Level")

rsiSellfilterlevel = input(50, minval = 1, title = "RSI cross below Sell Level")

////////////////////////////Bar Coloring//////////////////////////////////////////////////////////

TRM_Buy = ((tsi_value > TSI_Signal_Line) and (rsi > rsiBuyfilterlevel))

TRM_Sell = ( (tsi_value < TSI_Signal_Line) and (rsi <rsiSellfilterlevel))

TRM_Color = TRM_Buy? #3BB3E4 : TRM_Sell? #FF006E : #b2b5be

barcolor(TRM_Color)

///////////////////////////Strategy Paramters////////////////////////////////////////

if (TRM_Buy)

strategy.entry("Long", strategy.long, comment="Long")

if (TRM_Sell)

strategy.close("Long", comment="Sell")

Detail

https://www.fmz.com/strategy/440443

Last Modified

2024-01-30 16:04:19