Name

融合多重指标的情绪驱动突破策略Triple-Indicators-Sentiment-Driven-Breakout-Strategy

Author

ChaoZhang

Strategy Description

本策略融合了QQE改进型指标、SSL杂交指标和Waddah Attar爆发指标三个情绪类指标,形成交易信号,属于多重指标驱动的情绪类突破策略。它可以在突破前判断市场情绪面,避免假突破,属于较优质的突破策略。

本策略核心逻辑基于三个指标形成交易决策:

QQE改进型指标:该指标对RSI指标进行改进,使其更敏感,可以判断市场情绪高低。本策略使用该指标判断底部反转和顶部反转信号。

SSL杂交指标:该指标综合考量多条移动均线的突破情况,判断市场迹象。本策略使用该指标判断通道突破形态。

Waddah Attar爆发指标:该指标判断价格在通道内部的爆发力度。本策略使用该指标确定突破时的动量足够。

当QQE指标发出底部反转信号,SSL指标显示通道上沿突破,同时Waddah Attar指标判断动量爆发时,本策略产生买入决策。当三个指标同步发出相反信号时,做出卖出决策。

该策略同时设置止损和止盈精准退出点,最大程度锁住盈利,属于高质量的情绪驱动突破策略。

本策略具有以下优势:

- 融合多重指标判断市场情绪面,避免假突破的风险

- 同时考量反转指标、通道指标和动量指标,保证突破时市场确认度高

- 采用高精度的移动止损限制风险,追踪并锁定盈利

- 参数经过大量优化测试,稳定性好,适合中间至长线持有

- 可配置指标参数自主调整策略风格,适应更广泛市场情况

本策略主要存在以下风险:

- 大盘持续低迷时,容易产生较多小幅度亏损交易

- 需要同时依赖多个指标判断,在某些市场中可能异常失效

- QQE指标等多重指标存在参数优化过度风险,需谨慎设置

- 移动止损在特殊行情中可能较难正常发挥作用

针对以上风险,建议调整指标参数使之更加平稳,适当加大持仓周期获得更高获利率。

本策略可从以下方面进行进一步优化:

- 调整各指标参数,使之更加平稳,或更加灵敏

- 增加基于波动率的持仓规模优化模块

- 增加机器学习风控模块,实时评估市场状况

- 利用深度学习模型预测指标形态,提高决策准确性

- 引入跨时间周期分析,降低假突破概率

本策略综合运用了多重主流情绪指标的优势,构建了一个高效的情绪驱动突破策略。它成功避开了许多低质量突破带来的风险,同时具备高精度的止损理念锁定盈利,是一套成熟可靠的突破策略组合,值得学习和应用。随着参数的持续优化和模型预测的引入,本策略有望产生更加持续稳定的超额收益。

||

This strategy incorporates QQE Mod indicator, SSL Hybrid indicator and Waddah Attar Explosion indicator, forming trading signals and belonging to multiple indicators driven sentiment breakout strategy. It can judge market sentiment before breakout, avoiding false breakout, which is a relatively high-quality breakout strategy.

The core logic of this strategy is based on trading decisions formed by three indicators:

QQE Mod Indicator: This indicator improves RSI indicator to make it more sensitive in judging market sentiment. This strategy uses it to determine bottom reversal and top reversal signals.

SSL Hybrid Indicator: This indicator comprehensively considers the breakthrough situations of multiple moving averages to determine market signs. This strategy uses it to determine channel breakthrough patterns.

Waddah Attar Explosion Indicator: This indicator judges the explosive power of prices within the channel. This strategy uses it to determine if the momentum during breakout is sufficient.

When QQE indicator issues a bottom reversal signal, SSL indicator shows channel top breakout, and Waddah Attar indicator determines explosive momentum, this strategy generates a buy decision. When three indicators issue opposite signals synchronously, it makes sell decisions.

The strategy also sets precise stop loss and take profit to lock in profits to the maximum extent, which is a high-quality sentiment-driven breakout strategy.

This strategy has the following advantages:

- Integrate multiple indicators to determine market sentiment and avoid risks of false breakouts

- Comprehensively consider reversal indicators, channel indicators and momentum indicators to ensure high confirmation degree during breakout

- Adopt high-precision moving stop loss to limit risks and lock profits

- The parameters have gone through lots of optimization tests with good stability, suitable for medium and long-term holding

- Indicator parameters can be configured to adjust the style of strategy to suit more extensive market conditions

The main risks of this strategy include:

- It tends to generate more small losing trades during sustained downtrends

- It relies on multiple concurrent indicators signals, which may fail extraordinarily in some markets

- Risk of over-optimization exists for multiple indicators like QQE, parameters should be set cautiously

- Moving stop loss can hardly play its normal role in some unusual market conditions

To address the above risks, it's suggested to adjust indicator parameters to be more steady, and appropriately increase holding period to obtain higher profit rate.

This strategy can be further optimized in the following aspects:

- Adjust parameters of indicators to make them more steady or sensitive

- Add position sizing optimization module based on volatility

- Add machine learning risk control module to evaluate market conditions dynamically

- Utilize deep learning models to predict indicator patterns and improve decision accuracy

- Introduce cross timeframe analysis to reduce the probability of false breakouts

This strategy integrates the advantages of multiple mainstream sentiment indicators to build an efficient sentiment-driven breakout strategy. It successfully avoids risks brought by many low-quality breakouts, and features high-precision stop loss notions to lock profits. It's a mature and reliable breakout strategy worth learning and leveraging. With continuous parameter optimization and model prediction, it has the potential to generate more consistent excessive returns. [/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_3 | true | Show Baseline |

| v_input_4 | false | Show SSL1 |

| v_input_5 | true | Show ATR bands |

| v_input_6 | 14 | ATR Period |

| v_input_float_4 | true | ATR Multi |

| v_input_string_1 | 0 | ATR Smoothing: WMA |

| v_input_string_2 | 0 | SSL1 / Baseline Type: HMA |

| v_input_7 | 60 | SSL1 / Baseline Length |

| v_input_string_3 | 0 | SSL2 / Continuation Type: JMA |

| v_input_8 | 5 | SSL 2 Length |

| v_input_string_4 | 0 | EXIT Type: HMA |

| v_input_9 | 15 | EXIT Length |

| v_input_10_close | 0 | Source: close |

| v_input_int_16 | true | Kijun MOD Divider |

| v_input_11 | 3 | * Jurik (JMA) Only - Phase |

| v_input_12 | true | * Jurik (JMA) Only - Power |

| v_input_13 | 10 | * Volatility Adjusted (VAMA) Only - Volatility lookback length |

| v_input_float_5 | 0.8 | Modular Filter, General Filter Only - Beta |

| v_input_14 | false | Modular Filter Only - Feedback |

| v_input_float_6 | 0.5 | Modular Filter Only - Feedback Weighting |

| v_input_int_17 | 20 | EDSMA - Super Smoother Filter Length |

| v_input_int_18 | 0 | EDSMA - Super Smoother Filter Poles: 2 |

| v_input_15 | true | useTrueRange |

| v_input_float_7 | 0.2 | Base Channel Multiplier |

| v_input_16 | true | Color Bars |

| v_input_int_1 | 10 | (?Strategy: Risk Management)Swing High/Low Lookback Length |

| v_input_float_1 | 2 | Account percent loss per trade |

| v_input_int_2 | 2022 | (?Strategy: Date Range)Start Date |

| v_input_int_3 | 0 | start_month: 1 |

| v_input_int_4 | 0 | start_date: 1 |

| v_input_int_5 | 2023 | End Date |

| v_input_int_6 | 0 | end_month: 1 |

| v_input_int_7 | 0 | end_date: 1 |

| v_input_int_8 | 6 | (?Indicators: QQE Mod Settings)RSI Length |

| v_input_int_9 | 6 | RSI Smoothing |

| v_input_int_10 | 3 | Fast QQE Factor |

| v_input_int_11 | 3 | Thresh-hold |

| v_input_1_close | 0 | RSI Source: close |

| v_input_int_12 | 50 | Bollinger Length |

| v_input_float_2 | 0.35 | BB Multiplier |

| v_input_int_13 | 6 | RSI Length |

| v_input_int_14 | 5 | RSI Smoothing |

| v_input_float_3 | 1.61 | Fast QQE2 Factor |

| v_input_int_15 | 3 | Thresh-hold |

| v_input_2_close | 0 | RSI Source: close |

| v_input_int_19 | 180 | (?Indicators: Waddah Attar Explosion)Sensitivity |

| v_input_int_20 | 20 | FastEMA Length |

| v_input_int_21 | 40 | SlowEMA Length |

| v_input_int_22 | 20 | BB Channel Length |

| v_input_float_8 | 2 | BB Stdev Multiplier |

Source (PineScript)

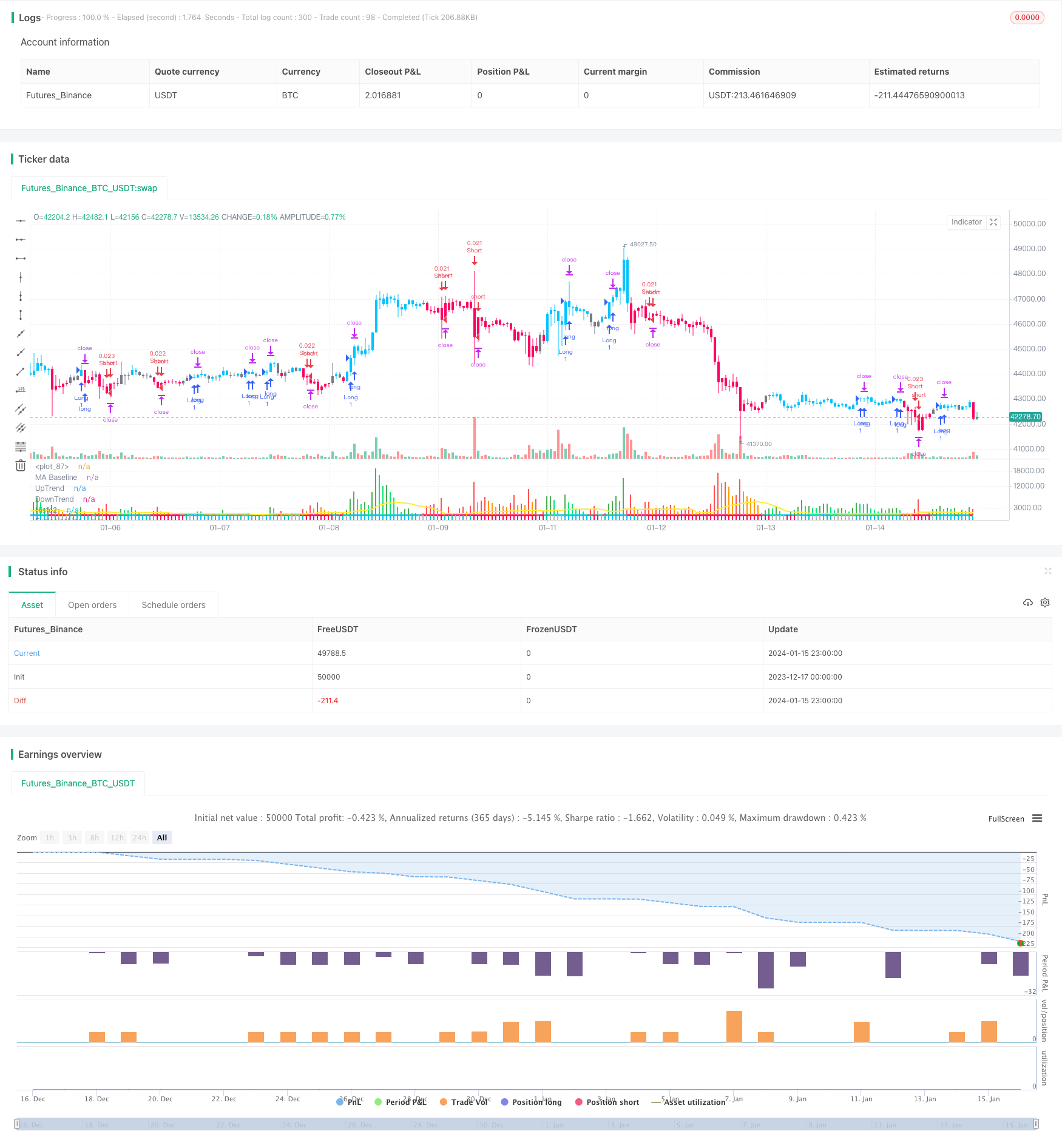

/*backtest

start: 2023-12-17 00:00:00

end: 2024-01-16 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// Strategy based on the 3 indicators:

// - QQE MOD

// - SSL Hybrid

// - Waddah Attar Explosion

//

// Strategy was designed for the purpose of back testing.

// See strategy documentation for info on trade entry logic.

//

// Credits:

// - QQE MOD: Mihkel00 (https://www.tradingview.com/u/Mihkel00/)

// - SSL Hybrid: Mihkel00 (https://www.tradingview.com/u/Mihkel00/)

// - Waddah Attar Explosion: shayankm (https://www.tradingview.com/u/shayankm/)

//@version=5

strategy("QQE MOD + SSL Hybrid + Waddah Attar Explosion", overlay=false)

// =============================================================================

// STRATEGY INPUT SETTINGS

// =============================================================================

// ---------------

// Risk Management

// ---------------

swingLength = input.int(10, "Swing High/Low Lookback Length", group='Strategy: Risk Management', tooltip='Stop Loss is calculated by the swing high or low over the previous X candles')

accountRiskPercent = input.float(2, "Account percent loss per trade", step=0.1, group='Strategy: Risk Management', tooltip='Each trade will risk X% of the account balance')

// ----------

// Date Range

// ----------

start_year = input.int(title='Start Date', defval=2022, minval=2010, maxval=3000, group='Strategy: Date Range', inline='1')

start_month = input.int(title='', defval=1, group='Strategy: Date Range', inline='1', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12])

start_date = input.int(title='', defval=1, group='Strategy: Date Range', inline='1', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31])

end_year = input.int(title='End Date', defval=2023, minval=1800, maxval=3000, group='Strategy: Date Range', inline='2')

end_month = input.int(title='', defval=1, group='Strategy: Date Range', inline='2', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12])

end_date = input.int(title='', defval=1, group='Strategy: Date Range', inline='2', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31])

in_date_range = true

// =============================================================================

// INDICATORS

// =============================================================================

// -------

// QQE MOD

// -------

RSI_Period = input.int(6, title='RSI Length', group='Indicators: QQE Mod Settings')

SF = input.int(6, title='RSI Smoothing', group='Indicators: QQE Mod Settings')

QQE = input.int(3, title='Fast QQE Factor', group='Indicators: QQE Mod Settings')

ThreshHold = input.int(3, title='Thresh-hold', group='Indicators: QQE Mod Settings')

qqeSrc = input(close, title='RSI Source', group='Indicators: QQE Mod Settings')

Wilders_Period = RSI_Period * 2 - 1

Rsi = ta.rsi(qqeSrc, RSI_Period)

RsiMa = ta.ema(Rsi, SF)

AtrRsi = math.abs(RsiMa[1] - RsiMa)

MaAtrRsi = ta.ema(AtrRsi, Wilders_Period)

dar = ta.ema(MaAtrRsi, Wilders_Period) * QQE

longband = 0.0

shortband = 0.0

trend = 0

DeltaFastAtrRsi = dar

RSIndex = RsiMa

newshortband = RSIndex + DeltaFastAtrRsi

newlongband = RSIndex - DeltaFastAtrRsi

longband := RSIndex[1] > longband[1] and RSIndex > longband[1] ? math.max(longband[1], newlongband) : newlongband

shortband := RSIndex[1] < shortband[1] and RSIndex < shortband[1] ? math.min(shortband[1], newshortband) : newshortband

cross_1 = ta.cross(longband[1], RSIndex)

trend := ta.cross(RSIndex, shortband[1]) ? 1 : cross_1 ? -1 : nz(trend[1], 1)

FastAtrRsiTL = trend == 1 ? longband : shortband

length = input.int(50, minval=1, title='Bollinger Length', group='Indicators: QQE Mod Settings')

qqeMult = input.float(0.35, minval=0.001, maxval=5, step=0.1, title='BB Multiplier', group='Indicators: QQE Mod Settings')

basis = ta.sma(FastAtrRsiTL - 50, length)

dev = qqeMult * ta.stdev(FastAtrRsiTL - 50, length)

upper = basis + dev

lower = basis - dev

//qqe_color_bar = RsiMa - 50 > upper ? #00c3ff : RsiMa - 50 < lower ? #ff0062 : color.gray

// Zero cross

QQEzlong = 0

QQEzlong := nz(QQEzlong[1])

QQEzshort = 0

QQEzshort := nz(QQEzshort[1])

QQEzlong := RSIndex >= 50 ? QQEzlong + 1 : 0

QQEzshort := RSIndex < 50 ? QQEzshort + 1 : 0

Zero = hline(0, color=color.white, linestyle=hline.style_dotted, linewidth=1, display=display.none)

RSI_Period2 = input.int(6, title='RSI Length', group='Indicators: QQE Mod Settings')

SF2 = input.int(5, title='RSI Smoothing', group='Indicators: QQE Mod Settings')

QQE2 = input.float(1.61, title='Fast QQE2 Factor', group='Indicators: QQE Mod Settings')

ThreshHold2 = input.int(3, title='Thresh-hold', group='Indicators: QQE Mod Settings')

src2 = input(close, title='RSI Source', group='Indicators: QQE Mod Settings')

Wilders_Period2 = RSI_Period2 * 2 - 1

Rsi2 = ta.rsi(src2, RSI_Period2)

RsiMa2 = ta.ema(Rsi2, SF2)

AtrRsi2 = math.abs(RsiMa2[1] - RsiMa2)

MaAtrRsi2 = ta.ema(AtrRsi2, Wilders_Period2)

dar2 = ta.ema(MaAtrRsi2, Wilders_Period2) * QQE2

longband2 = 0.0

shortband2 = 0.0

trend2 = 0

DeltaFastAtrRsi2 = dar2

RSIndex2 = RsiMa2

newshortband2 = RSIndex2 + DeltaFastAtrRsi2

newlongband2 = RSIndex2 - DeltaFastAtrRsi2

longband2 := RSIndex2[1] > longband2[1] and RSIndex2 > longband2[1] ? math.max(longband2[1], newlongband2) : newlongband2

shortband2 := RSIndex2[1] < shortband2[1] and RSIndex2 < shortband2[1] ? math.min(shortband2[1], newshortband2) : newshortband2

cross_2 = ta.cross(longband2[1], RSIndex2)

trend2 := ta.cross(RSIndex2, shortband2[1]) ? 1 : cross_2 ? -1 : nz(trend2[1], 1)

FastAtrRsi2TL = trend2 == 1 ? longband2 : shortband2

// Zero cross

QQE2zlong = 0

QQE2zlong := nz(QQE2zlong[1])

QQE2zshort = 0

QQE2zshort := nz(QQE2zshort[1])

QQE2zlong := RSIndex2 >= 50 ? QQE2zlong + 1 : 0

QQE2zshort := RSIndex2 < 50 ? QQE2zshort + 1 : 0

hcolor2 = RsiMa2 - 50 > ThreshHold2 ? color.silver : RsiMa2 - 50 < 0 - ThreshHold2 ? color.silver : na

plot(RsiMa2 - 50, color=hcolor2, title='Histo2', style=plot.style_columns, transp=50)

Greenbar1 = RsiMa2 - 50 > ThreshHold2

Greenbar2 = RsiMa - 50 > upper

Redbar1 = RsiMa2 - 50 < 0 - ThreshHold2

Redbar2 = RsiMa - 50 < lower

plot(Greenbar1 and Greenbar2 == 1 ? RsiMa2 - 50 : na, title='QQE Up', style=plot.style_columns, color=color.new(#00c3ff, 0))

plot(Redbar1 and Redbar2 == 1 ? RsiMa2 - 50 : na, title='QQE Down', style=plot.style_columns, color=color.new(#ff0062, 0))

// ----------

// SSL HYBRID

// ----------

show_Baseline = input(title='Show Baseline', defval=true)

show_SSL1 = input(title='Show SSL1', defval=false)

show_atr = input(title='Show ATR bands', defval=true)

//ATR

atrlen = input(14, 'ATR Period')

mult = input.float(1, 'ATR Multi', step=0.1)

smoothing = input.string(title='ATR Smoothing', defval='WMA', options=['RMA', 'SMA', 'EMA', 'WMA'])

ma_function(source, atrlen) =>

if smoothing == 'RMA'

ta.rma(source, atrlen)

else

if smoothing == 'SMA'

ta.sma(source, atrlen)

else

if smoothing == 'EMA'

ta.ema(source, atrlen)

else

ta.wma(source, atrlen)

atr_slen = ma_function(ta.tr(true), atrlen)

////ATR Up/Low Bands

upper_band = atr_slen * mult + close

lower_band = close - atr_slen * mult

////BASELINE / SSL1 / SSL2 / EXIT MOVING AVERAGE VALUES

maType = input.string(title='SSL1 / Baseline Type', defval='HMA', options=['SMA', 'EMA', 'DEMA', 'TEMA', 'LSMA', 'WMA', 'MF', 'VAMA', 'TMA', 'HMA', 'JMA', 'Kijun v2', 'EDSMA', 'McGinley'])

len = input(title='SSL1 / Baseline Length', defval=60)

SSL2Type = input.string(title='SSL2 / Continuation Type', defval='JMA', options=['SMA', 'EMA', 'DEMA', 'TEMA', 'WMA', 'MF', 'VAMA', 'TMA', 'HMA', 'JMA', 'McGinley'])

len2 = input(title='SSL 2 Length', defval=5)

SSL3Type = input.string(title='EXIT Type', defval='HMA', options=['DEMA', 'TEMA', 'LSMA', 'VAMA', 'TMA', 'HMA', 'JMA', 'Kijun v2', 'McGinley', 'MF'])

len3 = input(title='EXIT Length', defval=15)

src = input(title='Source', defval=close)

tema(src, len) =>

ema1 = ta.ema(src, len)

ema2 = ta.ema(ema1, len)

ema3 = ta.ema(ema2, len)

3 * ema1 - 3 * ema2 + ema3

kidiv = input.int(defval=1, maxval=4, title='Kijun MOD Divider')

jurik_phase = input(title='* Jurik (JMA) Only - Phase', defval=3)

jurik_power = input(title='* Jurik (JMA) Only - Power', defval=1)

volatility_lookback = input(10, title='* Volatility Adjusted (VAMA) Only - Volatility lookback length')

//MF

beta = input.float(0.8, minval=0, maxval=1, step=0.1, title='Modular Filter, General Filter Only - Beta')

feedback = input(false, title='Modular Filter Only - Feedback')

z = input.float(0.5, title='Modular Filter Only - Feedback Weighting', step=0.1, minval=0, maxval=1)

//EDSMA

ssfLength = input.int(title='EDSMA - Super Smoother Filter Length', minval=1, defval=20)

ssfPoles = input.int(title='EDSMA - Super Smoother Filter Poles', defval=2, options=[2, 3])

//EDSMA

get2PoleSSF(src, length) =>

PI = 2 * math.asin(1)

arg = math.sqrt(2) * PI / length

a1 = math.exp(-arg)

b1 = 2 * a1 * math.cos(arg)

c2 = b1

c3 = -math.pow(a1, 2)

c1 = 1 - c2 - c3

ssf = 0.0

ssf := c1 * src + c2 * nz(ssf[1]) + c3 * nz(ssf[2])

ssf

get3PoleSSF(src, length) =>

PI = 2 * math.asin(1)

arg = PI / length

a1 = math.exp(-arg)

b1 = 2 * a1 * math.cos(1.738 * arg)

c1 = math.pow(a1, 2)

coef2 = b1 + c1

coef3 = -(c1 + b1 * c1)

coef4 = math.pow(c1, 2)

coef1 = 1 - coef2 - coef3 - coef4

ssf = 0.0

ssf := coef1 * src + coef2 * nz(ssf[1]) + coef3 * nz(ssf[2]) + coef4 * nz(ssf[3])

ssf

ma(type, src, len) =>

float result = 0

if type == 'TMA'

result := ta.sma(ta.sma(src, math.ceil(len / 2)), math.floor(len / 2) + 1)

result

if type == 'MF'

ts = 0.

b = 0.

c = 0.

os = 0.

//----

alpha = 2 / (len + 1)

a = feedback ? z * src + (1 - z) * nz(ts[1], src) : src

//----

b := a > alpha * a + (1 - alpha) * nz(b[1], a) ? a : alpha * a + (1 - alpha) * nz(b[1], a)

c := a < alpha * a + (1 - alpha) * nz(c[1], a) ? a : alpha * a + (1 - alpha) * nz(c[1], a)

os := a == b ? 1 : a == c ? 0 : os[1]

//----

upper = beta * b + (1 - beta) * c

lower = beta * c + (1 - beta) * b

ts := os * upper + (1 - os) * lower

result := ts

result

if type == 'LSMA'

result := ta.linreg(src, len, 0)

result

if type == 'SMA' // Simple

result := ta.sma(src, len)

result

if type == 'EMA' // Exponential

result := ta.ema(src, len)

result

if type == 'DEMA' // Double Exponential

e = ta.ema(src, len)

result := 2 * e - ta.ema(e, len)

result

if type == 'TEMA' // Triple Exponential

e = ta.ema(src, len)

result := 3 * (e - ta.ema(e, len)) + ta.ema(ta.ema(e, len), len)

result

if type == 'WMA' // Weighted

result := ta.wma(src, len)

result

if type == 'VAMA' // Volatility Adjusted

/// Copyright © 2019 to present, Joris Duyck (JD)

mid = ta.ema(src, len)

dev = src - mid

vol_up = ta.highest(dev, volatility_lookback)

vol_down = ta.lowest(dev, volatility_lookback)

result := mid + math.avg(vol_up, vol_down)

result

if type == 'HMA' // Hull

result := ta.wma(2 * ta.wma(src, len / 2) - ta.wma(src, len), math.round(math.sqrt(len)))

result

if type == 'JMA' // Jurik

/// Copyright © 2018 Alex Orekhov (everget)

/// Copyright © 2017 Jurik Research and Consulting.

phaseRatio = jurik_phase < -100 ? 0.5 : jurik_phase > 100 ? 2.5 : jurik_phase / 100 + 1.5

beta = 0.45 * (len - 1) / (0.45 * (len - 1) + 2)

alpha = math.pow(beta, jurik_power)

jma = 0.0

e0 = 0.0

e0 := (1 - alpha) * src + alpha * nz(e0[1])

e1 = 0.0

e1 := (src - e0) * (1 - beta) + beta * nz(e1[1])

e2 = 0.0

e2 := (e0 + phaseRatio * e1 - nz(jma[1])) * math.pow(1 - alpha, 2) + math.pow(alpha, 2) * nz(e2[1])

jma := e2 + nz(jma[1])

result := jma

result

if type == 'Kijun v2'

kijun = math.avg(ta.lowest(len), ta.highest(len)) //, (open + close)/2)

conversionLine = math.avg(ta.lowest(len / kidiv), ta.highest(len / kidiv))

delta = (kijun + conversionLine) / 2

result := delta

result

if type == 'McGinley'

mg = 0.0

mg := na(mg[1]) ? ta.ema(src, len) : mg[1] + (src - mg[1]) / (len * math.pow(src / mg[1], 4))

result := mg

result

if type == 'EDSMA'

zeros = src - nz(src[2])

avgZeros = (zeros + zeros[1]) / 2

// Ehlers Super Smoother Filter

ssf = ssfPoles == 2 ? get2PoleSSF(avgZeros, ssfLength) : get3PoleSSF(avgZeros, ssfLength)

// Rescale filter in terms of Standard Deviations

stdev = ta.stdev(ssf, len)

scaledFilter = stdev != 0 ? ssf / stdev : 0

alpha = 5 * math.abs(scaledFilter) / len

edsma = 0.0

edsma := alpha * src + (1 - alpha) * nz(edsma[1])

result := edsma

result

result

///SSL 1 and SSL2

emaHigh = ma(maType, high, len)

emaLow = ma(maType, low, len)

maHigh = ma(SSL2Type, high, len2)

maLow = ma(SSL2Type, low, len2)

///EXIT

ExitHigh = ma(SSL3Type, high, len3)

ExitLow = ma(SSL3Type, low, len3)

///Keltner Baseline Channel

BBMC = ma(maType, close, len)

useTrueRange = input(true)

multy = input.float(0.2, step=0.05, title='Base Channel Multiplier')

Keltma = ma(maType, src, len)

range_1 = useTrueRange ? ta.tr : high - low

rangema = ta.ema(range_1, len)

upperk = Keltma + rangema * multy

lowerk = Keltma - rangema * multy

//Baseline Violation Candle

open_pos = open * 1

close_pos = close * 1

difference = math.abs(close_pos - open_pos)

atr_violation = difference > atr_slen

InRange = upper_band > BBMC and lower_band < BBMC

//SSL1 VALUES

Hlv = int(na)

Hlv := close > emaHigh ? 1 : close < emaLow ? -1 : Hlv[1]

sslDown = Hlv < 0 ? emaHigh : emaLow

//EXIT VALUES

Hlv3 = int(na)

Hlv3 := close > ExitHigh ? 1 : close < ExitLow ? -1 : Hlv3[1]

sslExit = Hlv3 < 0 ? ExitHigh : ExitLow

base_cross_Long = ta.crossover(close, sslExit)

base_cross_Short = ta.crossover(sslExit, close)

codiff = base_cross_Long ? 1 : base_cross_Short ? -1 : na

//COLORS

show_color_bar = input(title='Color Bars', defval=true)

color_bar = close > upperk ? #00c3ff : close < lowerk ? #ff0062 : color.gray

color_ssl1 = close > sslDown ? #00c3ff : close < sslDown ? #ff0062 : na

//PLOTS

plotarrow(codiff, colorup=color.new(#00c3ff, 20), colordown=color.new(#ff0062, 20), title='Exit Arrows', maxheight=20, offset=0, display=display.none)

p1 = plot(0, color=color_bar, linewidth=3, title='MA Baseline', transp=0)

barcolor(show_color_bar ? color_bar : na)

// ---------------------

// WADDAH ATTAR EXPLOSION

// ---------------------

sensitivity = input.int(180, title="Sensitivity", group='Indicators: Waddah Attar Explosion')

fastLength=input.int(20, title="FastEMA Length", group='Indicators: Waddah Attar Explosion')

slowLength=input.int(40, title="SlowEMA Length", group='Indicators: Waddah Attar Explosion')

channelLength=input.int(20, title="BB Channel Length", group='Indicators: Waddah Attar Explosion')

waeMult=input.float(2.0, title="BB Stdev Multiplier", group='Indicators: Waddah Attar Explosion')

calc_macd(source, fastLength, slowLength) =>

fastMA = ta.ema(source, fastLength)

slowMA = ta.ema(source, slowLength)

fastMA - slowMA

calc_BBUpper(source, length, mult) =>

basis = ta.sma(source, length)

dev = mult * ta.stdev(source, length)

basis + dev

calc_BBLower(source, length, mult) =>

basis = ta.sma(source, length)

dev = mult * ta.stdev(source, length)

basis - dev

t1 = (calc_macd(close, fastLength, slowLength) - calc_macd(close[1], fastLength, slowLength))*sensitivity

e1 = (calc_BBUpper(close, channelLength, waeMult) - calc_BBLower(close, channelLength, waeMult))

trendUp = (t1 >= 0) ? t1 : 0

trendDown = (t1 < 0) ? (-1*t1) : 0

plot(trendUp, style=plot.style_columns, linewidth=1, color=(trendUp<trendUp[1]) ? color.lime : color.green, transp=45, title="UpTrend", display=display.none)

plot(trendDown, style=plot.style_columns, linewidth=1, color=(trendDown<trendDown[1]) ? color.orange : color.red, transp=45, title="DownTrend", display=display.none)

plot(e1, style=plot.style_line, linewidth=2, color=color.yellow, title="ExplosionLine", display=display.none)

// =============================================================================

// STRATEGY LOGIC

// =============================================================================

// QQE Mod

qqeGreenBar = Greenbar1 and Greenbar2

qqeRedBar = Redbar1 and Redbar2

qqeBuy = qqeGreenBar and not qqeGreenBar[1]

qqeSell = qqeRedBar and not qqeRedBar[1]

// SSL Hybrid

sslBuy = close > upperk and close > BBMC

sslSell = close < lowerk and close < BBMC

// Waddah Attar Explosion

waeBuy = trendUp > 0 and trendUp > e1

waeSell = trendDown > 0 and trendDown > e1

inLong = strategy.position_size > 0

inShort = strategy.position_size < 0

longCondition = qqeBuy and sslBuy and waeBuy and in_date_range

shortCondition = qqeSell and sslSell and waeSell and in_date_range

swingLow = ta.lowest(source=low, length=swingLength)

swingHigh = ta.highest(source=high, length=swingLength)

longStopPercent = math.abs((1 - (swingLow / close)) * 100)

shortStopPercent = math.abs((1 - (swingHigh / close)) * 100)

// Position sizing (default risk 2% per trade)

riskAmt = strategy.equity * accountRiskPercent / 100

longQty = math.abs(riskAmt / longStopPercent * 100) / close

shortQty = math.abs(riskAmt / shortStopPercent * 100) / close

if (longCondition and not inShort and not inLong)

strategy.entry("Long", strategy.long, qty=longQty)

strategy.exit("Long SL/TP", from_entry="Long", stop=swingLow, alert_message='Long SL Hit')

buyLabel = label.new(x=bar_index, y=high[1], color=color.green, style=label.style_label_up)

label.set_y(id=buyLabel, y=0)

label.set_tooltip(id=buyLabel, tooltip="Risk Amt: " + str.tostring(riskAmt) + " Qty: " + str.tostring(longQty) + " Swing low: " + str.tostring(swingLow) + " Stop Percent: " + str.tostring(longStopPercent))

if (shortCondition and not inLong and not inShort)

strategy.entry("Short", strategy.short, qty=shortQty)

strategy.exit("Short SL/TP", from_entry="Short", stop=swingHigh, alert_message='Short SL Hit')

sellLabel = label.new(x=bar_index, y=high[1], color=color.red, style=label.style_label_up)

label.set_y(id=sellLabel, y=0)

label.set_tooltip(id=sellLabel, tooltip="Risk Amt: " + str.tostring(riskAmt) + " Qty: " + str.tostring(shortQty) + " Swing high: " + str.tostring(swingHigh) + " Stop Percent: " + str.tostring(shortStopPercent))

openTradesInProfit() =>

result = 0.

for i = 0 to strategy.opentrades-1

result += strategy.opentrades.profit(i)

result > 0

exitLong = inLong and base_cross_Short and openTradesInProfit()

strategy.close(id = "Long", when = exitLong, comment = "Closing Long", alert_message="Long TP Hit")

exitShort = inShort and base_cross_Long and openTradesInProfit()

strategy.close(id = "Short", when = exitShort, comment = "Closing Short", alert_message="Short TP Hit")

// =============================================================================

// DATA WINDOW PLOTTING

// =============================================================================

plotchar(0, "===========", "", location = location.top, color=#141823)

plotchar(0, "BUY SIGNALS:", "", location = location.top, color=#141823)

plotchar(0, "===========", "", location = location.top, color=#141823)

plotchar(qqeBuy, "QQE Mod: Buy Signal", "", location = location.top, color=qqeBuy ? color.green : color.orange)

plotchar(sslBuy, "SSL Hybrid: Buy Signal", "", location = location.top, color=sslBuy ? color.green : color.orange)

plotchar(waeBuy, "Waddah Attar Explosion: Buy Signal", "", location = location.top, color=waeBuy ? color.green : color.orange)

plotchar(inLong, "inLong", "", location = location.top, color=inLong ? color.green : color.orange)

plotchar(exitLong, "Exit Long", "", location = location.top, color=exitLong ? color.green : color.orange)

plotchar(0, "============", "", location = location.top, color=#141823)

plotchar(0, "SELL SIGNALS:", "", location = location.top, color=#141823)

plotchar(0, "============", "", location = location.top, color=#141823)

plotchar(qqeSell, "QQE Mod: Sell Signal", "", location = location.top, color=qqeSell ? color.red : color.orange)

plotchar(sslSell, "SSL Hybrid: Sell Signal", "", location = location.top, color=sslSell ? color.red : color.orange)

plotchar(waeSell, "Waddah Attar Explosion: Sell Signal", "", location = location.top, color=waeSell ? color.red : color.orange)

plotchar(inShort, "inShort", "", location = location.top, color=inShort ? color.red : color.orange)

plotchar(exitShort, "Exit Short", "", location = location.top, color=exitShort ? color.red : color.orange)

Detail

https://www.fmz.com/strategy/439109

Last Modified

2024-01-17 17:53:55