Name

趋势反转动量复合策略Reversal-Momentum-Compound-Strategy

Author

ChaoZhang

Strategy Description

趋势反转动量复合策略是一种结合趋势反转策略和动量突破策略的复合交易策略。该策略通过同时利用价格反转信号和动量指标信号,实现更准确地捕捉市场转折点,从而在价格开始反转的时候及时入场。

该策略由两部分组成:

-

123反转策略:当收盘价连续2天低于前一日收盘价后转抬,且9日慢速K线低于50时做多;当收盘价连续2天高于前一日收盘价后转跌,且9日快速K线高于50时做空。

-

DAPD动量突破策略:DAPD为近21日高点与近21日低点的平均差价,根据DAPD上下突破判断 entry 和 exit 点。

当两种策略信号同向时,发出入场信号;当信号方向相反时,则暂时待命。

该策略结合了反转策略和动量策略的优点,可以更加准确地捕捉价格转折点。主要优势有:

-

双重过滤增加信号可靠性。同向信号时,成功率较高。

-

123形态判断能减少头寸反转的风险。

-

DAPD动量指标判断,适合趋势型品种。

-

信号时间点匹配风险。两种策略信号产生时间可能存在偏差。

-

调参困难风险。两种策略参数不易同时优化。

-

双重交易成本风险。每次开仓需同时支付两种策略的手续费。

-

优化两种策略的参数匹配程度,使信号尽量同步。

-

研究不同品种使用不同参数组合的效果。

-

尝试只在策略信号强势时开仓,过滤弱信号。

趋势反转动量复合策略,利用反转策略和动量策略的优势,在价格开始反转时能准确及时入场。双重过滤机制提高信号的成功率。通过优化参数匹配度,可进一步提高绩效表现。该策略适合具有一定资金实力和交易经验的投资者使用。

||

The Reversal Momentum Compound strategy combines a reversal strategy and a momentum strategy. By utilizing both price reversal signals and momentum indicator signals, it captures market turning points more precisely and gets in the market in a timely manner as price starts to reverse.

The strategy consists of two parts:

-

123 Reversal Strategy: Go long when close is higher than previous close for 2 consecutive days after 2 days of lower close, and 9-day slow K line is below 50; Go short when close is lower than previous close for 2 consecutive days after 2 days of higher close, and 9-day fast K line is above 50.

-

DAPD Momentum Breakout Strategy: DAPD is the average difference between 21-day high and 21-day low. Determine entry and exit points based on DAPD breakout.

A entry signal is generated when two strategies give aligned signals. Stay sideline when signals are conflicting.

The strategy combines the merits of reversal and momentum strategies, capturing turning points more precisely. Main advantages:

-

Dual filter increases signal reliability. Higher success rate when signals align.

-

123 pattern reduces risk of whipsaws.

-

DAPD momentum suitable for trending products.

-

Signal timing mismatch risk. Signals from two strategies may not align perfectly.

-

Parameter tuning difficulty. Hard to optimize two sets of parameters together.

-

Doubled transaction cost risk. Commission fees apply to both strategies.

-

Optimize signal alignment of two strategies.

-

Test effectiveness of different parameter sets on different products.

-

Only take high-conviction signals to filter out weak ones.

The Reversal Momentum Compound strategy captures reversing price timely by combining merits of reversal and momentum strategies. Dual filters increase success rate. Further performance improvement can be achieved by optimizing signal alignment. The strategy suits investors with sufficient capital and trading expertise.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 14 | Length |

| v_input_2 | true | KSmoothing |

| v_input_3 | 3 | DLength |

| v_input_4 | 50 | Level |

| v_input_5 | 21 | LengthDAPD |

| v_input_6 | false | Trade reverse |

Source (PineScript)

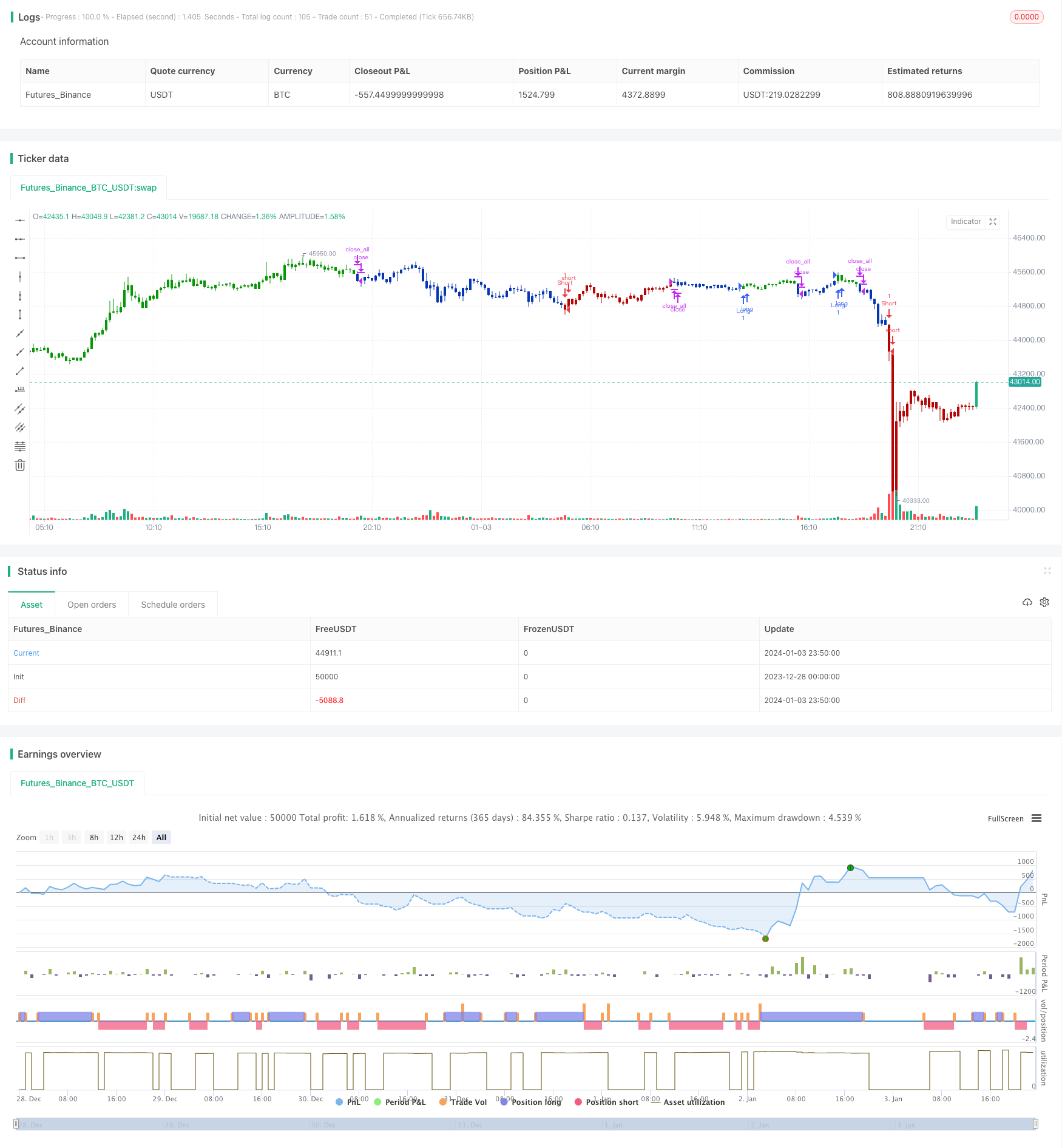

/*backtest

start: 2023-12-28 00:00:00

end: 2024-01-04 00:00:00

period: 10m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 10/12/2019

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// This indicator is similar to Bollinger Bands. It based on DAPD - Daily

// Average Price Delta. DAPD is based upon a summation for each of the

// highs (hod) for the 21 days prior to today minus the summation for

// each of the lows (lod) for the last 21 days prior to today. The result

// of this calculation would then be divided by 21.

// It will be buy when high above previos DAPD high and sell if low below previos DAPD low

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

DAPD(Length) =>

pos = 0.0

xHighSMA = sma(high, Length)

xLowSMA = sma(low, Length)

nDAPD = xHighSMA - xLowSMA

nTop = high + nDAPD

nBottom = low - nDAPD

pos := iff(high > nTop[1], 1,

iff(low < nBottom[1], -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & DAPD", shorttitle="Combo", overlay = true)

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

LengthDAPD = input(21, minval=1)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posDAPD = DAPD(LengthDAPD)

pos = iff(posReversal123 == 1 and posDAPD == 1 , 1,

iff(posReversal123 == -1 and posDAPD == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )

Detail

https://www.fmz.com/strategy/437769

Last Modified

2024-01-05 14:06:21