Name

趋势追踪-turtle系统Turtle-Trend-Trading-System

Author

ChaoZhang

Strategy Description

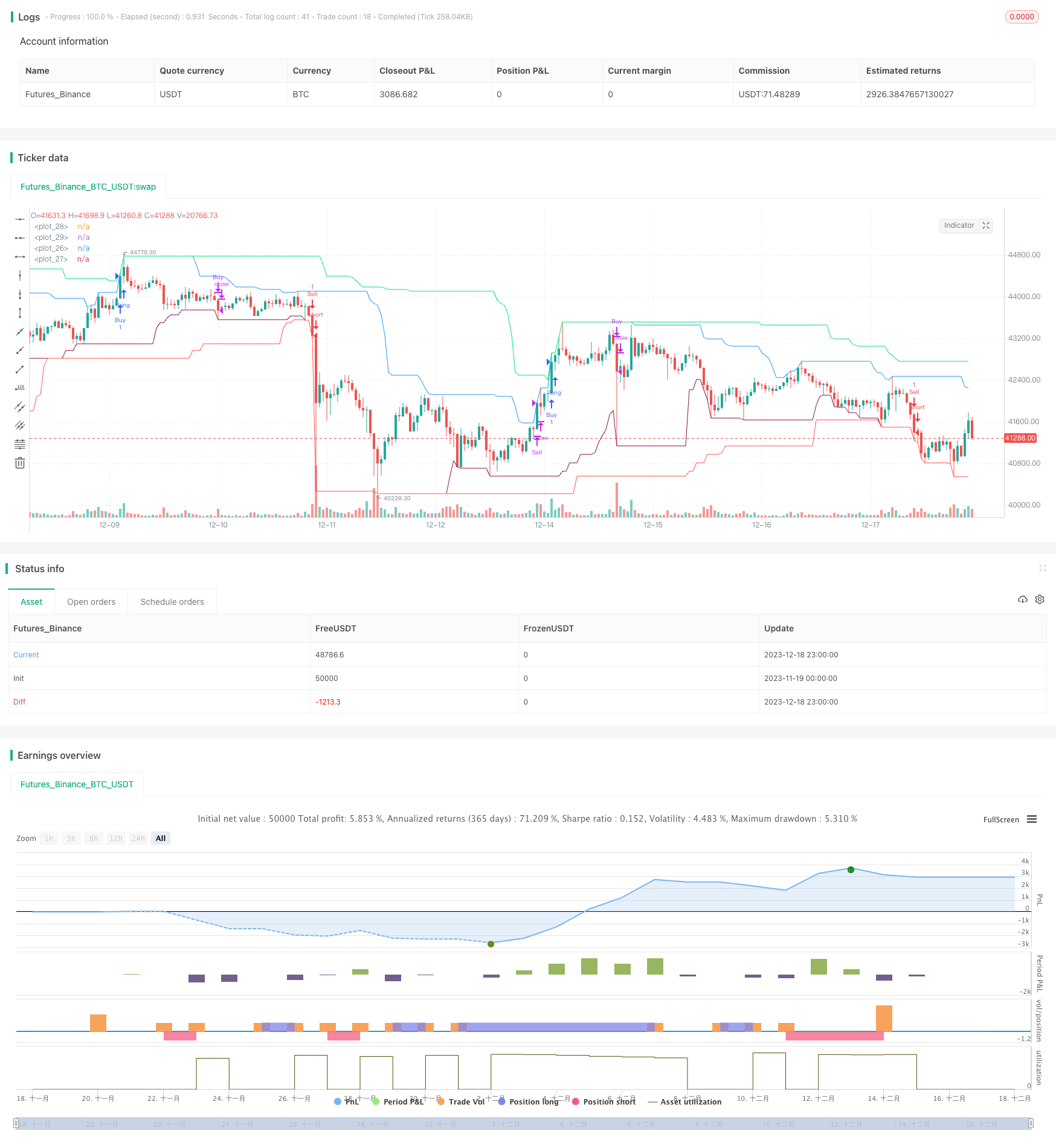

该策略是著名的Turtle交易系统的实际代码实现,使用55周期通道作为入场信号,20周期通道作为退出信号,追踪较长周期的趋势,属于趋势跟踪类型策略。

该策略主要基于两个指标:55周期最高价(HI)和最低价(LO)构建入场通道,以及20周期最高价(hi)和最低价(lo)构建退出通道。

当价格上穿55周期通道时生成买入信号;当价格下穿55周期通道时生成卖出信号。这是典型的趋势追踪策略入场逻辑。

当价格下穿20周期通道时平掉多单;当价格上穿20周期通道时平掉空单。这是策略的退出逻辑。

该策略同时绘图显示55周期通道和20周期通道,可以直观看到策略的入场和退出点。

该策略主要具有以下几点优势:

- 追踪中长线趋势,回撤相对较小

- 入场信号明确,运用通道原理,回撤控制效果好

- 退出机制较为严格,避免反转带来的损失

- 参数设置简单,容易实施

该策略也存在一些风险:

- 无法捕获短线机会,盈利能力相对较弱

- 无法应对突发事件,容易止损

- 无法有效控制单边行情的超额亏损

- parametric,对参数非常敏感

可以通过以下方法降低风险:

- 优化参数,找到最佳参数组合

- 增加止损策略,控制单边行情下的损失

- 结合其他指标,识别潜在的反转机会

该策略可以从以下几个方向进行优化:

- 优化入场通道和出场通道的参数,找到最优参数组合

- 增加波动率指标,避免陷入震荡行情

- 结合交易量指标,确保入场时交易量放大

- 增加移动止损策略,实时跟踪止损线

- 结合多个时间周期,实现多周期综合交易

该策略整体是一个非常典型的趋势跟踪策略,通过通道来捕获中长线趋势,回撤控制效果较好。同时也存在一些典型的趋势跟踪策略的问题,如捕获趋势的不足,难以应对反转等。通过多方面优化,可以将该策略的优势发挥到极致,成为一个可靠的量化策略。

||

This strategy is the actual code implementation of the famous Turtle trading system, using a 55-period channel for entry signals and a 20-period channel for exit signals to track longer-term trends, belonging to the trend-following strategy type.

The strategy is mainly based on two indicators: the 55-period highest price (HI) and lowest price (LO) to construct the entry channel, and the 20-period highest price (hi) and lowest price (lo) to construct the exit channel.

When the price breaks above the 55-period channel, a buy signal is generated; when the price breaks below the 55-period channel, a sell signal is generated. This is the typical trend-following entry logic.

When the price breaks below the 20-period channel, long positions are closed; when the price breaks above the 20-period channel, short positions are closed. This is the exit logic of the strategy.

The strategy also plots the 55-period channel and 20-period channel, which can visually see the entry and exit points of the strategy.

The main advantages of this strategy are:

- Tracking mid-to-long-term trends with relatively small drawdowns

- Clear entry signals using channel principle and good drawdown control

- Strict exit mechanism to avoid losses from reversals

- Simple parameter settings, easy to implement

There are also some risks with this strategy:

- Unable to capture short-term opportunities, relatively weak profitability

- Unable to cope with sudden events, prone to stop loss

- Cannot effectively control excessive losses in one-way markets

- Very sensitive to parameters

The risks can be reduced through:

- Parameter optimization to find optimal combinations

- Adding stop loss strategies to control one-way market losses

- Combining other indicators to identify potential reversal opportunities

The strategy can be optimized in several aspects:

- Optimize parameters of entry and exit channels to find optimal combination

- Add volatility indicators to avoid choppy markets

- Combine trading volume indicators to ensure amplified volumes on entry signals

- Add moving stop loss strategies to follow dynamic stop loss lines

- Combine multiple timeframes for comprehensive multi-timeframe trading

In summary, this is a very typical trend-following strategy, using channels to capture mid-to-long term trends with good drawdown control. It also has some typical issues of trend-following strategies, like insufficient trend capturing ability and difficulty dealing with reversals. With comprehensive optimizations, the advantages can be fully realized to become a reliable quantitative strategy.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 55 | Entry Length |

| v_input_2 | 20 | Exit Length |

Source (PineScript)

/*backtest

start: 2023-11-19 00:00:00

end: 2023-12-19 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © racer8

//@version=4

strategy("Turtle System", overlay=true)

n = input(55,"Entry Length")

e = input(20,"Exit Length")

HI = highest(n)

LO = lowest(n)

hi = highest(e)

lo = lowest(e)

if close>HI[1]

strategy.entry("Buy", strategy.long)

if close<LO[1]

strategy.entry("Sell", strategy.short)

if low<lo[1]

strategy.close("Buy")

if high>hi[1]

strategy.close("Sell")

plot(HI,color=color.lime)

plot(LO,color=color.red)

plot(hi,color=color.blue)

plot(lo,color=color.maroon)

Detail

https://www.fmz.com/strategy/435960

Last Modified

2023-12-20 14:16:48