Name

SMART专业量化交易策略SMART-Professional-Quantitative-Trading-Strategy

Author

ChaoZhang

Strategy Description

该策略基于智能资金概念,使用日线均量指标识别机构资金的累积与分配,以捕捉市场趋势。当机构资金累积时,策略做多;当机构资金分配时,策略做空。

-

均量指标(OBV)

OBV是一种动量指标,它将成交量与价格变化相关联。OBV在价格上涨日累加成交量,在价格下跌日减去成交量。

该策略使用日线OBV。

-

智能资金条件

策略基于OBV的斜率识别两种主要条件:

-

智能资金买入条件:当OBV斜率为正,表示可能出现机构资金累积。

-

智能资金卖出条件:当OBV斜率为负,表示可能出现机构资金分配。

-

-

信号绘图

使用绿色上箭头和红色下箭头代表买入和卖出信号。

-

策略逻辑

当识别到智能资金买入条件时,做多;当识别到智能资金卖出条件时,做空。

-

出场逻辑

当做多时,如果出现智能资金卖出信号,平仓做多单;当做空时,如果出现智能资金买入信号,平仓做空单。

-

使用均量指标识别市场趋势,有效滤除市场噪音。

-

基于机构资金行为判断市场结构,精准捕捉趋势转折。

-

策略信号明确,规则简单,容易实施。

-

可在任何品种和任何时间框架使用。

-

OBV指标可能产生错误信号,导致错过买入/卖出时机。可适当结合其他指标进行验证。

-

无法预测极端行情的突发事件。可设置止损来控制风险。

-

机构资金行为难以准确判断,可能导致信号偏差。可适当放宽买入/卖出条件。

-

结合其他指标验证信号可靠性,如K线形态、stoch指标等。

-

设置动态止损或跟踪止损来控制单笔损失。

-

测试不同时间框架的参数设置,寻找最优参数组合。

-

添加机构资金力度指标,判断资金流入/流出的力度,提高信号质量。

SMART专业量化交易策略利用均量指标识别机构资金行为,判断市场结构,精确捕捉趋势转折点。策略信号简单明确,容易实施,可广泛应用于任何品种和时间周期,是一种非常实用的趋势跟踪策略。结合其他指标信号验证和适当风险控制,可提高策略稳定性和profit因子。

||

This strategy is based on the Smart Money concept using the On-Balance Volume (OBV) indicator to identify institutional fund accumulation and distribution to capture market trends. It goes long when smart money is accumulating and goes short when smart money is distributing.

-

On-Balance Volume (OBV)

OBV is a momentum indicator that relates volume to price change. It accumulates volume on up days and subtracts volume on down days.

The strategy uses daily OBV.

-

Smart Money Conditions

The strategy identifies two main conditions based on OBV slope:

-

Smart Money Buy Condition: OBV slope > 0, indicating potential smart money accumulation.

-

Smart Money Sell Condition: OBV slope < 0, indicating potential smart money distribution.

-

-

Plotting Signals

Green up arrows and red down arrows represent buy and sell signals.

-

Entry Logic

Go long when smart money buy condition is met. Go short when smart money sell condition is met.

-

Exit Logic

When long, if smart money sell signal occurs, close long position. When short, if smart money buy signal occurs, close short position.

-

Identify market trends using OBV, filtering out market noise.

-

Precisely capture trend reversals based on institutional fund behavior .

-

Clear signal rules, easy to implement.

-

Applicable for any symbol and timeframe.

-

OBV may generate false signals, missing entry/exit timing. Verify signals using other indicators.

-

Cannot predict extreme events. Use stop loss to control risk.

-

Difficult to accurately determine institutional behavior, leading to signal deviation. Relax buy/sell conditions.

-

Add other indicators to verify signal reliability e.g. candlestick patterns, Stochastics etc.

-

Use dynamic or trailing stop loss to control loss per trade.

-

Test different timeframes and parameter settings to find optimal combination.

-

Incorporate volume pressure indicator to judge strength of funds inflow/outflow.

The SMART professional quantitative trading strategy identifies institutional fund behavior using OBV to determine market structure and accurately capture trend reversals. Simple and clear signal rules make it easy to implement across any symbol and timeframe. Combining signal verification and appropriate risk control improves strategy robustness and profit factor.

[/trans]

Source (PineScript)

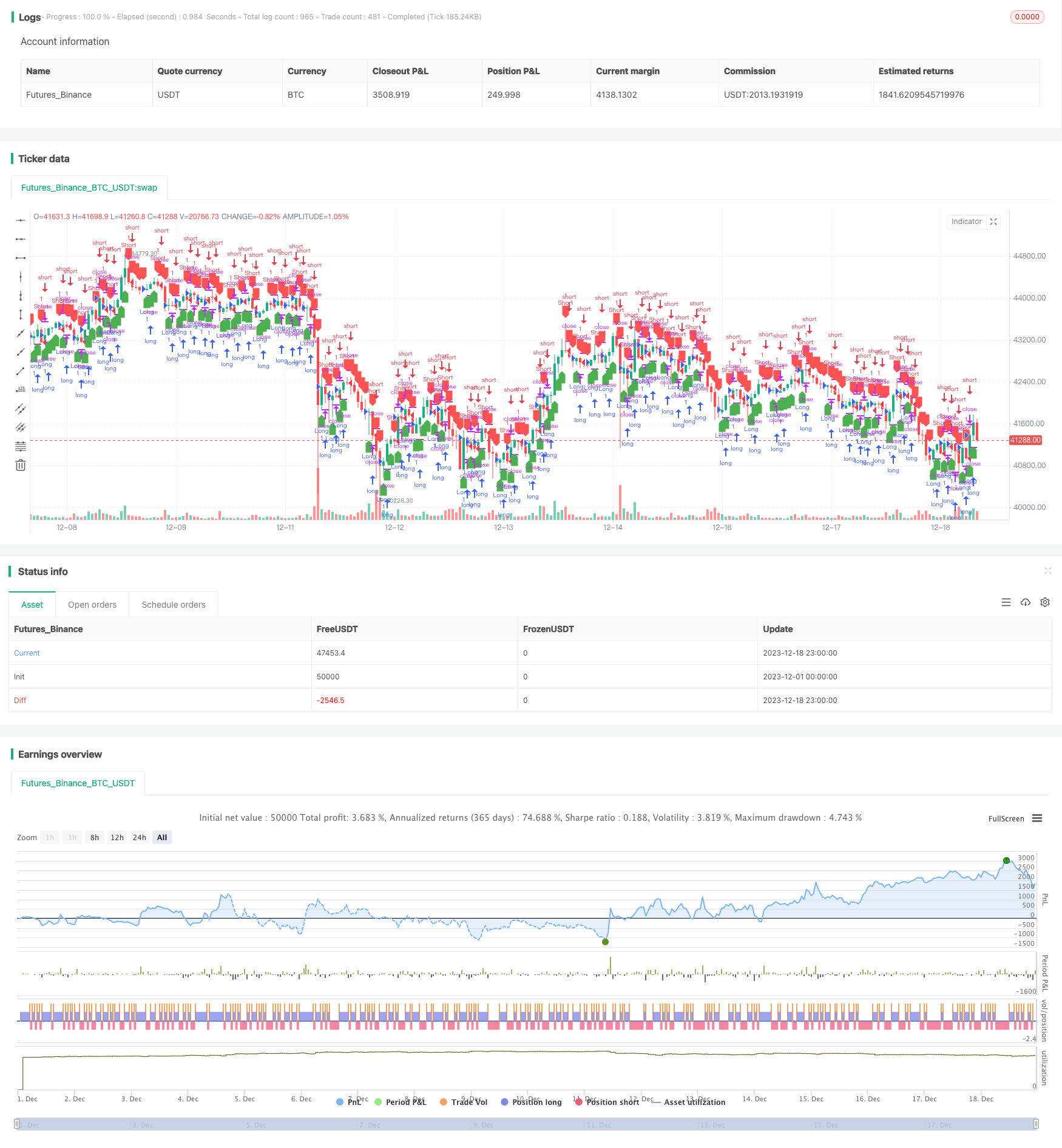

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-18 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Smart Money Concept Strategy", overlay=true)

// Smart Money Concept: On-Balance Volume (OBV)

obv_value = request.security(syminfo.tickerid, "D", close)

obv_slope = obv_value - obv_value[1]

// Define conditions for smart money accumulation/distribution

smart_money_buy_condition = obv_slope > 0

smart_money_sell_condition = obv_slope < 0

// Plot signals

plotshape(series=smart_money_buy_condition, title="Buy Signal", color=color.green, style=shape.labelup, location=location.belowbar)

plotshape(series=smart_money_sell_condition, title="Sell Signal", color=color.red, style=shape.labeldown, location=location.abovebar)

// Strategy Logic

if (smart_money_buy_condition)

strategy.entry("Long", strategy.long)

if (smart_money_sell_condition)

strategy.entry("Short", strategy.short)

// Strategy Exit Logic

strategy.close("ExitLong")

strategy.close("ExitShort")

Detail

https://www.fmz.com/strategy/440503

Last Modified

2024-01-31 10:28:34