Name

rest-版OKEX跨期对冲策略教学

Author

小小梦

Strategy Description

-

只做正套,反套可以修改下,合约调换一下,即是反套。

-

添加两个 交易所对象,第一个季度,第二个当周。

-

精简了所有能简化的代码,优化空间还很大,教学策略谨慎实盘,跨期有一定风险。

-

欢迎反馈BUG。

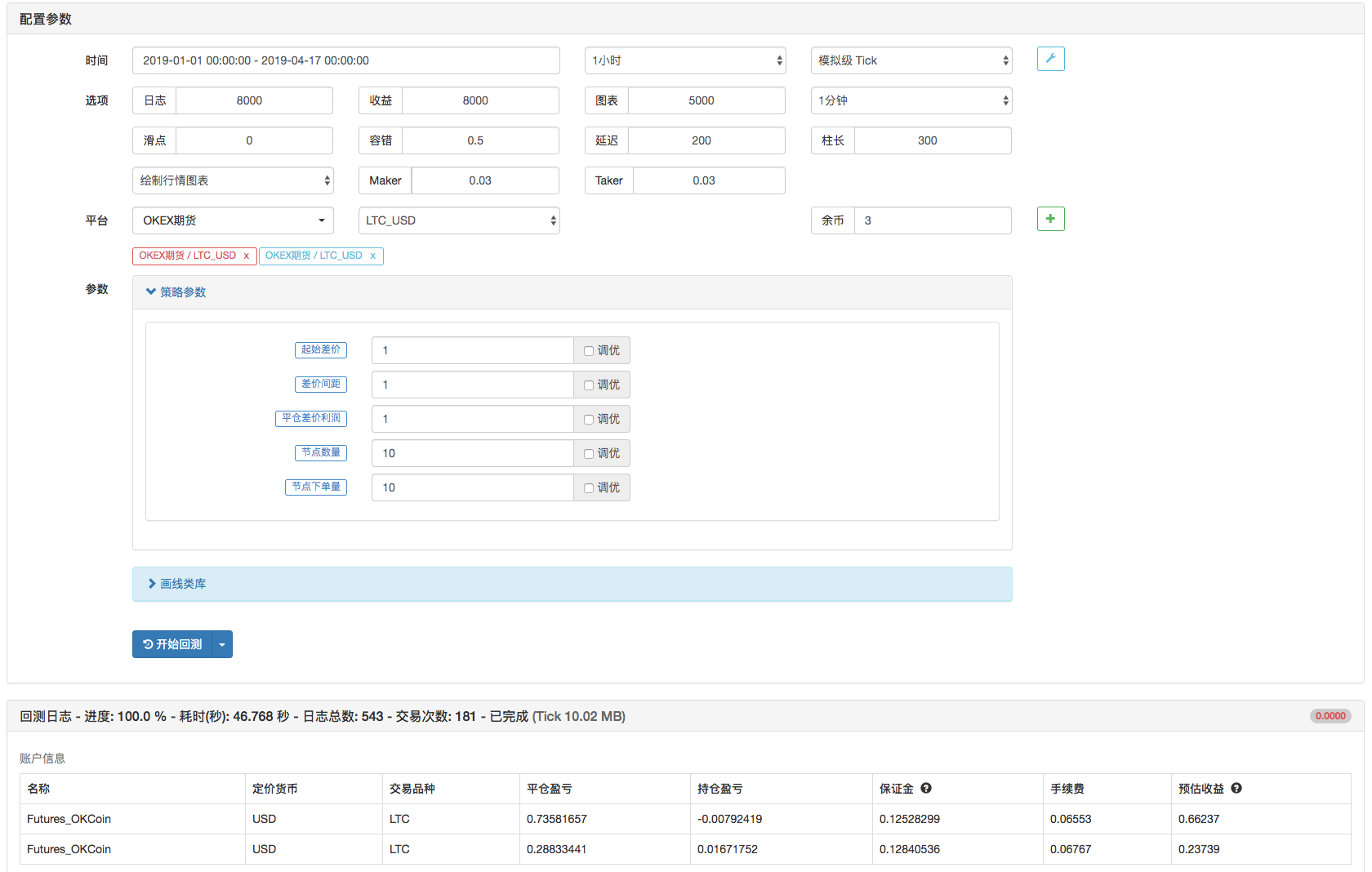

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| _Begin | true | 起始差价 |

| _Add | true | 差价间距 |

| _Profit | true | 平仓差价利润 |

| _Count | 10 | 节点数量 |

| _ContractNum | true | 节点下单量 |

Source (javascript)

function Hedge (isOpen, priceA, priceB) {

exchanges[0].SetDirection(isOpen ? "sell" : "closesell")

exchanges[1].SetDirection(isOpen ? "buy" : "closebuy");

(function (routineA, routineB) {

Log(routineA.wait(), routineB.wait(), priceA, priceB)

})(exchanges[0].Go(isOpen ? "Sell" : "Buy", priceA, _ContractNum), exchanges[1].Go(isOpen ? "Buy" : "Sell", priceB, _ContractNum));

}

var slidePrice = 5

function main () {

var tickerA, tickerB

var arr = []

for (var i = 0 ; i < _Count ; i++) {

arr.push({open: _Begin + i * _Add, cover: _Begin + i * _Add - _Profit, isHold: false})

}

exchanges[0].SetContractType("quarter")

exchanges[1].SetContractType("this_week")

while (1) {

var tab = {type: "table", title: "状态", cols: ["节点信息"], rows: []}

tickerA = exchanges[0].GetTicker()

tickerB = exchanges[1].GetTicker()

if (tickerA && tickerB) {

$.PlotLine("差价:A所-B所", tickerA.Last - tickerB.Last)

for (var j = 0 ; j < arr.length; j++) {

if (tickerA.Buy - tickerB.Sell > arr[j].open && !arr[j].isHold) {

Hedge(true, tickerA.Buy - slidePrice, tickerB.Sell + slidePrice)

arr[j].isHold = true

}

if (tickerA.Sell - tickerB.Buy < arr[j].cover && arr[j].isHold) {

Hedge(false, tickerA.Sell + slidePrice, tickerB.Buy - slidePrice)

arr[j].isHold = false

}

tab.rows.push([JSON.stringify(arr[j])])

}

}

LogStatus(_D(), "\n `" + JSON.stringify(tab) + "`")

Sleep(500)

}

}Detail

https://www.fmz.com/strategy/144406

Last Modified

2019-04-17 16:58:51